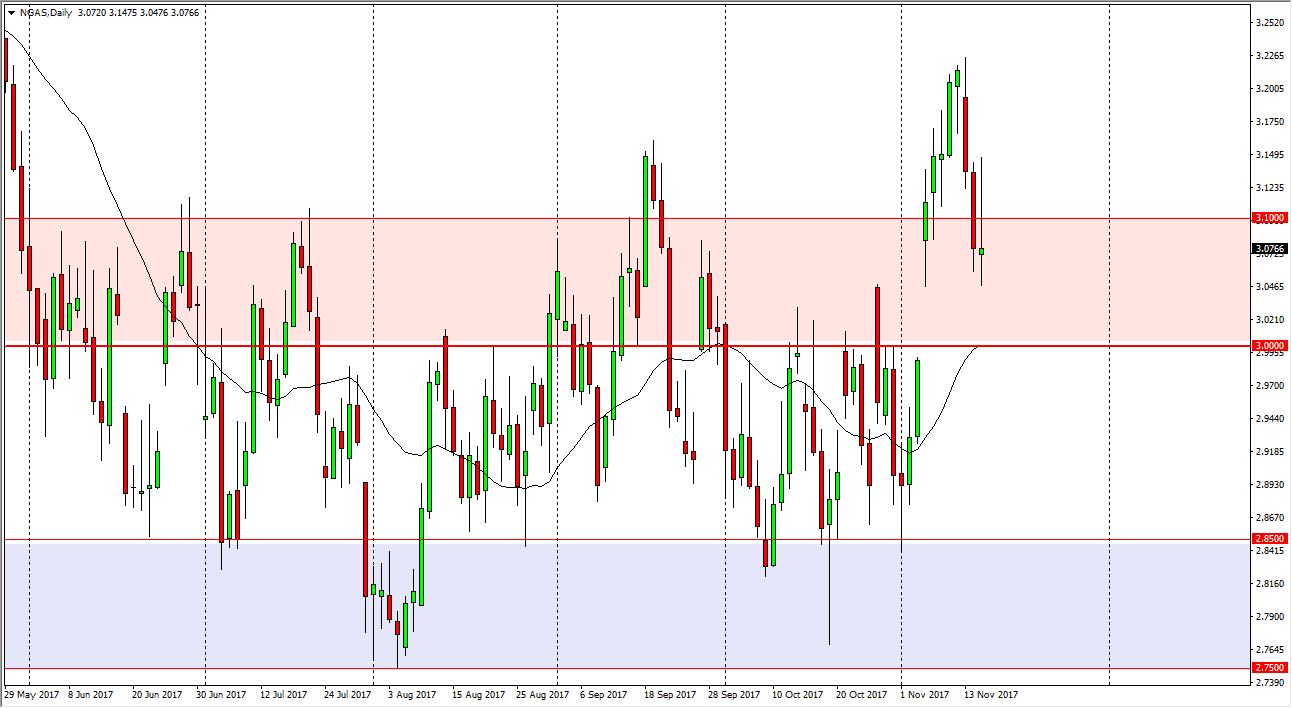

WTI Crude Oil

The WTI Crude Oil market went sideways initially during the day, but found a little bit of volatility after the inventory announcement. We tried to rally, but gave back about half of the gains. The resulting daily candle is a shooting star, which sits on the $55 level, but it’s not until we break down below the $54 level that should send this market even lower, perhaps down to the $53 level. Overall, I believe in buying the dips, but if we break down below the $53 level, the market should then go to the $50 handle. The volatility should continue to be very extreme, as we are concerned about Saudi Arabia, Iran, and of course the US dollar. Beyond that, we have quite a bit of noise coming out of the oversupply. Because of this, I think that it’s likely the market will continue to be very choppy and volatile. A break above the top of the range for the day could send this market looking for $57, perhaps even $58.

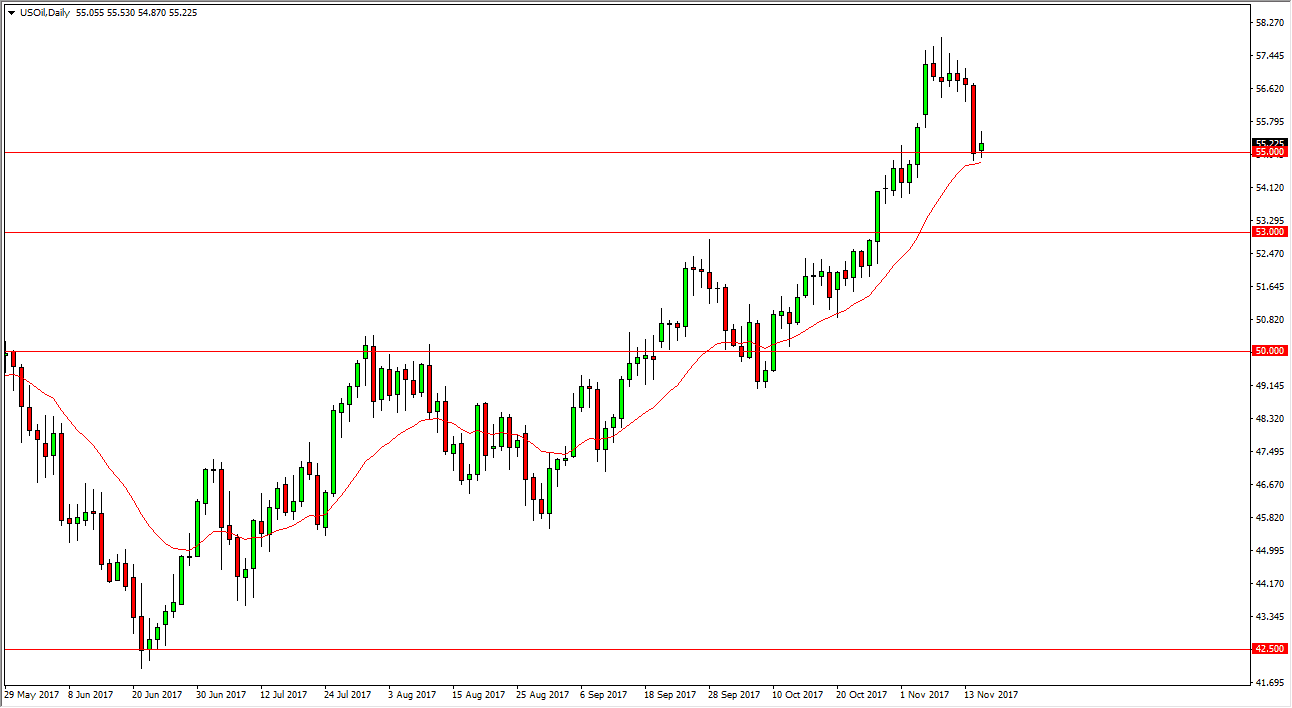

Natural Gas

Natural gas markets went back and forth during the trading session on Wednesday, forming a shooting star by the time was all said and done. If we break down below the bottom of the shooting star, the market probably drums down to the $3.00 level underneath, filling the gap. That is a typical technical move, but I think that the buyers will return near the $3.00 level. A breakdown below there would be significantly bearish, but a break above the top of the shooting star would be an extraordinarily bullish sign. I believe that this time of year tends to favor the upside in general, so I am airing on the side of caution.