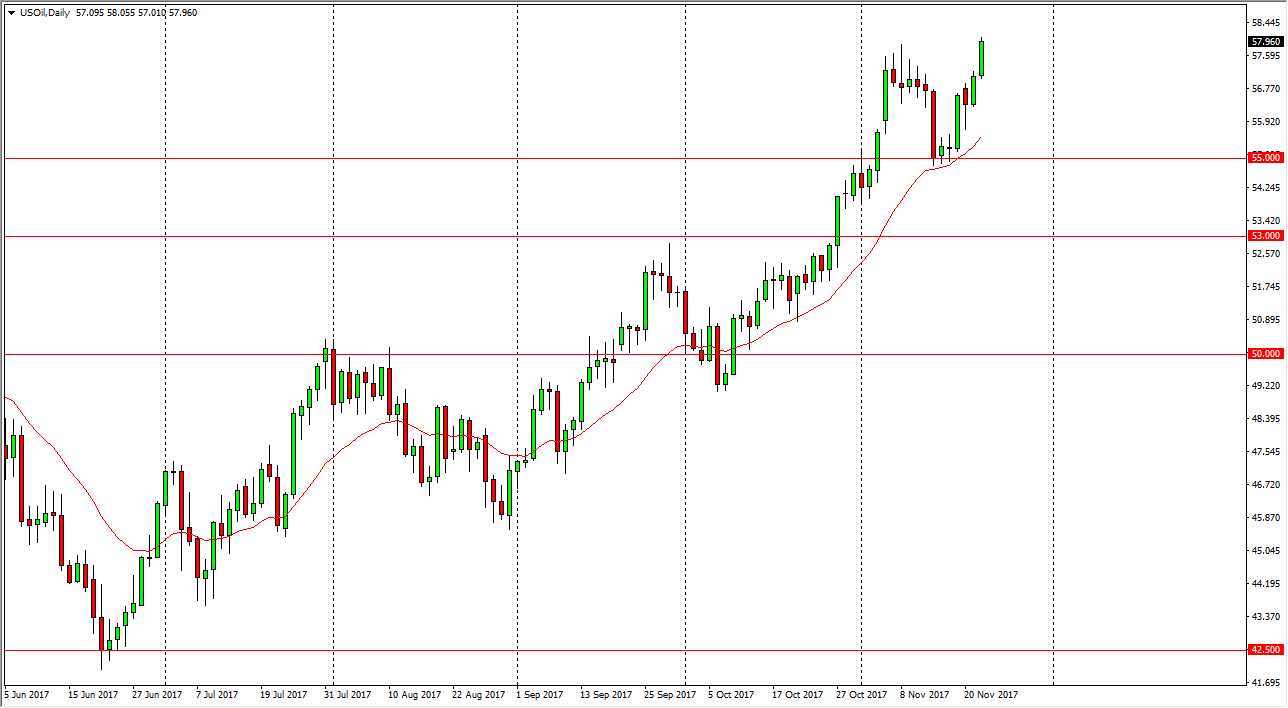

WTI Crude Oil

The WTI Crude Oil market rallied significantly during the trading session on Wednesday, reaching towards the $58 level again. The $50 level course has been resistive in the past, and the fact that we are closing right around that level is a good sign. However, the futures market will be thin electronic trading at best over the next 24 hours, so I think that we have the potential for volatility. Pullbacks should be buying opportunities, especially considering how much tension we are starting to see in the Middle East, and the potential troubles between Iran and Saudi Arabia should continue to put upward pressure on the market. Longer-term, it’s likely that we will have plenty of seller’s above, as once pricing gets high enough, the American start flooding the markets with more drilling.

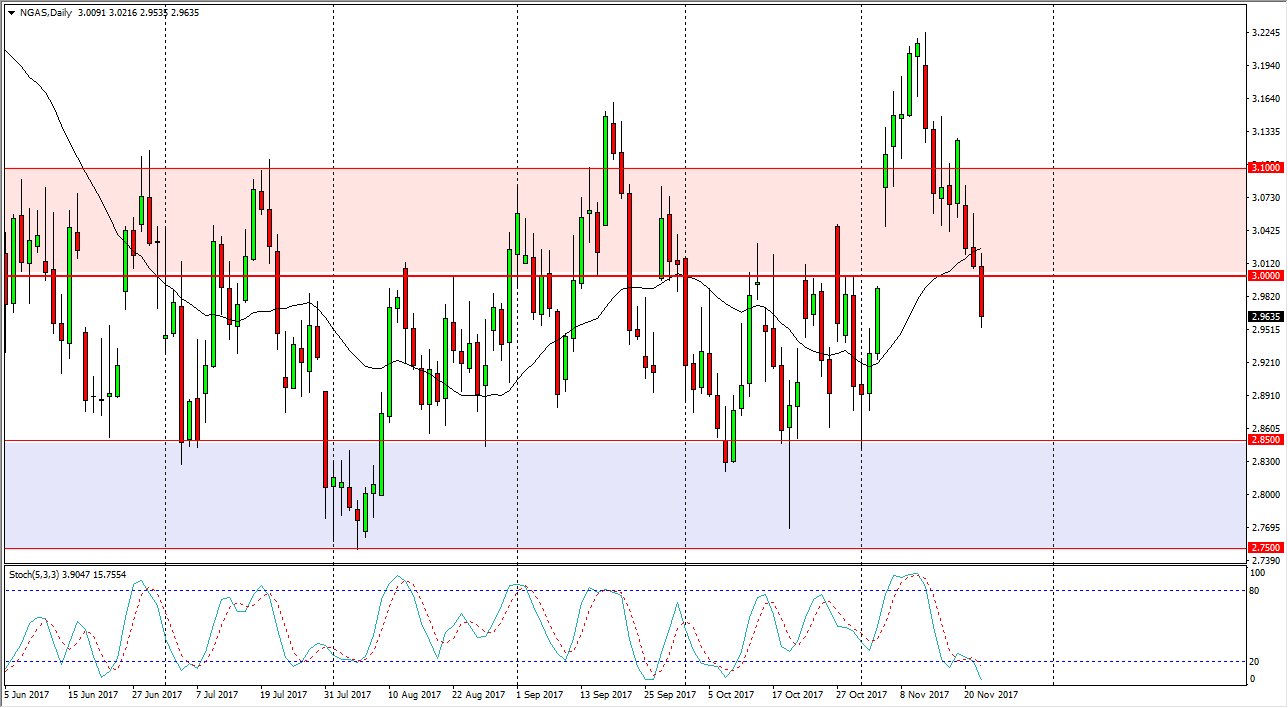

Natural Gas

Natural gas markets fell hard during the day on Wednesday, slicing through the $3 handle. By doing so, they not only filled the gap during the session, but broke down below it. That’s a very negative sign, and it’s likely that we will continue to fall towards the $2.85 level. Ultimately, the fact that even during the seasonally strong time of the year natural gas can break down through a gap, it’s likely that we will continue to see a lot of selling pressure. This is catastrophic from what I can see, and I think that rallies continue to be selling opportunities at the first sign of exhaustion. If we did break above the $3.10 level, at that point I think the buyers would come back but I must admit I am rather surprised that the rally had failed so catastrophically, and I believe that the natural gas markets are only getting more dangerous, not less.