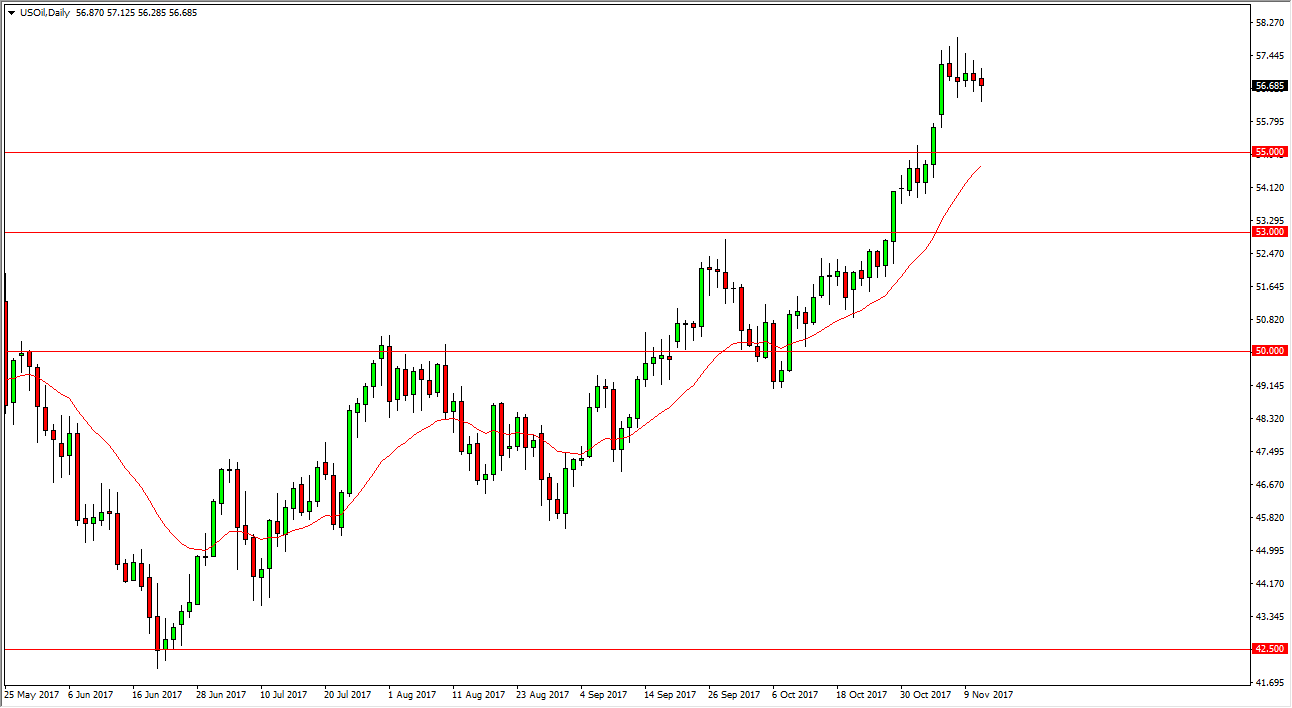

WTI Crude Oil

The WTI Crude Oil market continues to be very choppy lately, as we have gotten a bit overextended. By being so overextended, it’s likely that we need to pull back to find some type of value and I suspect that the cluster of order flow near the $55 level is that area that we will be looking for. Because of this, I’m looking for a pullback, and then a buying opportunity in that region. I would not short this market, it has been bullish for some time, and seems to defy gravity occasionally. There are a lot of tensions in the Middle East right now, so although there are a lot of questions as to the validity of a longer-term uptrend, and the short-term I certainly wouldn’t want to get in front of this type of momentum. Be patient, your trading opportunity should present itself given enough time.

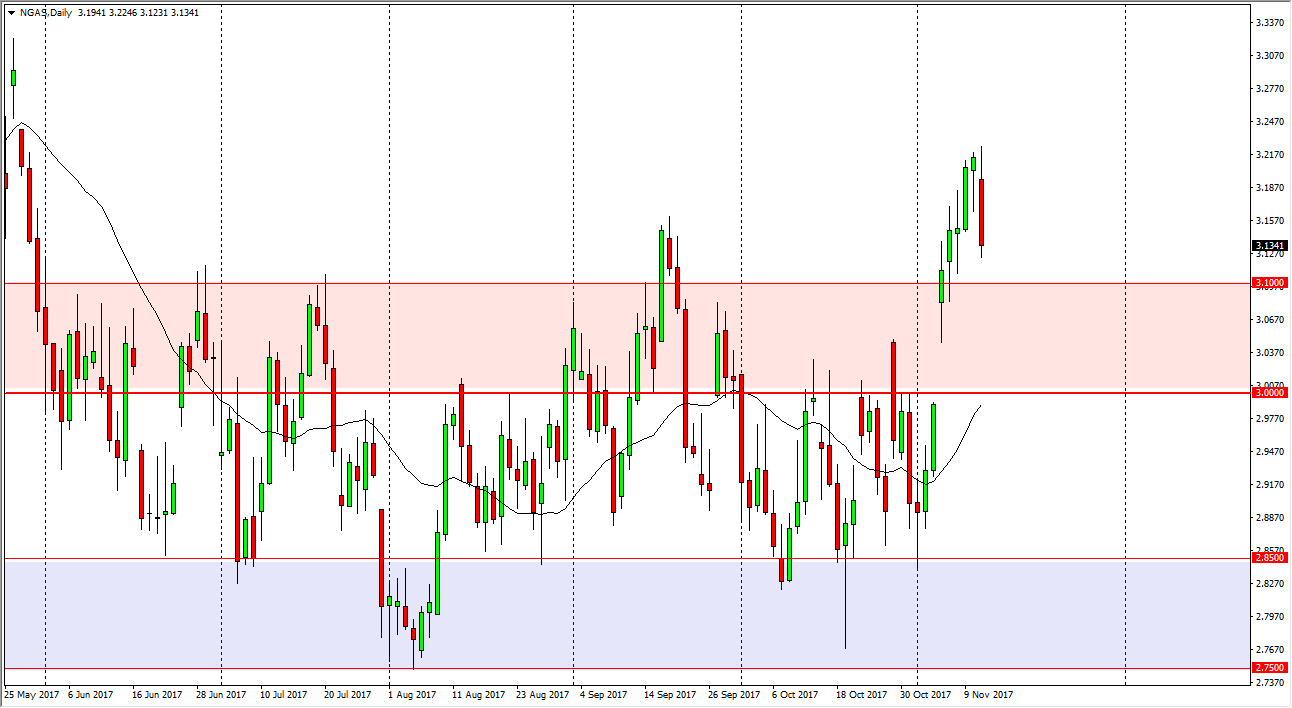

Natural Gas

Natural gas markets had a very negative looking day on Monday, wiping out well over a dime. Because of that, I think that we are going to go down to the $3.10 level, possibly even lower than that, we might even end up filling the gap, meaning a move back down to the $3 handle. I suspect that we will still have buying pressure though, because quite frankly we have broken through some major barriers in the last couple of weeks. Seasonality suggests that natural gas market should go higher, at least until the end of the year. That doesn’t mean that we won’t get violent pullbacks occasionally, obviously we well. However, I think that the market should continue to be volatile, so being patient is going to be absolutely necessary. I don’t like natural gas in general, but over the next couple of months it historically will do well.