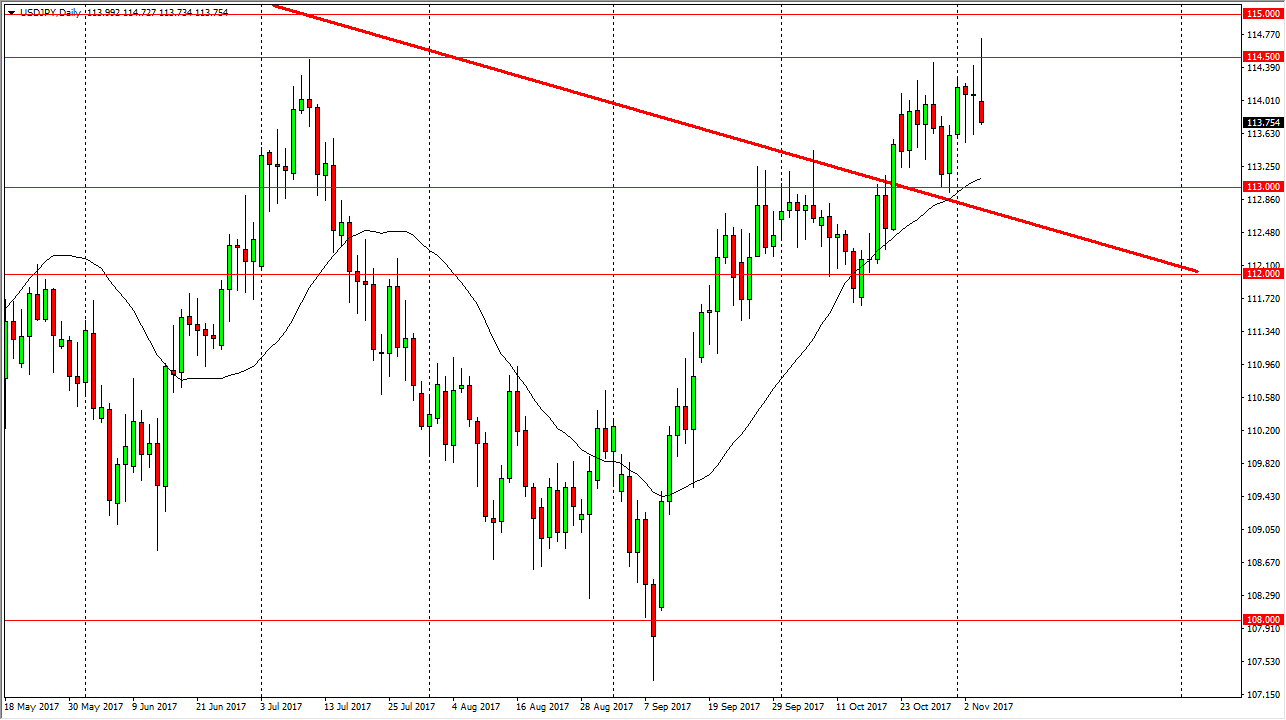

USD/JPY

The US dollar initially rallied on Monday, breaking above the vital 114.50 level. There is a significant amount of resistance above there and towards the 115 handle, so at this point I suspect that we are going to roll over, especially considering that we had formed a massive shooting star. The 113-level underneath should continue to be supportive, just as the previous downtrend line had been. I think that some type a pullback from here should only end up offering a buying opportunity based upon value at lower levels. If we were to break below the 112 level, I could be convinced to start selling, at least for the short term. Overall, I anticipate that the buyers are going to jump back into this market eventually, and once we break above the 115 handle, we should then go to the 118 level.

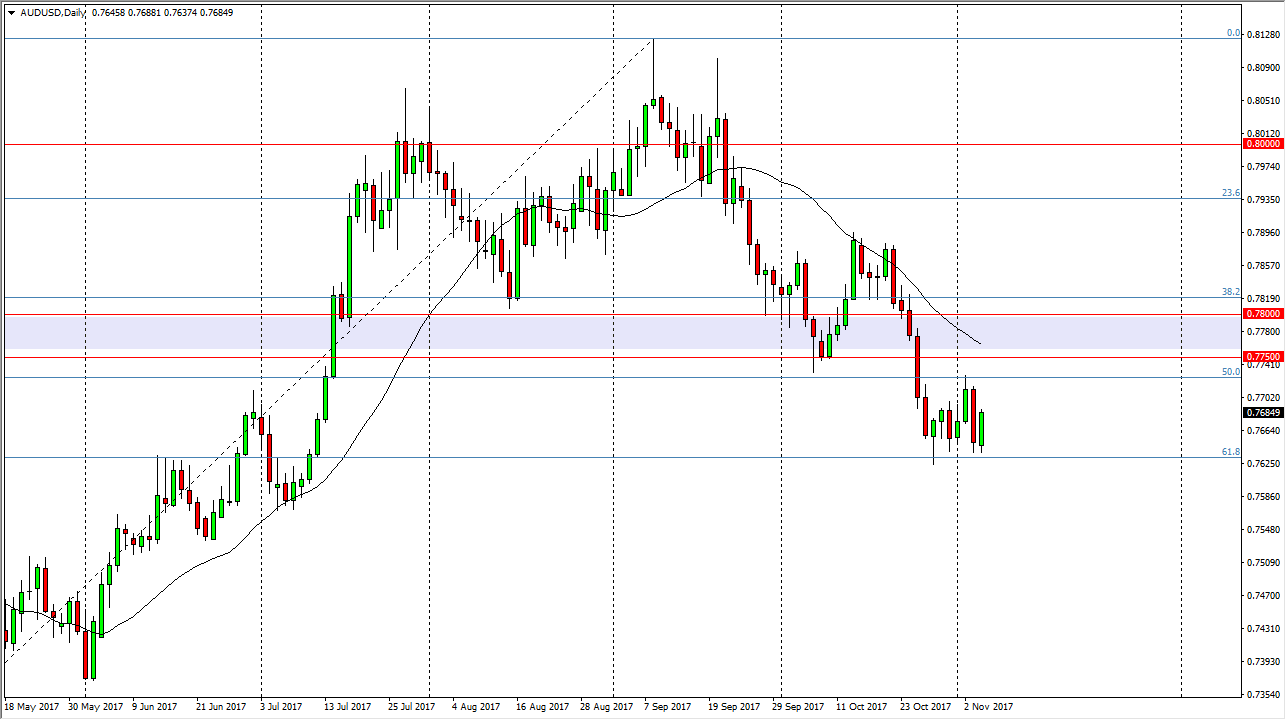

AUD/USD

The 61.8% Fibonacci retracement level has offered support yet again, and it looks like we are ready to continue the consolidation that we have seen in the Australian dollar of the last several sessions. I recognize that the 0.7750 level above is resistance, and I think that resistance runs to the 0.78 level above. If we get any signs of exhaustion between here and there, I am more than willing to start selling the Aussie, especially if the gold markets are rolling over at the same time. I believe that eventually we will break down below the 61.8% Fibonacci retracement level, and once we do we should probably reach down towards the 0.75 level next. However, if we break above the 0.78 handle, the market should then go to the 0.80 level above. It will be volatile, but at the end of the day I think we should receive clarity soon.