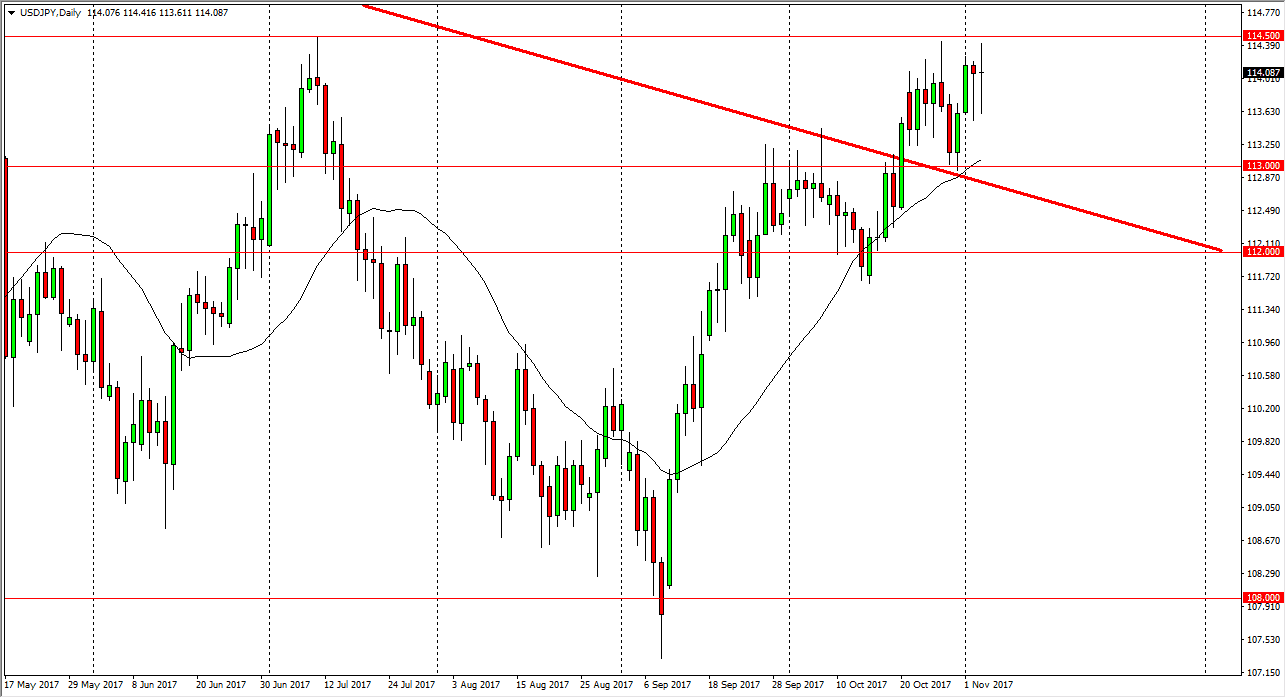

USD/JPY

The US dollar had a volatile session on Friday as the nonfarm payroll number came out less than anticipated. However, the 114.50 level above is massive resistance, while the 113-level underneath is significant support. We have recently broken above a downtrend line, suggesting that we are trying to break out for a larger move. Nonetheless, it’s not until we break above the 115 level that I feel comfortable going long for a larger move. I think that short-term pullback should continue to offer buying opportunities, if we can stay above the 112 handle. Once we break down below there I think the market is prime to go back to the 108 handle. Watch the ZN futures markets, as the ten-year interest rates in America have a great influence on this market. If interest rates rally, this pair should continue to go higher. However, it’s going to take a significant amount of momentum to finally break out.

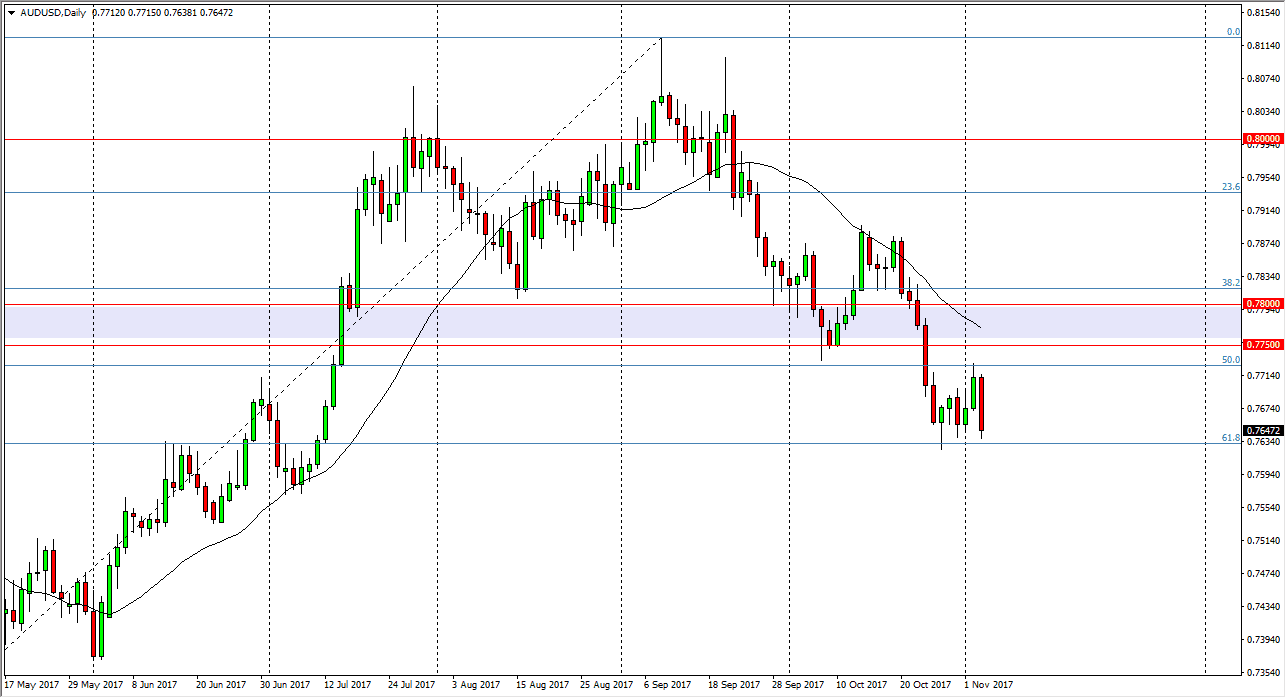

AUD/USD

The Australian dollar fell significantly during the day on Friday, reaching down towards the 61.8% Fibonacci retracement level again, near the 0.7650 level. If we can break down below there, the market should then go to the 0.75 level underneath, as it is the next major support level from both a psychological and structural standpoint. Rallies of this point should continue to be selling opportunities, as I see a significant amount of resistance near the 0.7750 level, extending to the 0.78 level. I think that any type of exhaustive candle in that area could be a nice selling opportunity as it offers value in the US dollar. However, if we were to break above that area we could go as high as the 0.80 level. Overall, this is a market that continues to see volatility but until Gold helps as well.