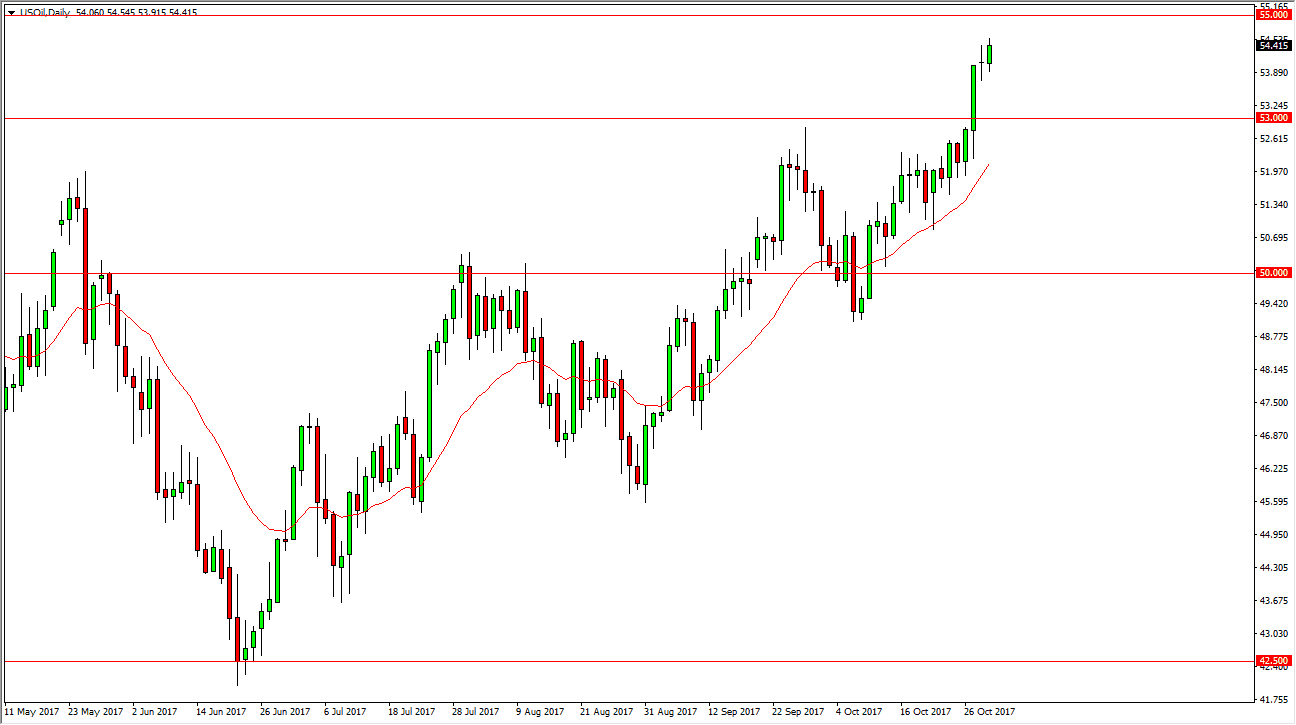

WTI Crude Oil

The WTI Crude Oil market initially fell during the Tuesday trading session, but we turned around a break above the top of the neutral candle from the Monday session. If we can break above the range for the day, I think it’s only a matter of time before we test the vital $55 level above. That is an area that should be resistive, but I think it’s only a matter of time before we break above there and extend the gains. In the short term, we could very easily see some type of pull back, but I believe that will be thought of as value. It’s not until we break down below the $53 level that I would be concerned in general. Even then, I suspect that the $50 level will continue to be even more supportive. A lot of hedge funds that I speak to have been getting bullish of this market, and I think we will continue to see a “buy the dips” mentality.

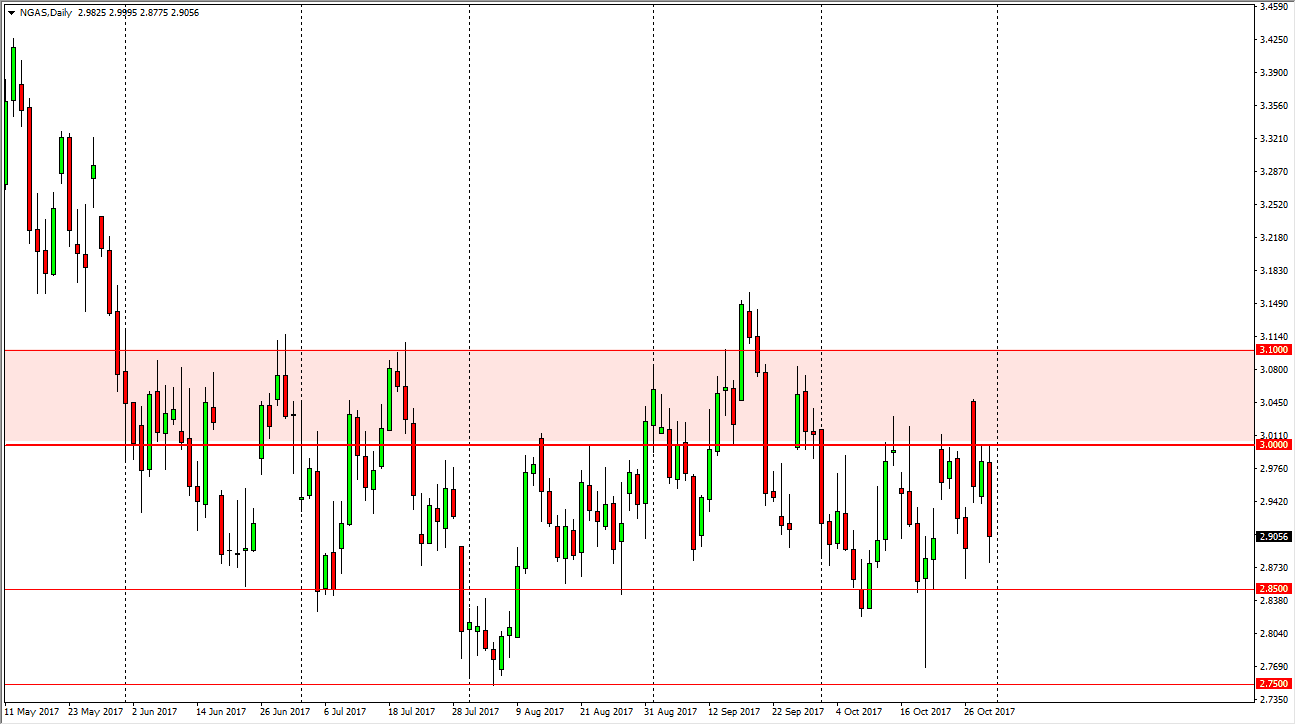

Natural Gas

The natural gas markets initially tried to rally on Tuesday but found the $3.00 level above to be resistant yet again. There is a massive amount of resistance above, reaching towards the $3.10 level. I think it’s only a matter of time before the exhaustion comes back into the marketplace, and we start selling yet again. Quite frankly, I have no interest in buying this market, although I know several short-term traders who have been buying closer to the $2.87 level. The $3.00 level is where US fracking companies start to see profits again, so there is an extraordinarily large amount of supply in that region. Because of this, I do not think we are going anywhere soon, as we continue to knock around.