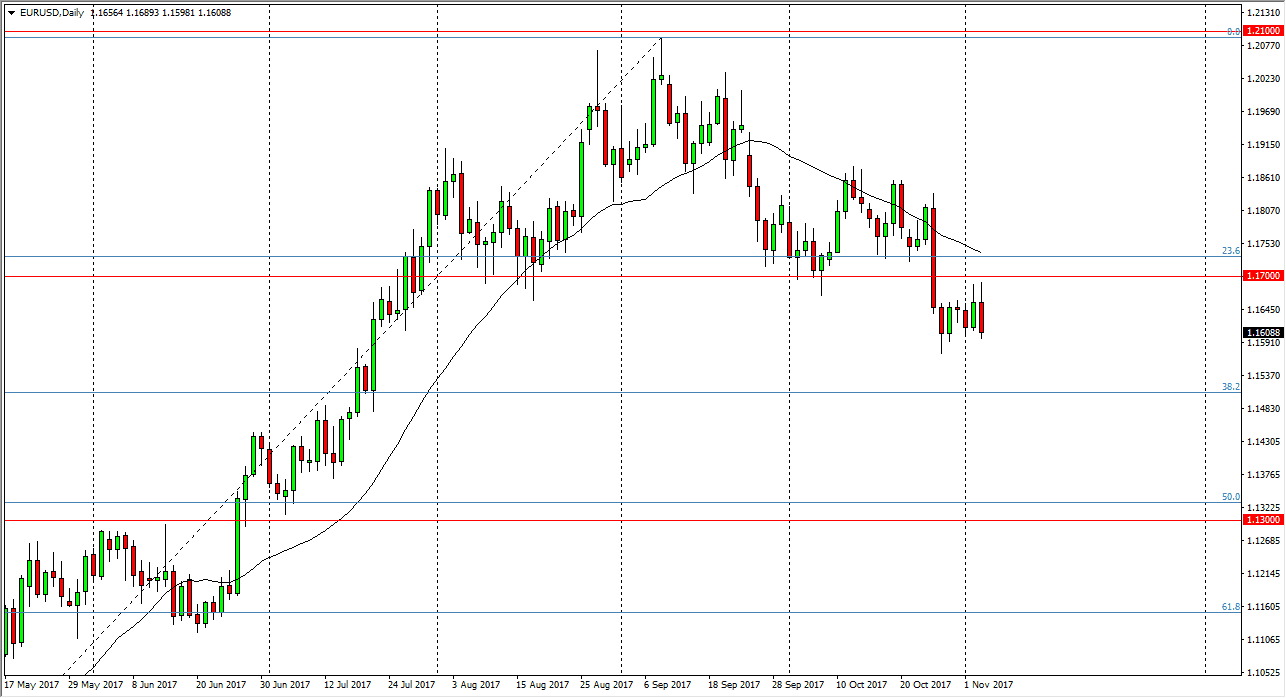

EUR/USD

The EUR/USD pair tried to rally initially during the Friday session, testing the 1.17 level again. This level was the neckline for a head and shoulders, and the fact that it has repulsed buying opportunities twice now tells me that we are more than likely going to go ahead and fall from here. I have the 1.13 level underneath marked on the chart as the potential target, as the head and shoulders measures for a 400 pip move. I believe that the market should continue to sell rallies, and I believe that more than likely we will find massive support in that area as it is not only structural support from the past, it is also the 50% Fibonacci retracement level along with the measured move from the head and shoulders.

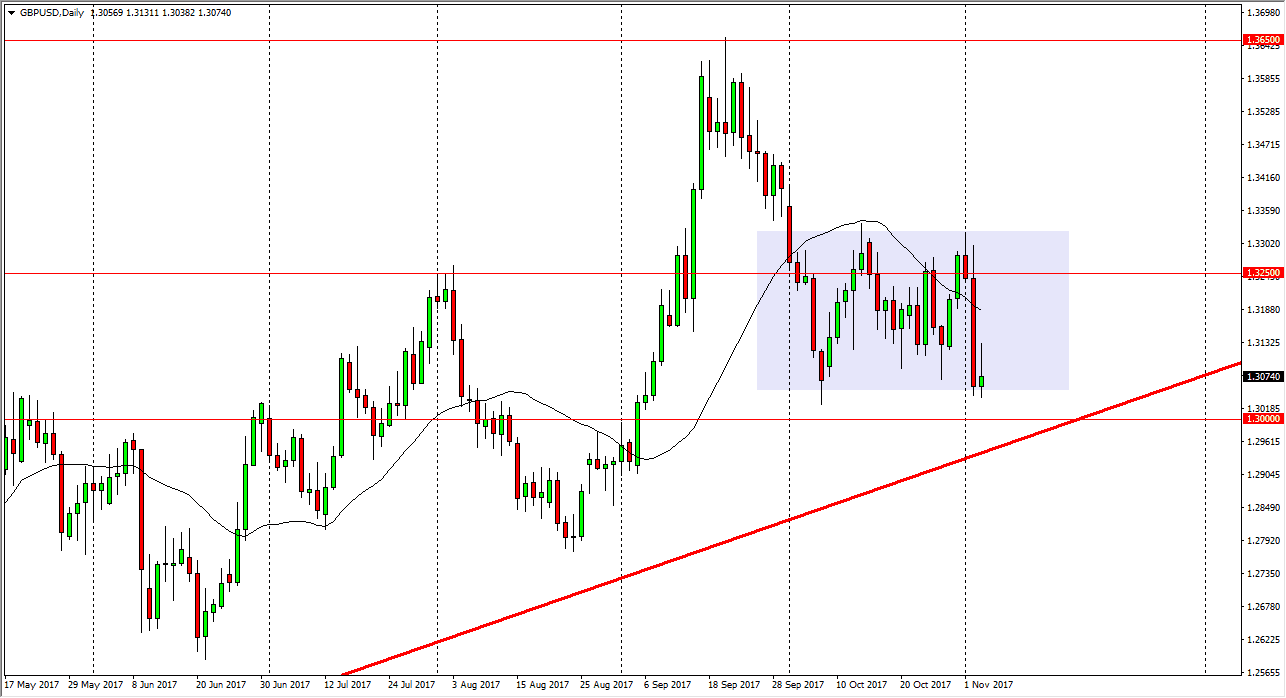

GBP/USD

The British pound initially tried to rally during the day on Friday, but rolled over to form a shooting star. We are at the bottom of a consolidation region, and I think that the uptrend line just below should be a massively supportive level as well. Because of this, if we break down below the 1.30 level, the market should to fall apart and continue to go much lower. This was mainly due to Mark Carney suggesting that the Bank of England was not going to be raising interest rates anytime soon. However, if we break above the top of the range for the Friday session, I think we go to the top of the purple box, meaning that we will test the 1.33 level after that. A move above there should send this market towards the 1.3650 level above. I expect a lot of volatility, so be very careful in this pair as we are trying to get our footing in one direction or the other.