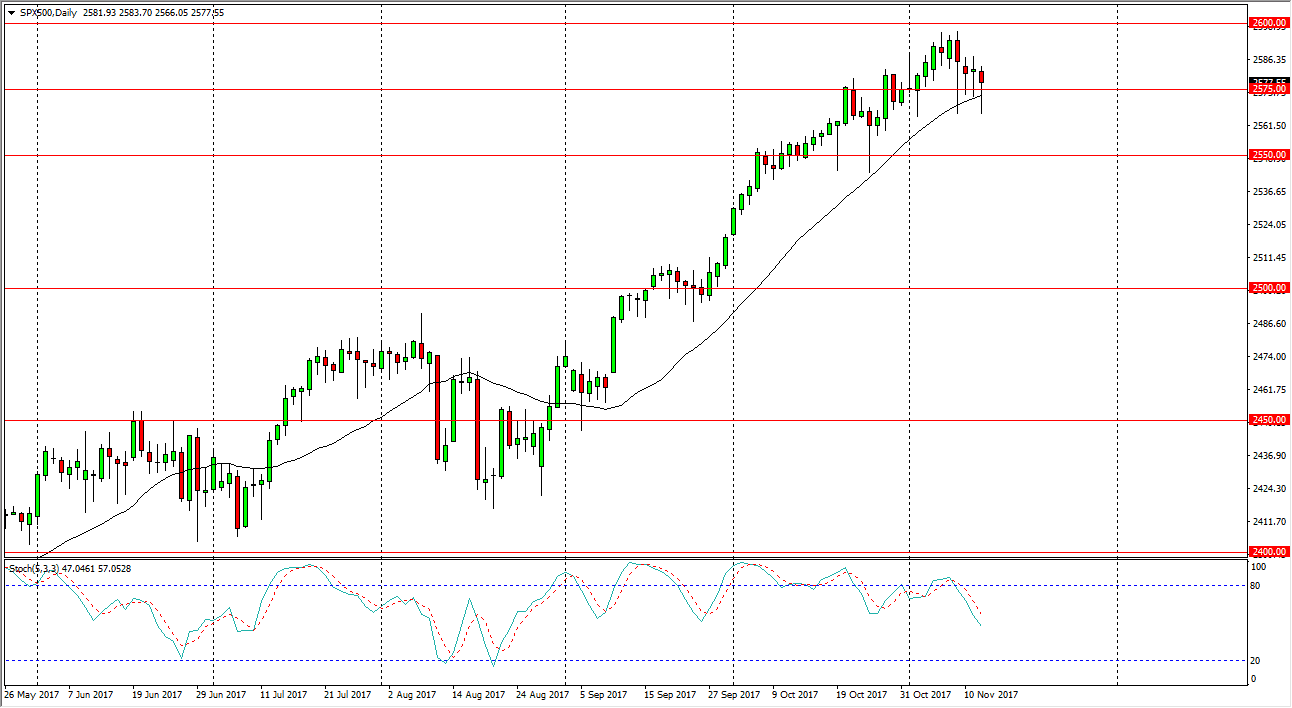

S&P 500

The S&P 500 fell initially on Tuesday yet again, but as we have seen over the last several sessions, buyers are willing to step into the market beneath the 2575 handle. However, although it looks as if there is a bit of a fight to the upside, I am a bit suspicious of this market for the next couple of sessions. At the very least, I think the market needs to find a catalyst to grind to the upside. Overall, I think that the Stochastic Oscillator are showing that we are running out of momentum, so I think we’re going to have a couple of more quiet sessions. If we can pull back from here, I would be willing to buy at the 2550 handle as well. I think it’s only a matter of time before we break out to the upside, but after the recent run higher, it makes sense that we need to take a breather.

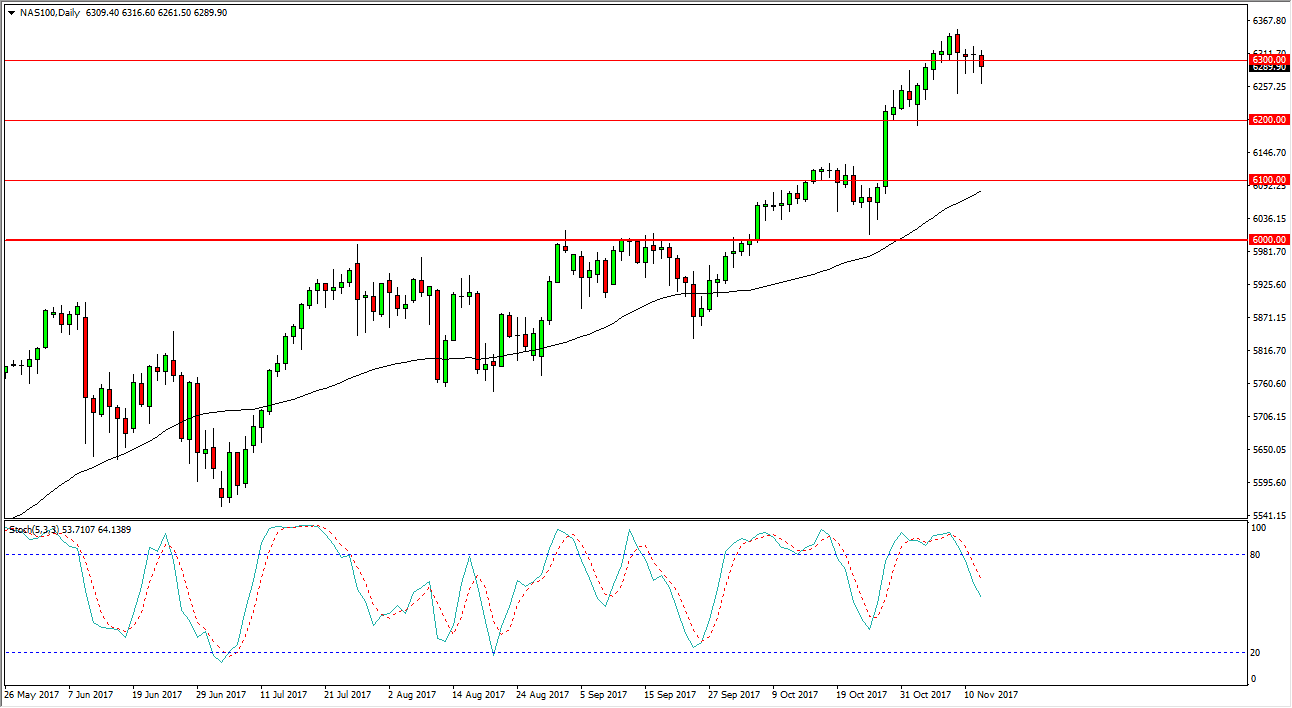

NASDAQ 100

The NASDAQ 100 fell during the trading session on Tuesday, slicing through the 6300 level again. We had formed multiple hammers, and it looks likely that we are going to continue to find buying pressure in this market. However, we are bit overextended, so I wouldn’t be averse to a pullback from here. The 6200-level underneath should be support, and it is likely that we will find buyers near that area. I think given enough time, the NASDAQ 100 continues to grind its way higher, but pullbacks are not only a necessity of a healthy market, but an opportunity to pick up value in a market that should continue to strengthen. Overall, I am not interested in shorting this market anytime soon.