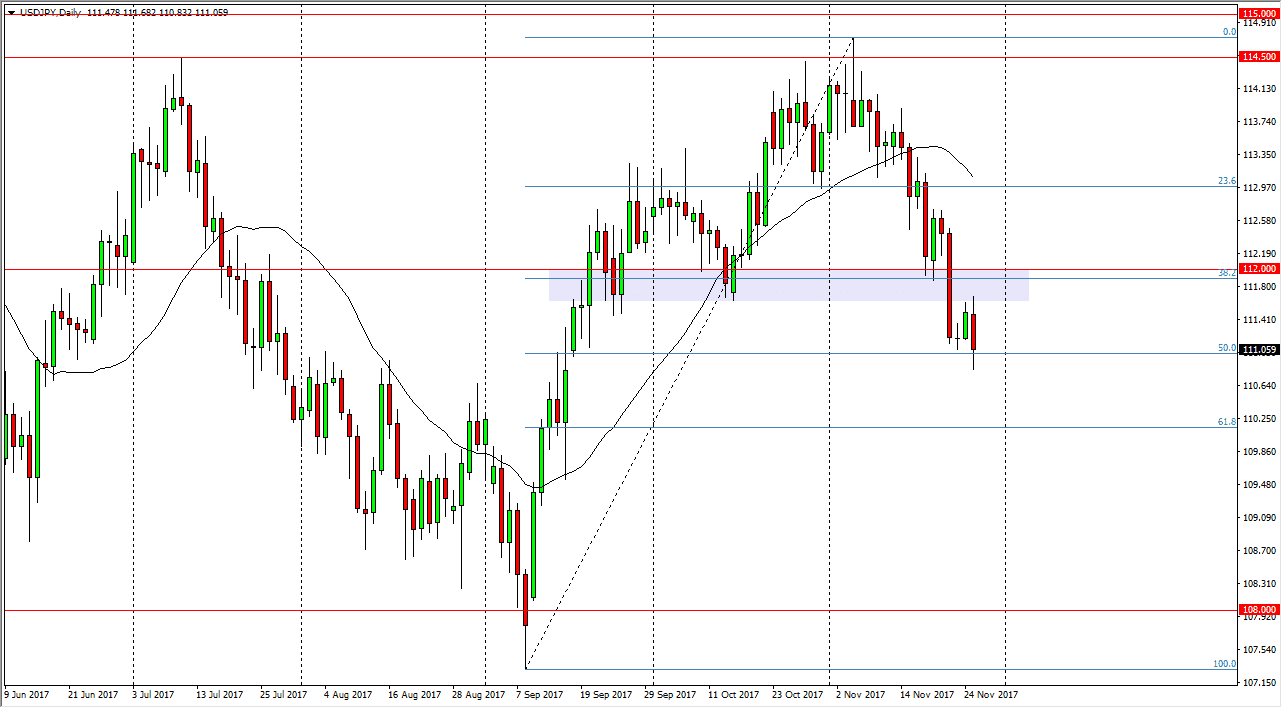

USD/JPY

The US dollar has found a bit of support at the 111 level against the Japanese yen, but face is a significant amount of resistance above at the 112 handle. We also have the 50% Fibonacci retracement level offering support at the 111 level, but the 112 level has been so important that it’s hard to imagine we would blow right through it. In other words, I think this market is probably stuck in this general range, and I think it’s a matter of waiting to see which direction we break and simply following. I suspect that the US dollar continues to have a lot of negativity around it though, as Congress can’t pass tax legislation that matters. A move above the 112 level would be very bullish, a move below the 110.80 level would send this market looking towards the 110 handle, and then eventually the 108 level.

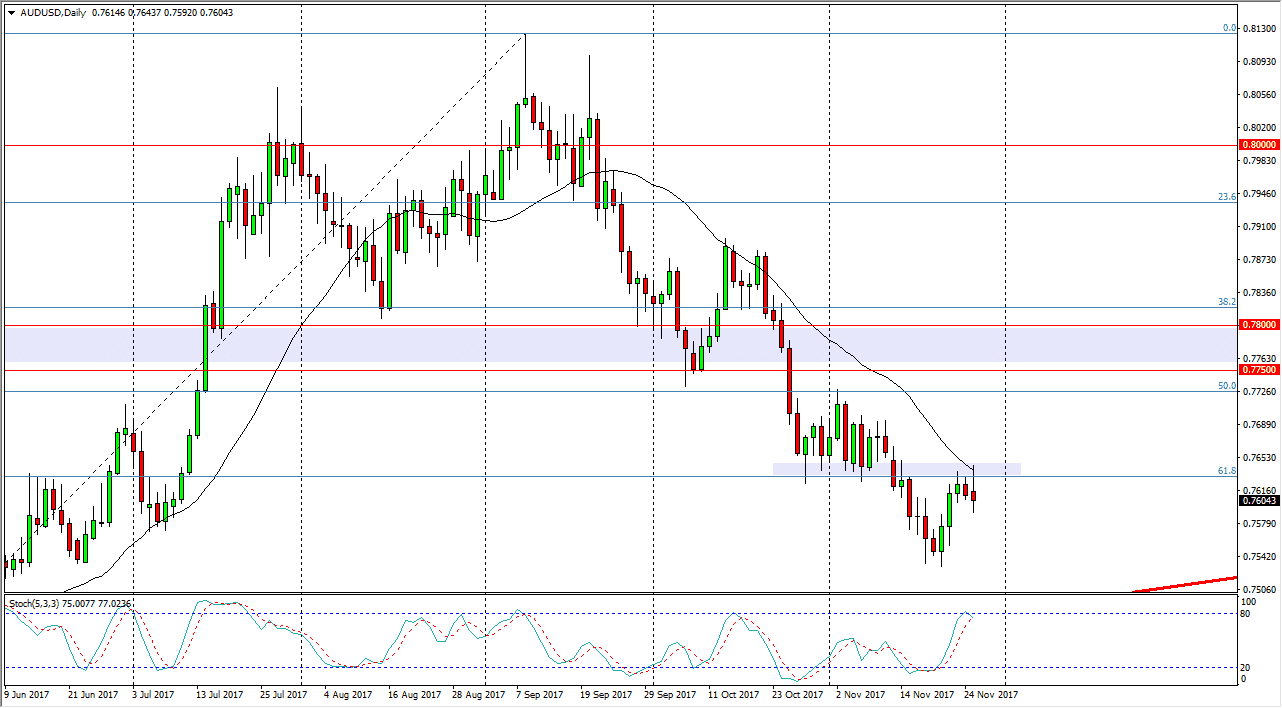

AUD/USD

The Australian dollar rallied during the day, but as soon as we ran into resistance rolled over to form a shooting star. Furthermore, the market is starting to cross near the 80 line on the stochastic oscillator, so it suggests that we are temporarily overbought and may go looking for the 0.75 level underneath. The shape of the candle is perfect, so I like the fact that it is a continuation shooting star more than anything else. There is a significant amount of support at the 0.75 level however, so I don’t think it’s going to be easy to break down through there. If we break the top of the shooting star, I think we then go looking towards the 0.7725 level again as a potential selling area. Pay attention to gold, the correlation between it and the Australian dollar remains as strong as ever.