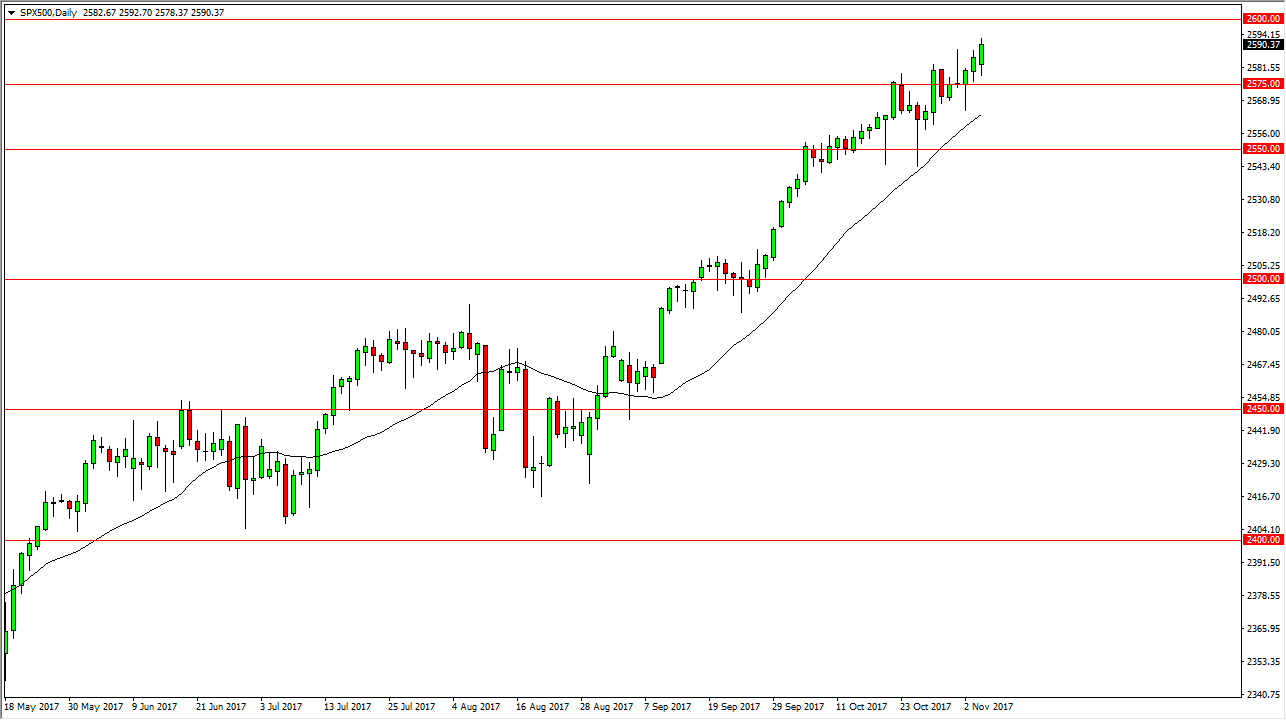

S&P 500

The S&P 500 initially fell during the trading session on Monday, but found enough support just above the 2575 handle to turn around and continue to rally. I believe that the market is going to go looking towards the 2600 level above, and perhaps break above there given enough time. I believe that the S&P 500 should continue to be bullish, as we have seen so much in the way of buying opportunities in the past. I believe the pullbacks should find buyers near 2575, and then of course the 2550 handle under there. The market has been in a longer-term uptrend, and I believe that the market should continue to go higher, but I also recognize that we desperately need some type of pullback. We are overextended, and quite frankly I am not very interested in trying to buy at these extreme levels. I believe that the market desperately needs to pull back, but the algorithmic traders are not allowing it to happen.

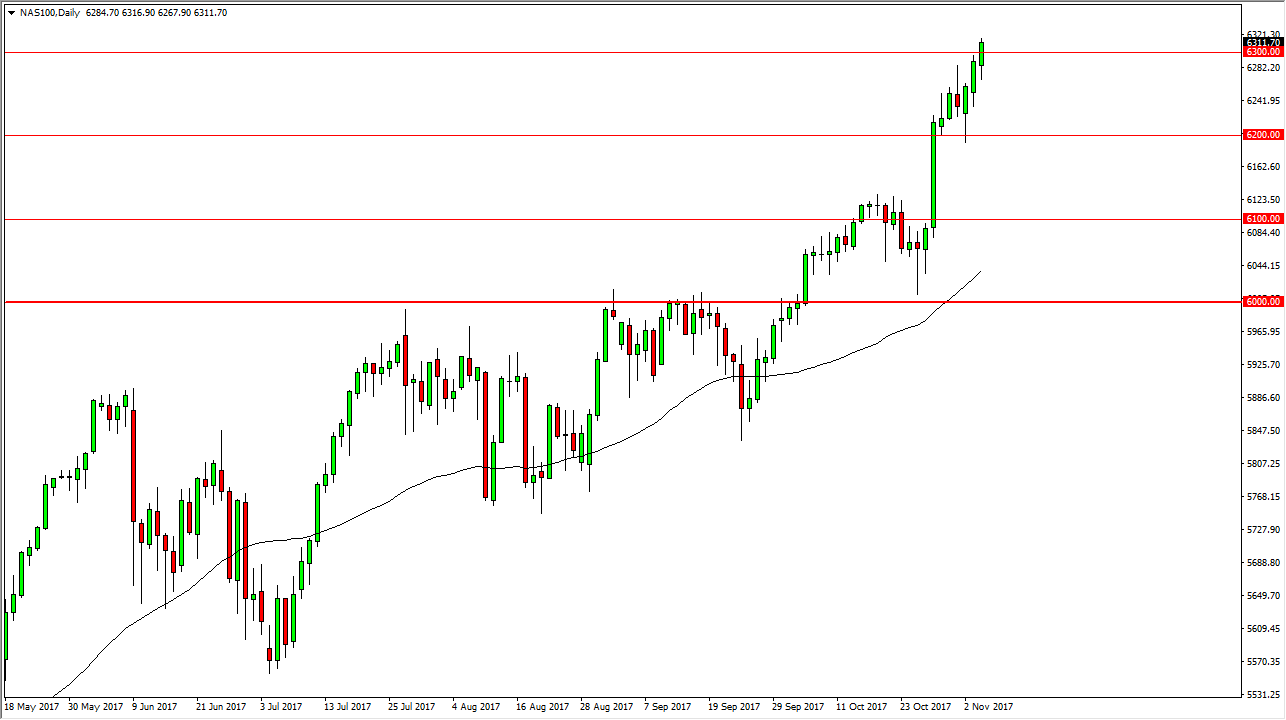

NASDAQ 100

The NASDAQ 100 initially fell and then turned around to sliced through the 6300 level. This market has gotten ahead of itself, and I think that the market will eventually have to pull back. I believe that the 6200 level should be the floor in the market, and even if we do go higher today, I will be sitting this one out, as I believe that the momentum has gotten far ahead of itself. The momentum is cutting, because it works in both directions and you can see that we are clearly light years away from the 50-day exponential moving average, something that I believe acts as a “mean” for the market in general. I believe the absolute floor in the uptrend can be found at the 6000 handle.