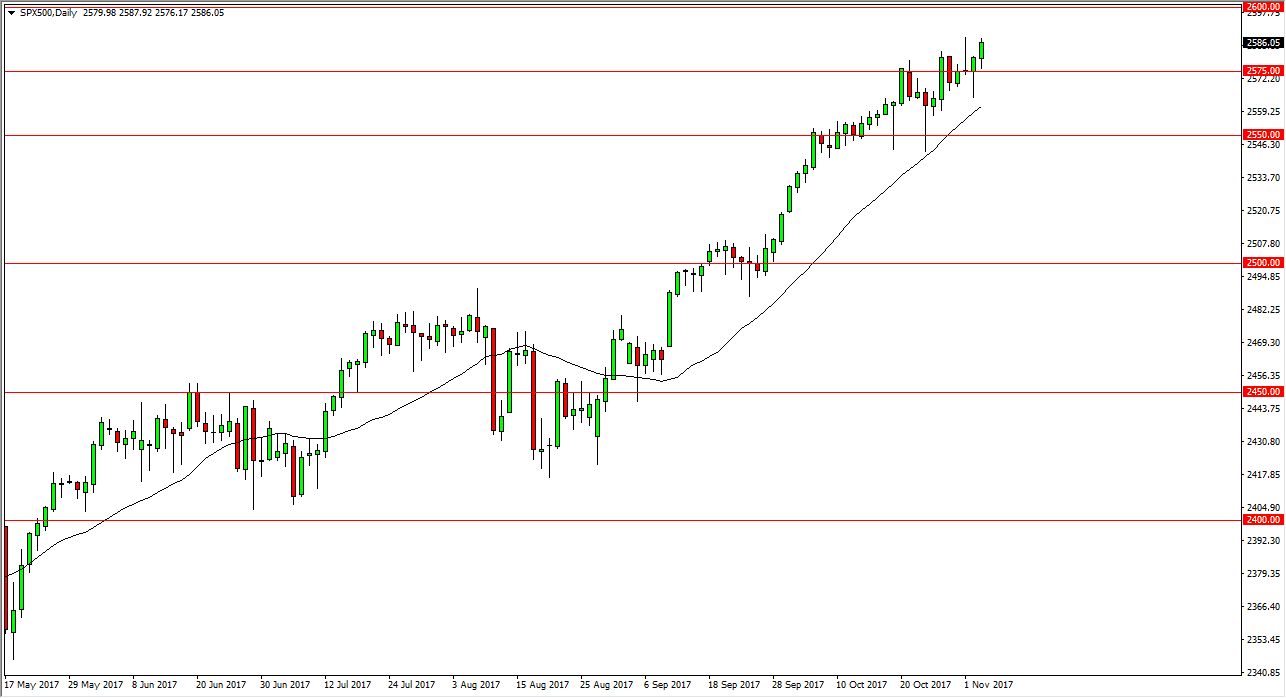

S&P 500

The S&P 500 fell initially during the trading session on Friday, reaching down towards the 2575 level, and finding support. We bounce from there and rallied significantly, giving me the impression that we are about to reach towards the 2600 level. A break above the top of the range for the session on Friday has me going long and looking for that barrier. Pullbacks should be buying opportunities, and I believe that there is more than enough support underneath to keep this market afloat. I think that the earnings season has been decent enough for stock markets to continue to rally. Given enough time, I not only think that we reach the 2600 level above, but we break above it and continue to go even higher. Selling is all but impossible, least not until we break down below the 2500 level.

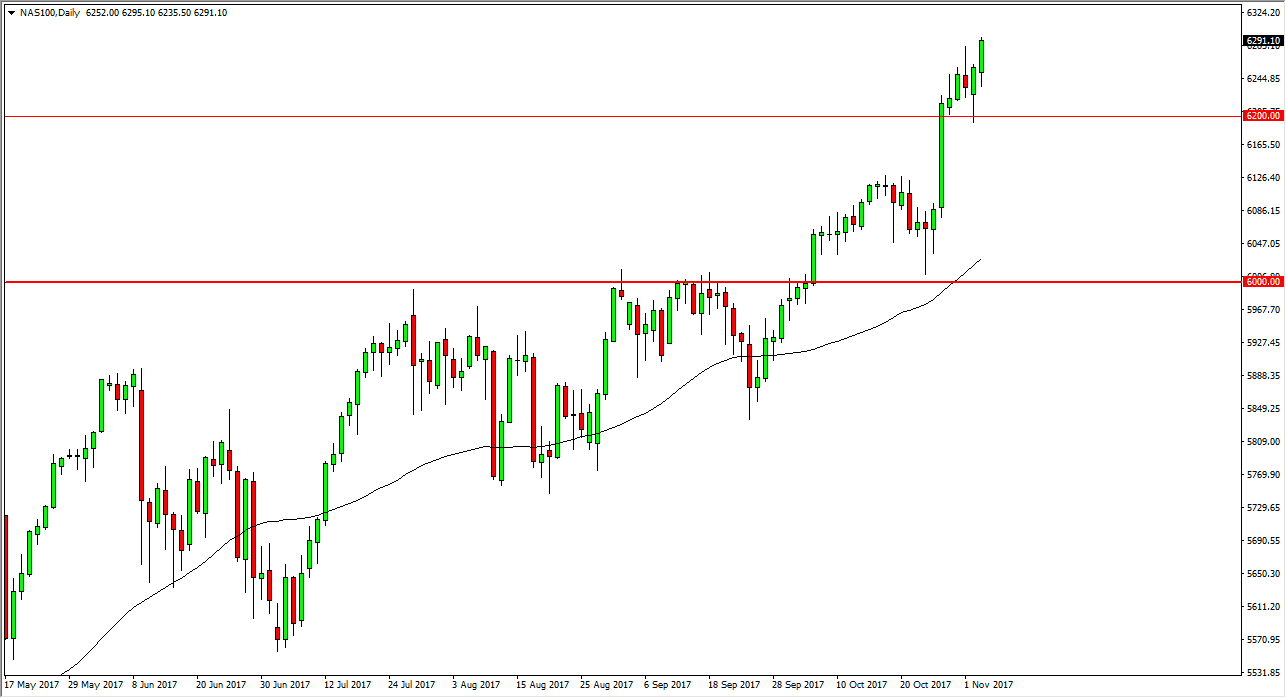

NASDAQ 100

The NASDAQ 100 fell initially during the trading session on Friday, and then rallied significantly. The 6300 level above be a target, looking as a large, round, psychologically significant number. I think that pullbacks will find plenty of buyers at the 6200 level, which should be supportive based upon the rally that we had seen during the day on Thursday. The 6000-level underneath was previous resistance, but should now be the “floor” in the market, as we look very positive, and of course had a good earnings season recently. If we were to break down below the 6000 handles, that would be a very negative sign, but quite frankly I don’t think that happens. I suspect that the buyers will be more than willing to pick up any pullback as the algorithmic traders have been programming their machines to pick up cheap stocks for months now, and there’s nothing to show that things have changed.