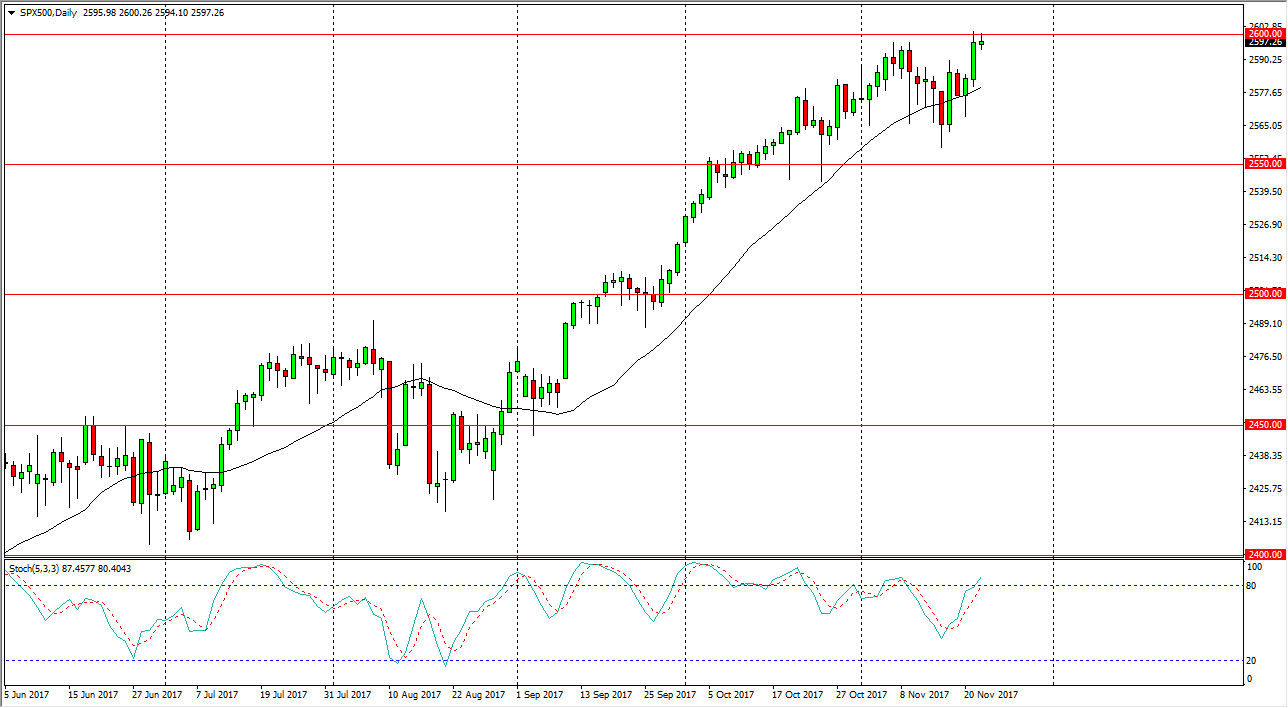

S&P 500

Obviously, with Thanksgiving day holiday in America today, stock trading will be nonexistent. However, as many of you trade the CFD markets, they are going to be open through various brokers. The first thing I would point out is that any electronic trading will be thin at best, as there is no underlying movement. I believe that the market does look very bullish after the action on Wednesday though, so it’s only a matter of time before we break above the 2600 level. At that point, I believe that the market goes looking towards the 2625 handle, and then the 2650 level. I believe that pullbacks should continue to offer buying opportunities based upon value as well, as the 2550 level is massive support. Overall, I believe that US indices continue to favor the upside as algorithmic traders continue to push higher.

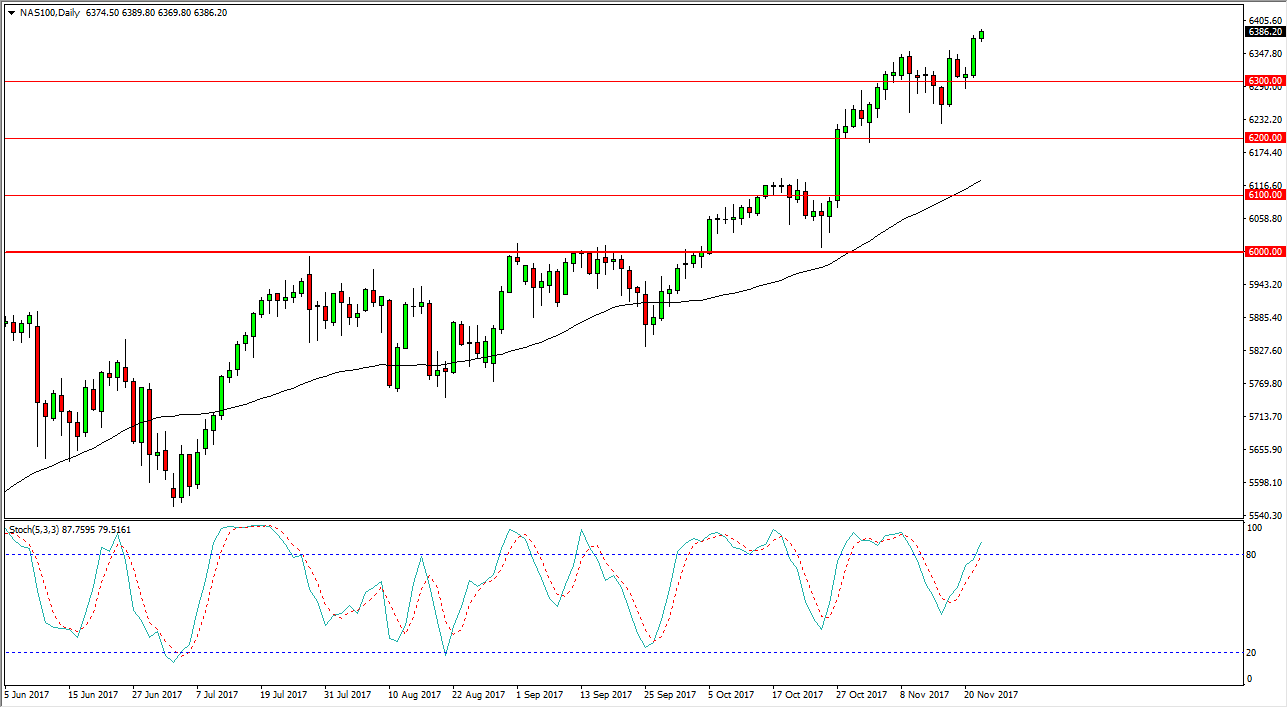

NASDAQ 100

The NASDAQ 100 rallied significantly during the day on Wednesday, using the 6300 level as support. Now that we have broken higher, looks like the market is ready to continue to go towards the 6500 level. The market looks very likely to continue to offer value on pullbacks, but obviously we won’t have underlying momentum to push higher today. I think that the overall attitude remains bullish though, and therefore have no interest in shorting. If the CFD market was to come undone for some reason, I would look at that as an inefficiency that I would need to start buying.