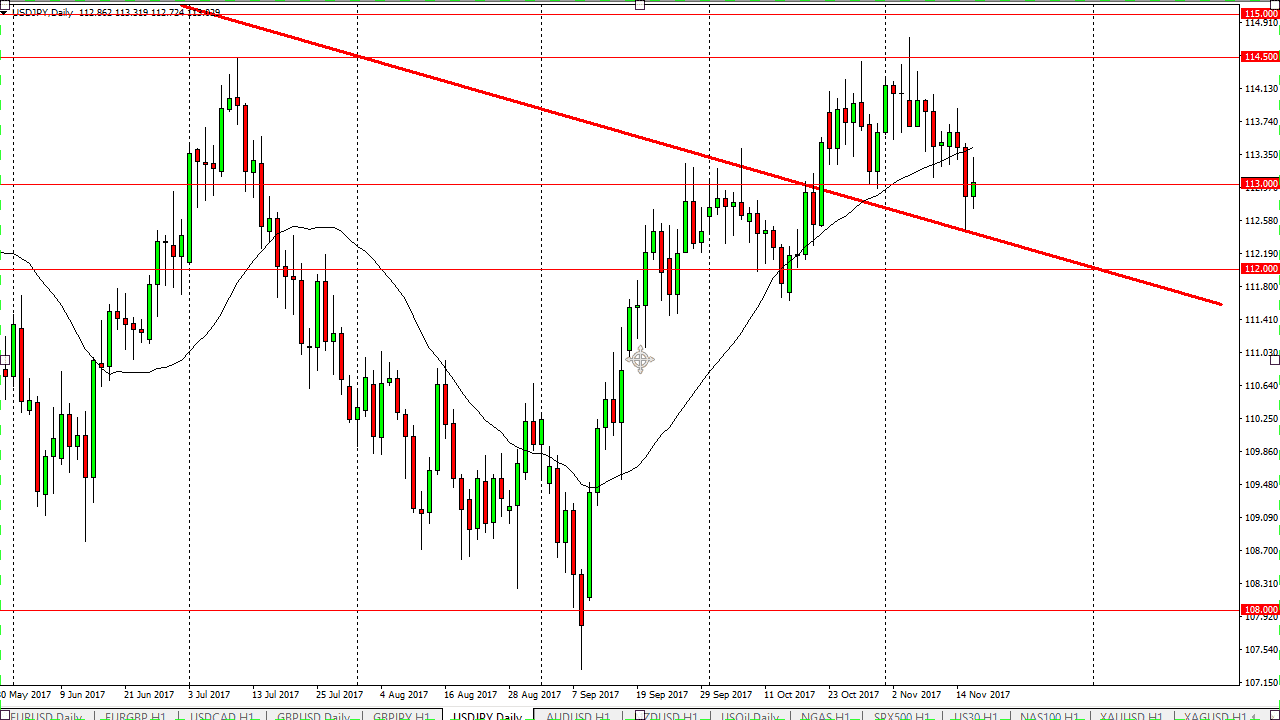

USD/JPY

The US dollar rallied significantly during the trading session on Thursday, breaking above the 113 handle. By doing so, looks as if the market is trying to rally a bit, perhaps breaking higher than the range for the day could send this market to the 114.50 level above, which is the beginning of resistance. That area extends to the 115 handle, and if we can finally break above there I think it’s more of a longer-term buy-and-hold situation. However, I think that short-term dips offer buying opportunities, although it’s going to be very volatile. If we were to break down below the 112 level, then the market is free to go down to the 108 level, but I don’t think that’s going to happen anytime soon, and remain bullish yet cautious about this market.

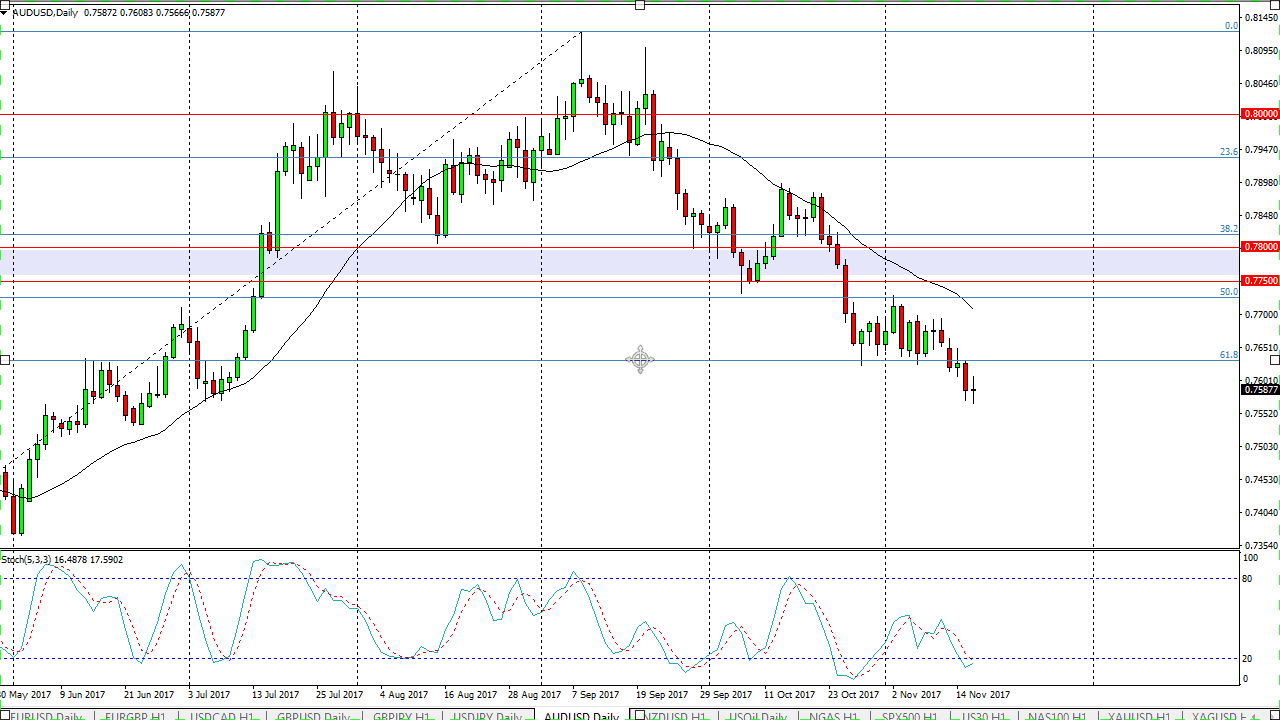

AUD/USD

The Australian dollar has been very choppy during the Thursday session, as we continue to hover just below the 0.76 level. A breakdown below the bottom of the range for the session on Thursday should send this market even lower, and I think that we will eventually have that happen. However, in the short term we could get a bit of a bounce, but that bounce should be an opportunity to sell at higher levels. I believe that the purple area on the chart extending from 0.7750 to the 0.78 level is the “ceiling” in the pair right now. Longer-term, I would not be surprised at all to see this market reach down to the 0.7350 level, which would be a complete retrace of the entire move to the upside. Volatility should continue, but at this point I don’t see any reason to start buying until we clear the purple barrier that I have marked on the chart.