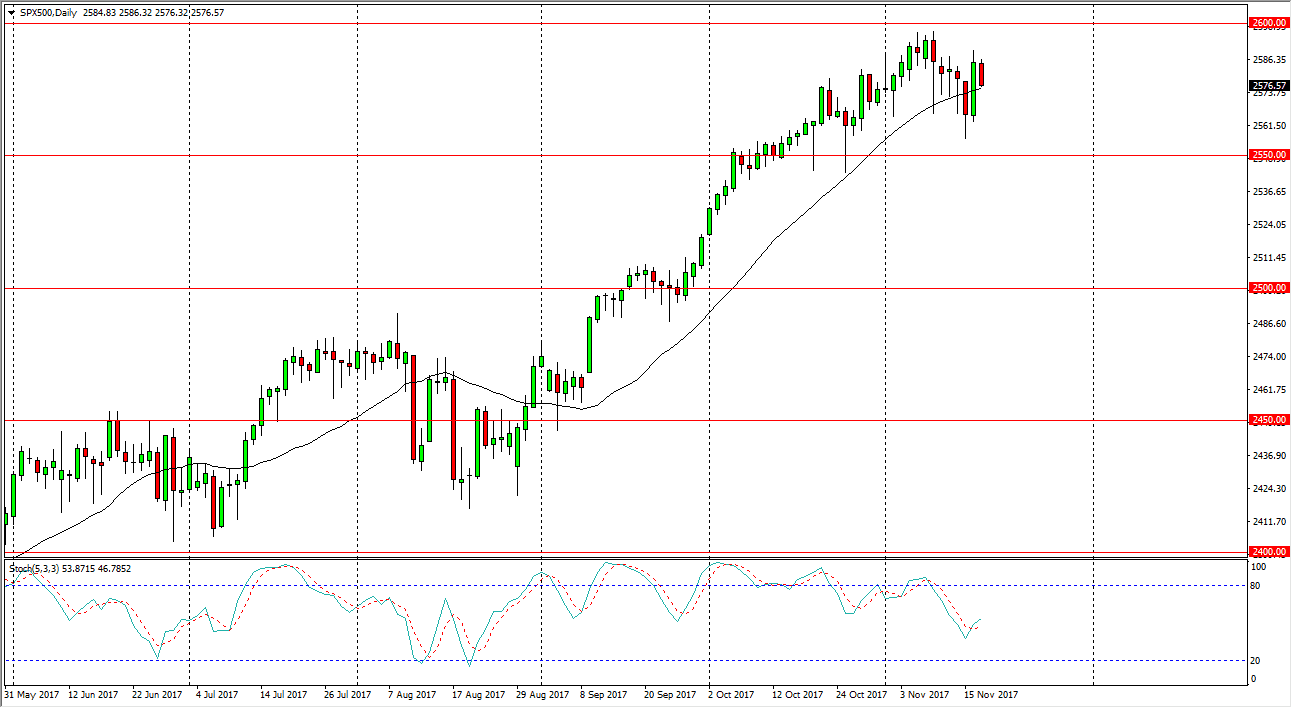

S&P 500

The S&P 500 fell a bit during the trading session on Friday, as we continue to grind back and forth. Currently, I believe that the market is essentially trying to catch his breath after a significant move higher, as we have essentially gone nowhere over the last couple of weeks. I believe that the 2550 level continues to offer significant support, and a breakdown below that level would be very negative. However, I would not expect it to turn the market around completely, rather it should send the market down to the 2500 level. A break above the 2600 level is very bullish, and is the next leg higher just waiting to happen. Nonetheless, I believe that we are going nowhere quick, but still believe in buying on the dip, at least in short term increments.

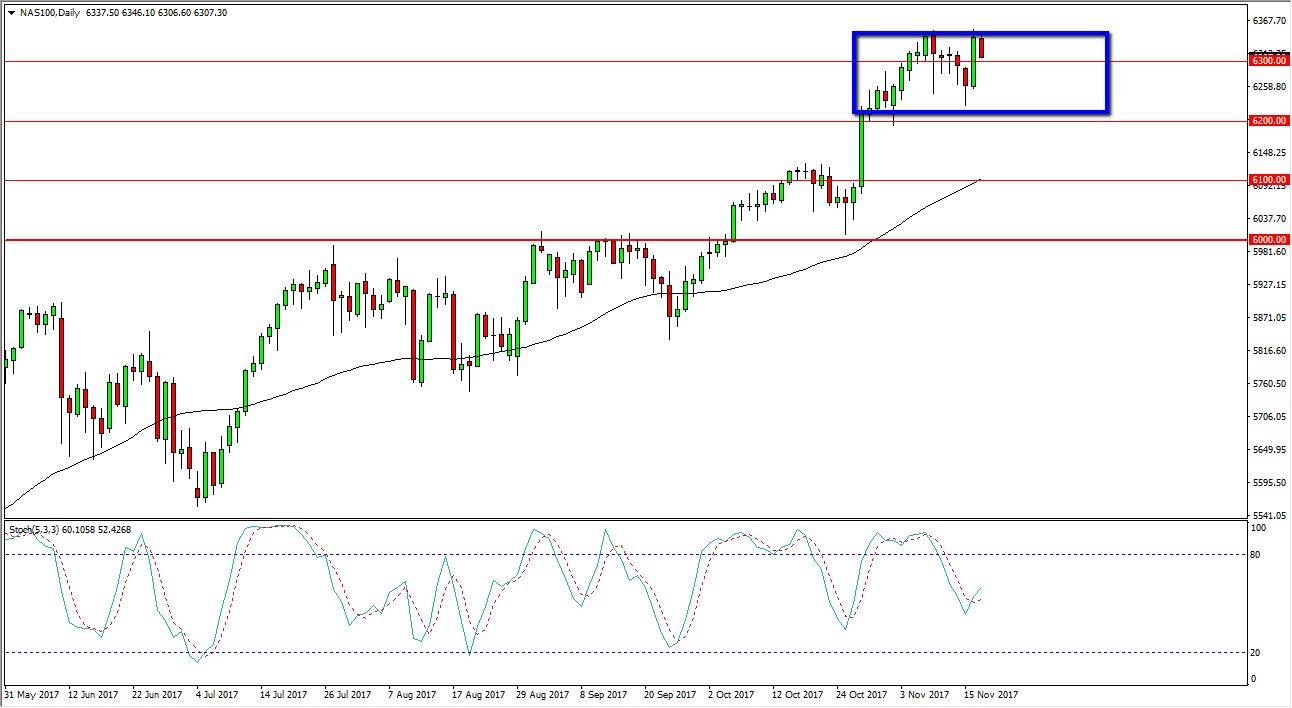

NASDAQ 100

The NASDAQ 100 fell during the trading session as well, reaching towards the 6300 level. That is an area that I believe continues to be of interest, but we dance around it significantly, and therefore I don’t think there’s much trouble breaking back down towards the 6250 level. The 6200 level is the support for the market, and move below there would of course signify that we could go down to the 6100 level. I believe that the uptrend is intact if we can stay above the 6000 handle. In other words, we have room for a pullback to build up the momentum necessary to continue the uptrend. U.S. Congress passing a tax bill would be a huge boom for this market as well, perhaps being the driver for much higher prices. In the meantime, we may get some type a pullback because of the lack of ability to make that happen.