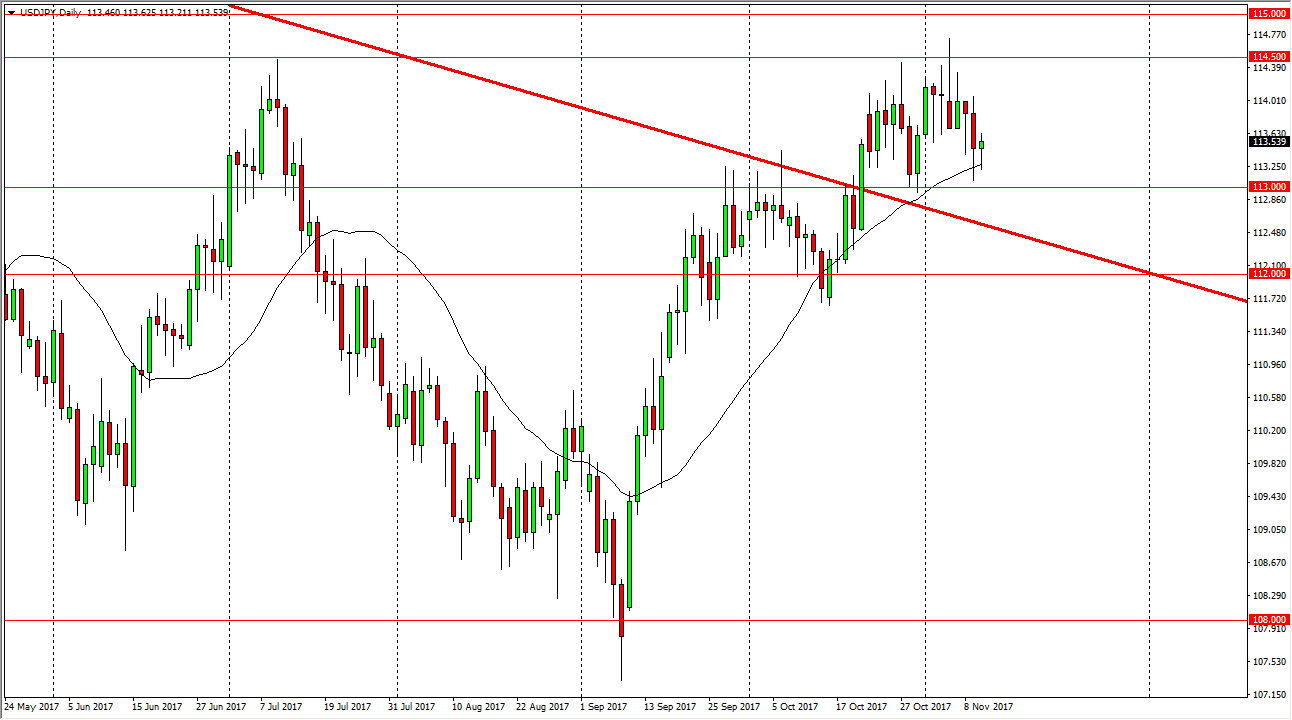

USD/JPY

The US dollar drifted a little bit lower during the trading session on Friday but found enough support just above the 113 handle to turn around and form a hammer. The hammer of course is a bullish sign, and we have recently broken above the downtrend line. The market looks likely to continue to grind sideways and the short-term, if not drift a little bit lower. I think there is a massive amount of support at the previous downtrend line, the 113 handle, and most certainly the 112 handle. I believe it’s only a matter of time before the buyers return, especially if the interest rate on the 10-year note continues to rise. The interest rate differential between the 2 economies continues to widen, and that should eventually get this market to be strong enough to break out to the upside and clear the 115 handle finally.

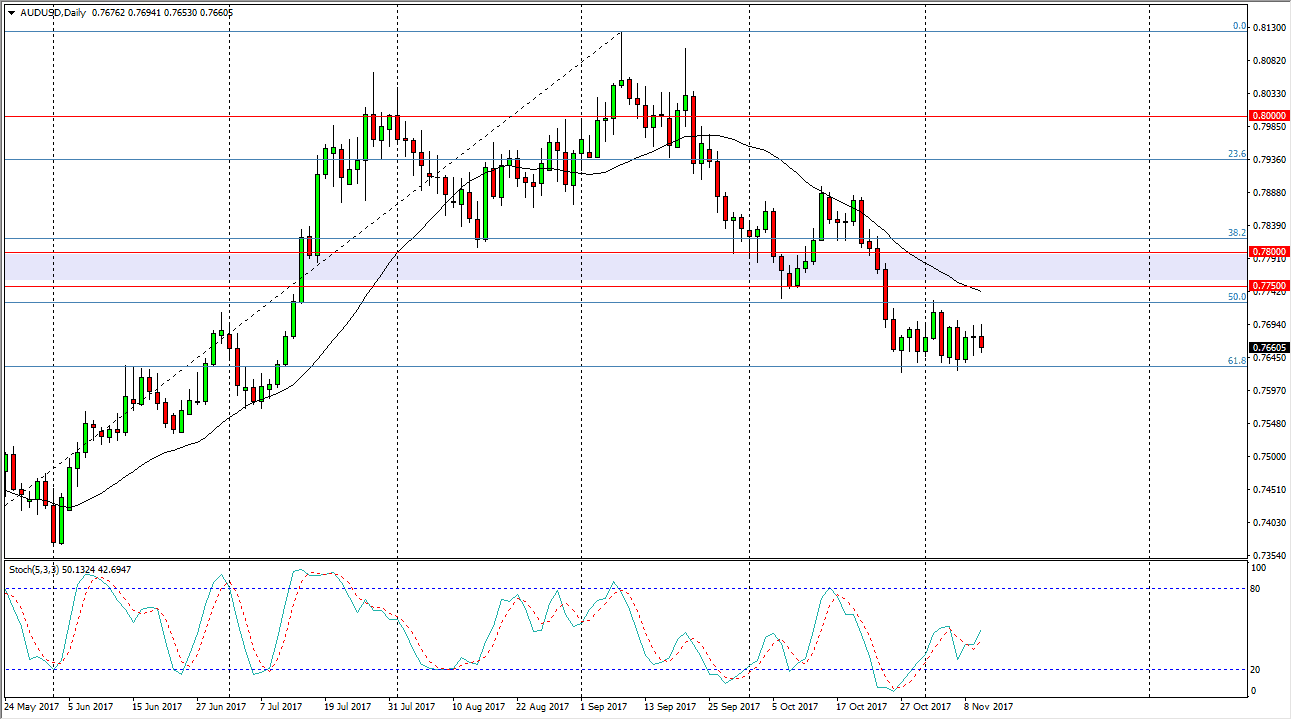

AUD/USD

The Australian dollar did very little during the trading session on Friday, as we continue to consolidate. We’ve gone sideways just above the 0.76 level, but more importantly the 61.8% Fibonacci retracement level from the search higher. If we were to break down below that level, then I think the market probably drops down to the 0.7350 level. In the meantime, I recognize the 0.7750 level as the beginning of massive resistance. I think that any time we get close to that area, the sellers will more than likely return as it is a significant level of importance based upon the longer-term charts. If we were to break above the 0.78 handle, the market should then go to the 0.80 level after that. In general, I think we need to see the gold market rallied significantly to get the Australian dollar to the upside.