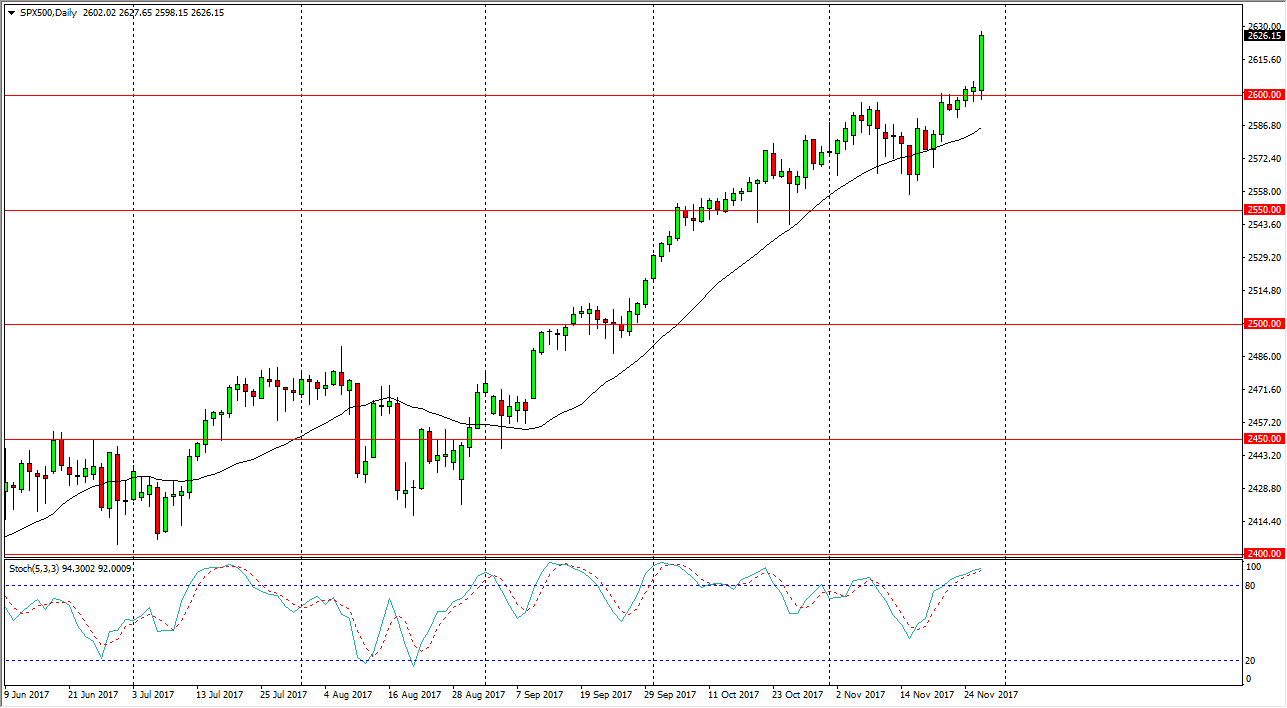

S&P 500

The S&P 500 rallied during the day on Tuesday, breaking well above the 2625 level, as the tax reform bill that the Republicans have been working on passed the Senate committee. This of course is a good sign for the potential of tax reform, and that should send the stock market higher. At this point, I believe that the 2600 level is a bit of a floor, and that if we pull back towards that area, there should be plenty of support. Of course, there’s always the concern about being overbought, which I think you can say we have been for quite some time. However, algorithmic trading continues to come back into the marketplace and pick up any little bit that we get. Because of this, buying the dips continues to work, and if the tax reform bill continues to move through the overall procedure, we should continue to see buyers.

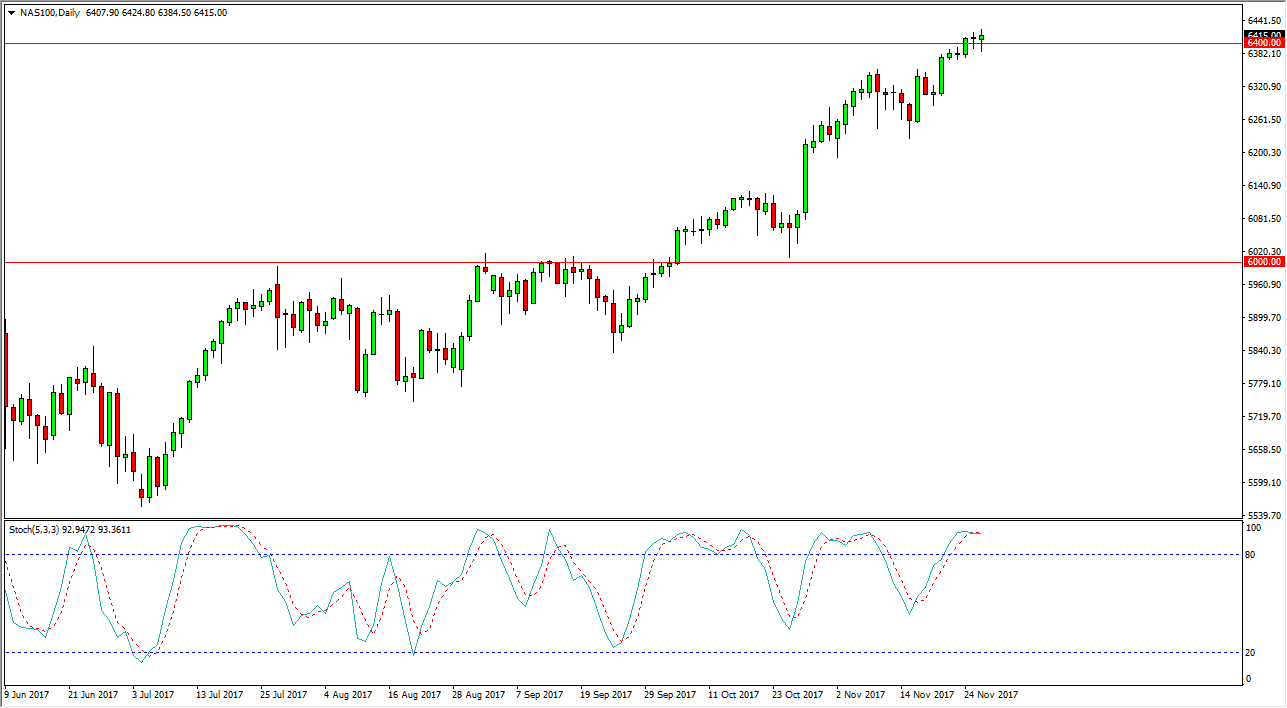

NASDAQ 100

The NASDAQ 100 initially fell during the day but turned around to form a hammer as we closed above the 6400 level. By doing so, looks as if the NASDAQ 100 is ready to continue going higher as well. A break above the top of the range for the day is a buy signal technical analysis speaking, but we are also overbought on the Stochastic Oscillator, and starting to cross. However, I don’t give that indicator as much weight when we are trending in a particular direction, as we clearly are now. That being the case, any pullback at this point will probably be a buying opportunity and something that value hunters and algorithmic traders will pounce upon. I believe that the NASDAQ 100 is going to go looking towards the 6500 level over the next several days, if not weeks.