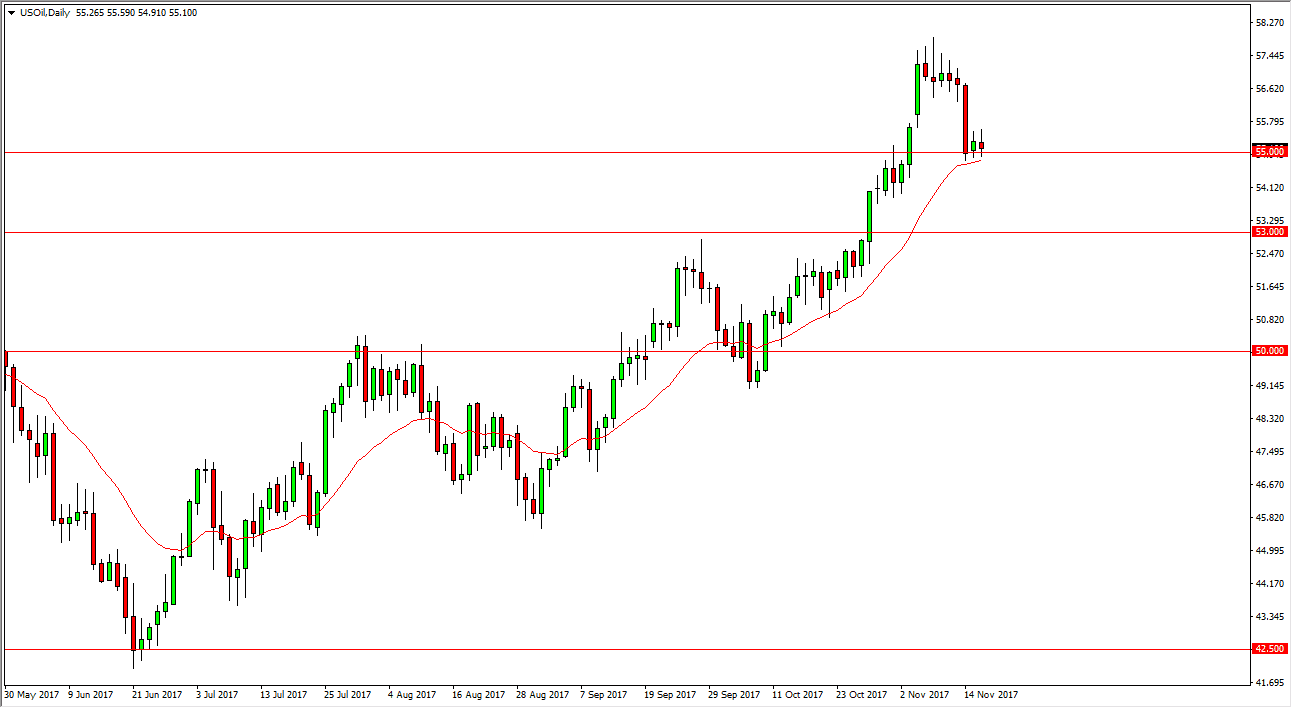

WTI Crude Oil

The WTI Crude Oil market continues to dance around the $55 level, finding support at that level. However, the question now is whether we can break down or not. If we do, the market will probably find support at $53, as supply continues to be a significant issue. Alternately, if we were to break above the $56 level, I think that the market goes looking for the $58 level next. Either way, we had gotten a bit ahead of ourselves, so it makes sense that this pullback is not only structurally needed, but timely as well. I suspect the buyers are waiting for signs of support or impulsivity to the upside to take advantage of. The volatility should continue, but eventually I think that the buyers will prevail.

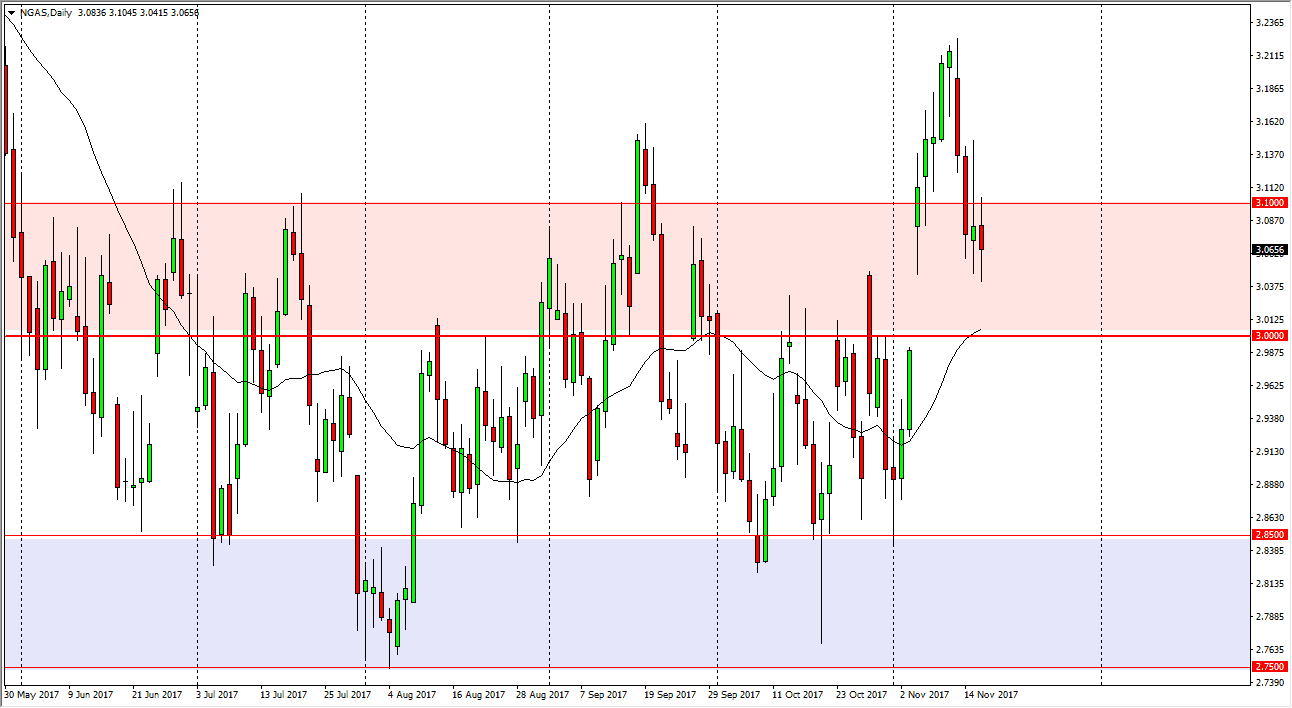

Natural Gas

The natural gas markets continue to be very noisy, forming a slightly negative candle. It looks as if we are trying to fill the gap, which extends down to the $3.00 level. That is an area that should be supportive, and eventually we should find support in that area and more importantly, buyers. That should have the market turn around and looking to go to the upside as the seasonality of the natural gas markets favors buying. The colder temperatures in the United States should drive demand and the short-term, but it is going to take some doing. If we can break down below the $3.00 level, the market probably falls apart at that point. If we can break above the $3.10 level before that, I would be convinced that we have found enough momentum to go ahead and jump into the market there also. A breakdown below the $3.00 level is catastrophic.