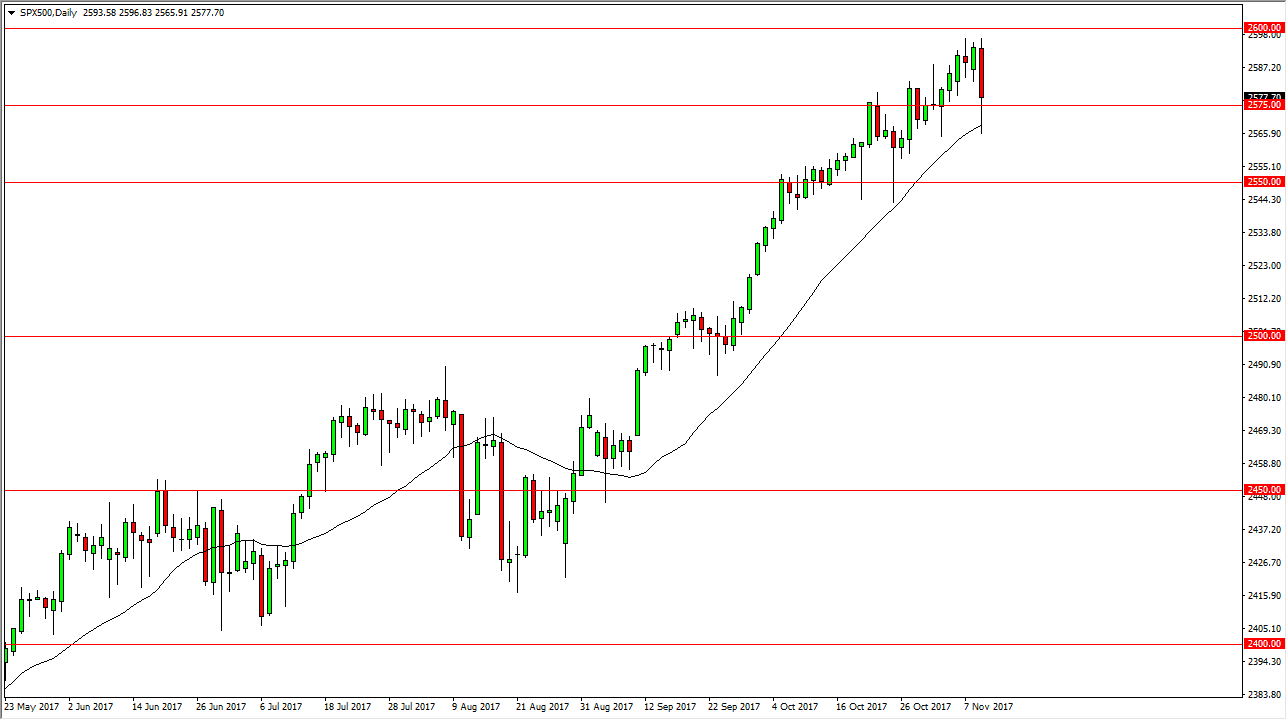

S&P 500

The S&P 500 fell significantly during the day on Thursday, slicing through the 2575 handle. By doing so, it shows just how precarious this rally is, because quite frankly we are overextended. I think that the 2600 level will probably continue to be a bit resistive, and with uncertainty around the tax bill being passed in the United States, or at least of the very least continued delays, it’s likely that the market should pull back a bit. I think it’s going to take very little to spook the market, and I believe that the 2550 level is a little bit more stringent support than the 2575 handle. Ultimately, I like buying pullbacks as value, but I think that the market has gotten far ahead of itself, and that buying at these high levels is going to be a very difficult proposition. Markets have been overcooked for a while, and quite frankly I don’t like the idea of buying anymore. Shorting is almost impossible.

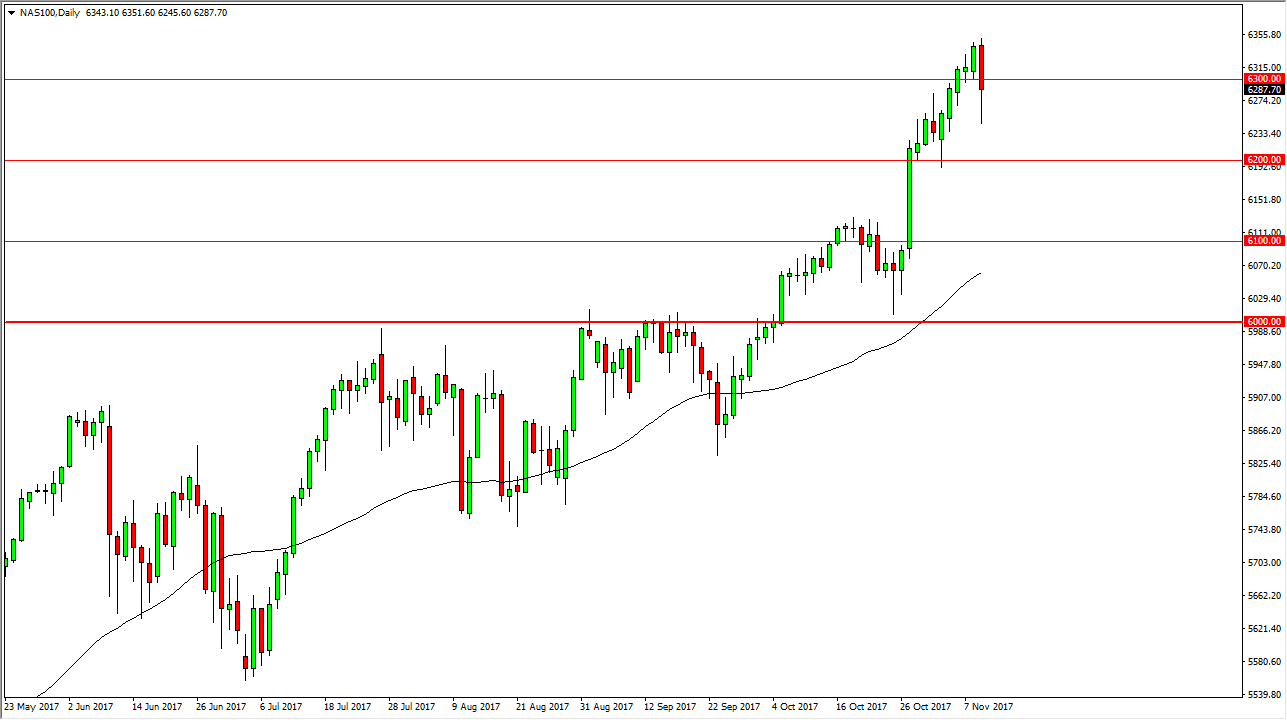

NASDAQ 100

The NASDAQ 100 also fell during the day, slicing through the 6300 level. We bounced a bit, but on the short-term charts, it looks as if the 6300 level is going to be resistance, and we could roll right back over. I would love to see a significant pullback of a couple of hundred points, so that we can get an opportunity to pick up value. The 6000-level underneath should be the “floor”, and if we can come back to retest that general vicinity, that should be a nice opportunity to go long. The market has been far too bullish for far too long, and we need to pull back significantly so that we can pick up value. The NASDAQ 100 should continue to be positive longer-term, but these ebbs and flows will continue to be what we look for.