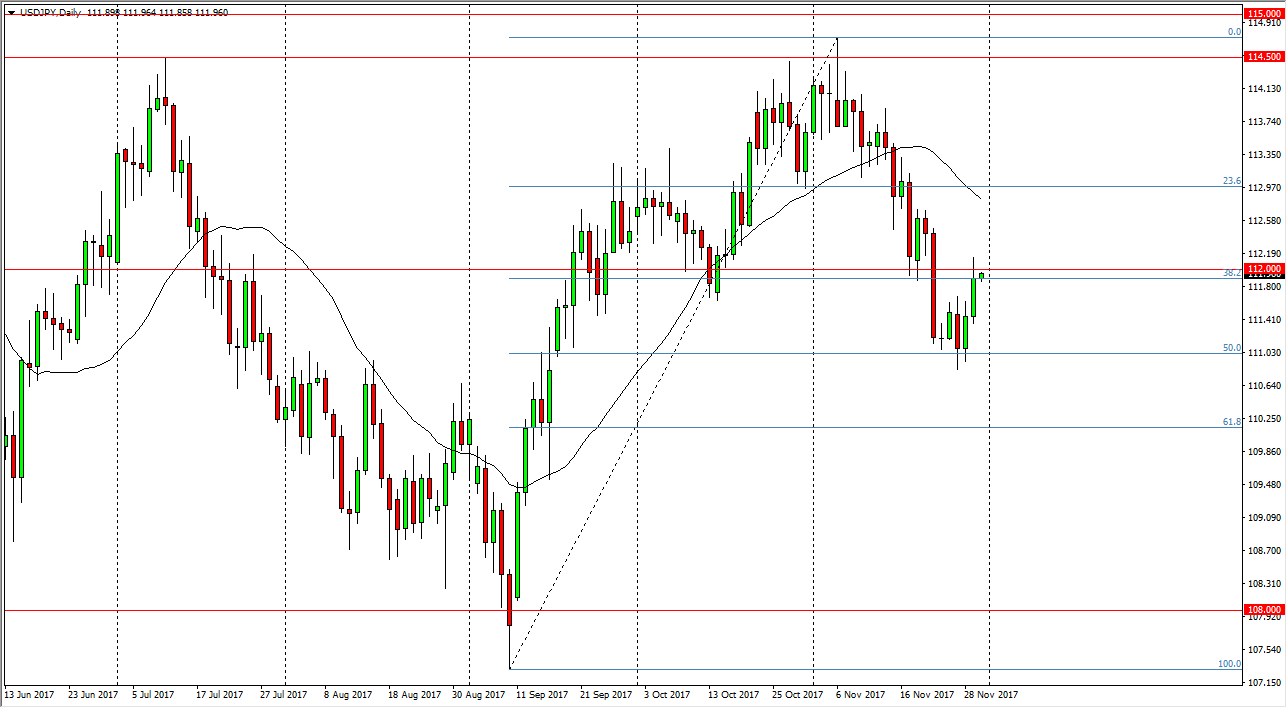

USD/JPY

The US dollar rallied during the trading session on Wednesday, slicing through the 112 level at one point during the day. We did pull back a bit, but as we roll over into the Thursday session, it looks as if the buyers are trying to continue the move to the upside. If we can break above the top of the candle for the Wednesday session, then I think that the US dollar continues to rally, probably aiming for the 113 handle next. Alternately, if we were to get some type of exhaustive daily close, perhaps something like a shooting star, the market should roll right back over and go looking towards the 111 level. It is worth noting that we bounced from the 50% Fibonacci retracement level, so it might be the market trying to continue the uptrend that we had previously been in.

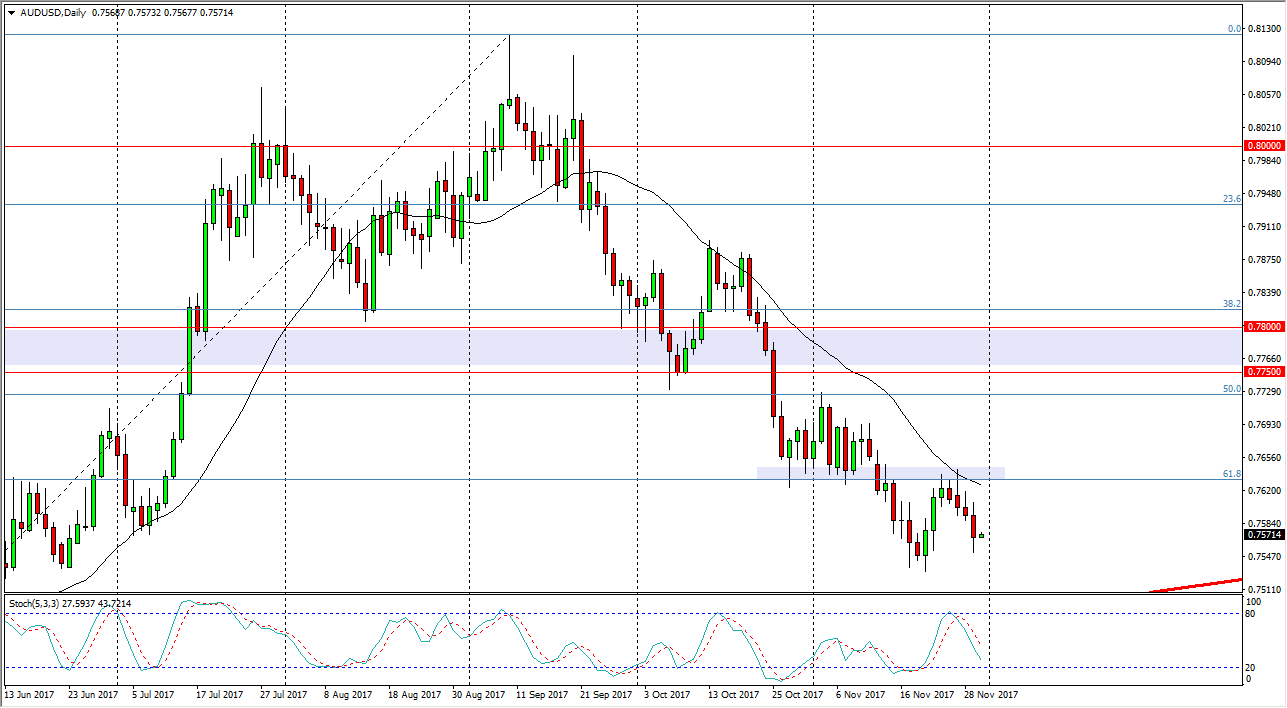

AUD/USD

The Australian dollar initially tried to rally during the trading session on Wednesday, but fell again as the US dollar continues to pick up a bit of strength. If the tax reform bill in stop being passed, that should be a good sign for the United States dollar, and the 0.75 level underneath is significant support. Ultimately, I believe that if we can break down below there, the market goes to the 0.7350 level. In general, I believe that we need to see gold take off to the upside to see the Australian dollar climb in value. In general, I think that this is a market that continues to offer a “sell the rallies” attitude, and that’s how you have to approach the Aussie in general. If gold managed to break above the $1300 level solidly, at that point I might be convinced to buy this pair. Until then, I have a negative outlook.