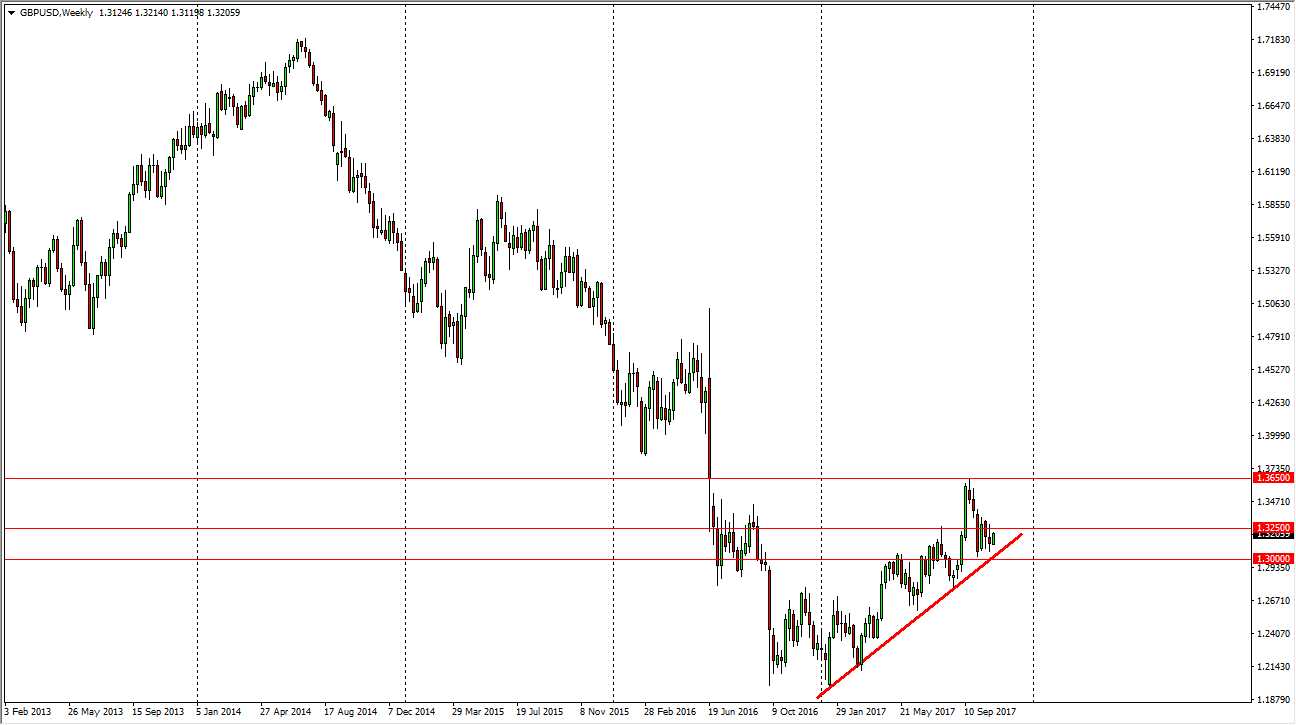

The GBP/USD pair rallied a bit over the last month after initially falling with significance, but as you can see on the weekly chart, I have an uptrend line holding support, and I also recognize that the 1.30 level underneath should be a bit of a floor going forward, ultimately, I think that the market should continue to go much higher, via the 1.3250 level, and then perhaps the 1.35 handle. I think that the 1.3650 level above being broken to the upside would be a very bullish sign, as it would wipe out the losses from the gap down after the surprise boat to leave the European Union. If that happens, I think it’s only a matter of time before we go to the 1.48 level.

Overall, I am bullish of this pair, but I also recognize that there are a lot of moving pieces. After all, the Federal Reserve is likely to raise interest rates several times over the next year, but at the same time the Bank of England looks to do the same. Inflation in England is going higher, and it’s likely that we will continue to see interest in this pair. If we were to break down below the 1.30 level, that of course would be negative, but I think even then we probably find the 1.25 level as another potential support region. Overall, this is a market that I think continues to find buyers and tries to form some type of base, but I think November is going to be every bit as choppy as October was. I have an overall upward bias, but I also recognize that small position sizing is going to be crucial for this market. It is not until we break down below the 1.25 level that I would be interested in selling, something that I don’t see happening.