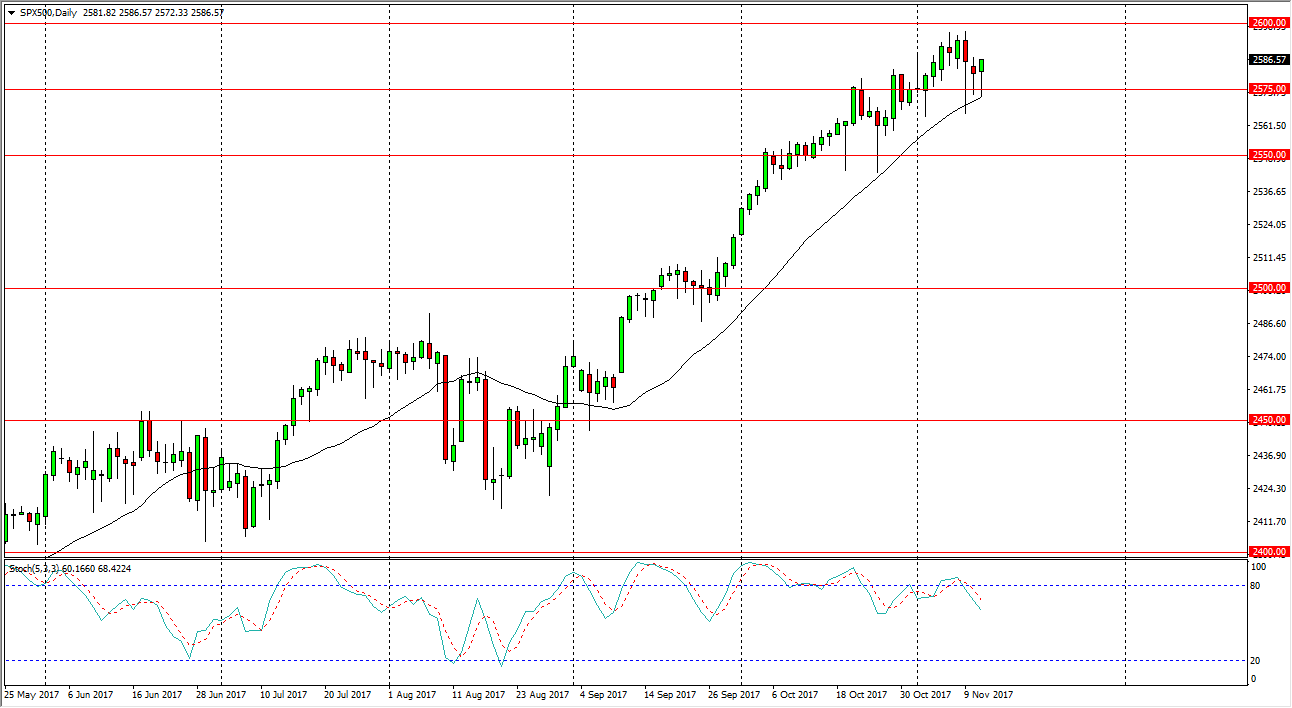

S&P 500

The S&P 500 fell during the trading session on Monday, breaking below the 2575 level early in the day. However, we turned around to form a hammer and it suggests that we are going to continue to try to reach the 2600 level, if not break above it. This is a very bullish looking market, but I believe that short-term buying is about all you can do as we are getting to be a bit overdone. Once we finally break above the 2600 level, momentum should pick up again. So, I think short-term traders will continue to jump into this market and pick up little dips, but at this point it is probably more or less just algorithmic trading and scalping that we will be seen. I have no interest in shorting regardless, as it’s obviously a fool’s errand to try to do so.

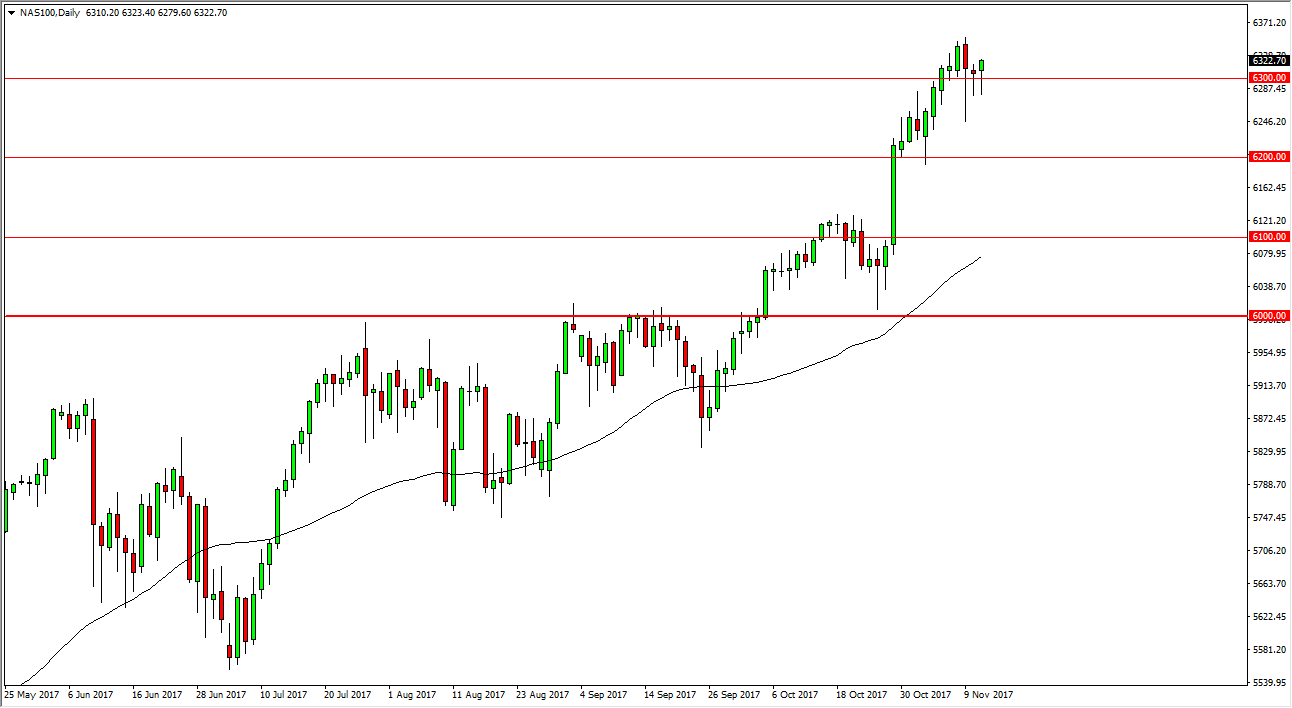

NASDAQ 100

The NASDAQ 100 initially fell during the trading session as well, but turned around to bounce above the 6300 level. By forming a hammer, it looks very likely to continue to the upside. I am a bit leery about these high valuations, but quite frankly the market isn’t showing much in the way of proclivity to the downside. I think we will eventually break out to the upside, but you need to look for pullbacks to find value, we could get a sudden breakdown after all. The NASDAQ 100 does tend to be very volatile, but at the end of the day it does tend to lead the rest of the United States, at least it has this past year. I don’t have any interest in shorting, so I look at every pullback as a potential buying opportunity.