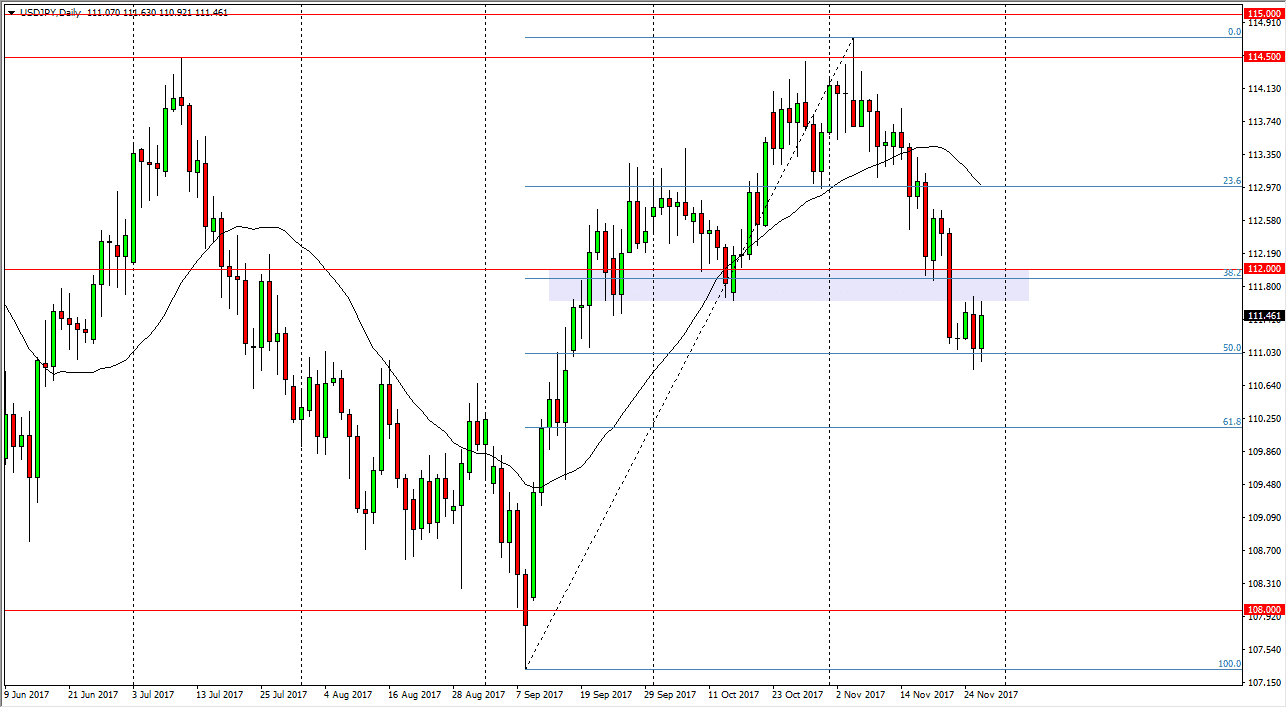

USD/JPY

This pair got kicked around a bit during the day on Tuesday, as the North Koreans launched a missile. However, technically speaking we are simply bouncing from the 50% Fibonacci retracement level, which is essentially the 111 level, and the previous support which should now be resistance near the 111.75 handle. Because of this, I think we still have a bit of downside possible, but I anticipate that a breakdown will probably find plenty of support near the 110 level, but possibly could go through there and continue the overall consolidation that we have seen over the last couple of years. If that’s the case, we could be looking at a bottom near the 108 level. Alternately, if we were to break above the 112 level, I could be convinced to start buying again.

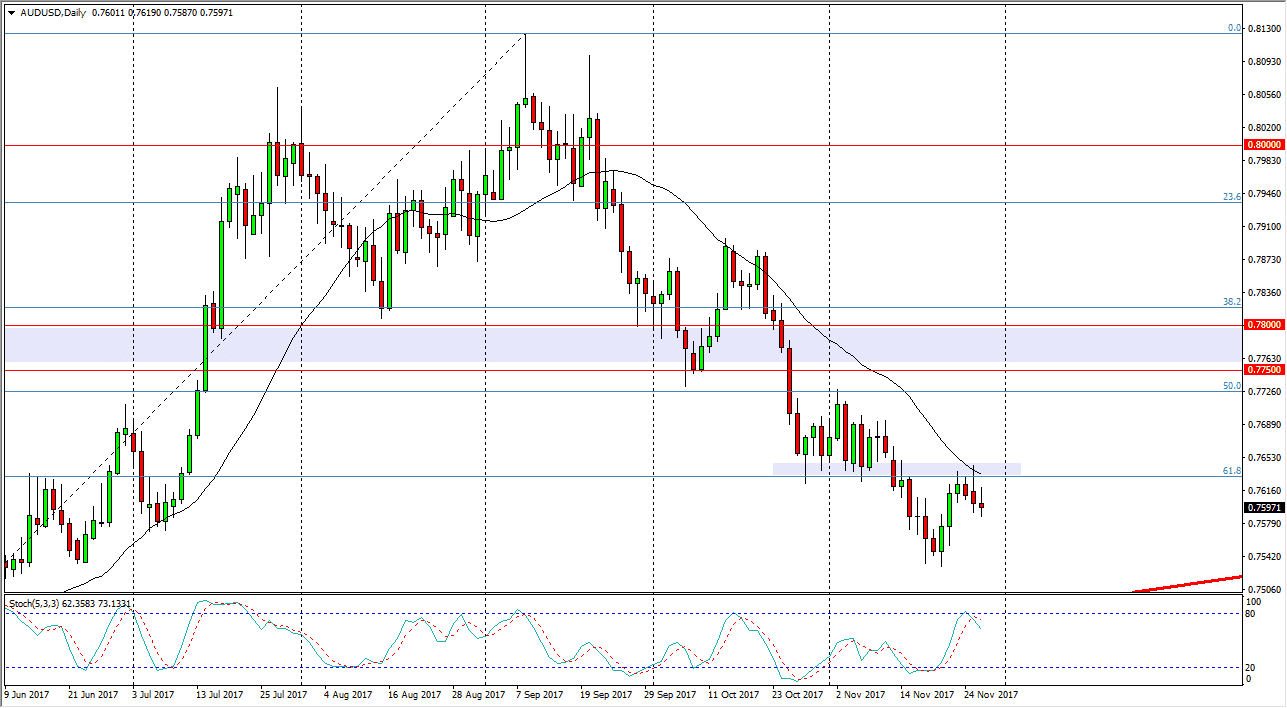

AUD/USD

The Australian dollar simply cannot rally for any length of time against the US dollar, and of course gold is not helping. With gold stalling underneath $1300, and the Aussie stalling at previous support, it’s likely that we will continue to roll over a bit, perhaps reaching down to the 0.75 handle. That’s an area where I expect to see a lot of support, but if we were to break down below there it would be a negative sign. Although not technically in the overbought area of the Stochastic Oscillator, we did just get across, which for some trading systems is a cell signal in and of itself. I believe that short-term rallies continue to offer selling opportunities, and therefore I don’t have any interest in buying the Aussie, as I see no reason to turn around. Beyond that, US bonds are paying more in interest than Australian ones now.