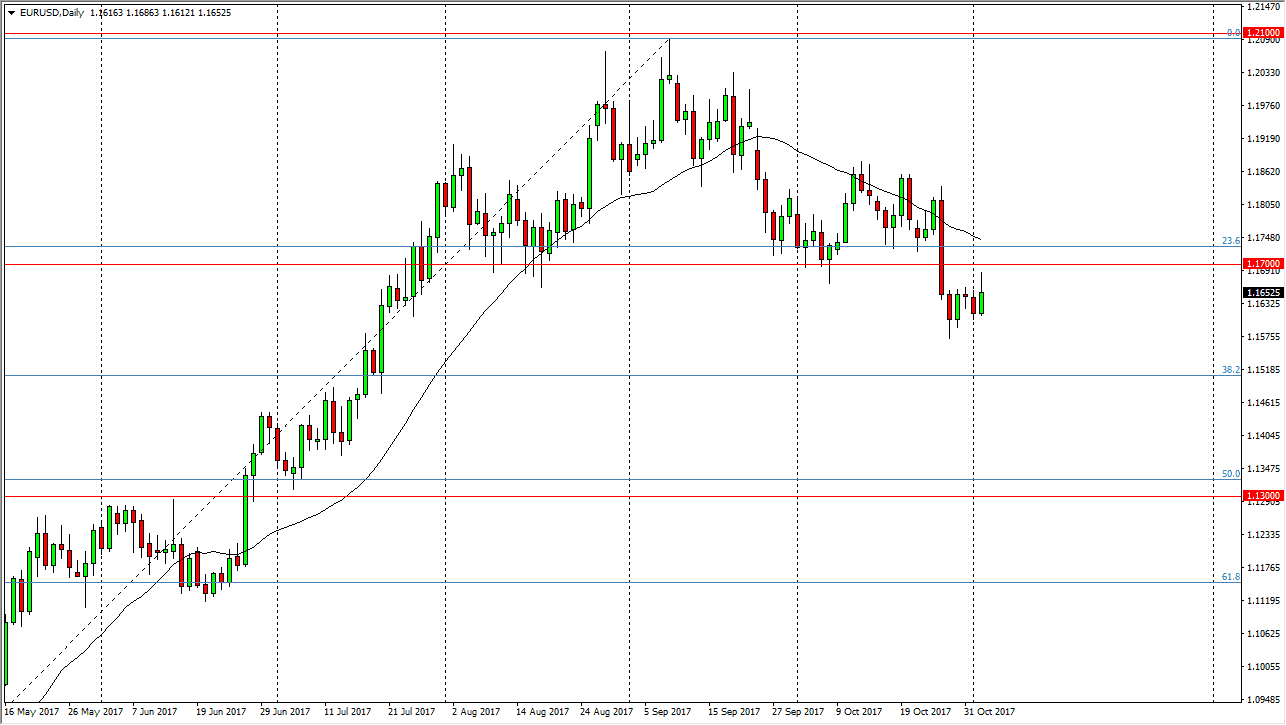

EUR/USD

The EUR/USD pair rallied a bit during the day on Thursday, reaching towards the 1.17 handle. However, this was the neckline from a significant head and shoulders on the daily chart, so I anticipate that there will be selling in this general vicinity. With today being the jobs announcement coming out of the United States, it’s likely that we will see a significant amount of volatility. From a technical standpoint, we should continue to go lower, perhaps reaching towards the 1.13 level underneath, based upon the measurement of the head and shoulders. I also recognize that the area just above should be resistive as it was previously supportive, so I’m looking for the first signs of exhaustion after the announcement to start selling.

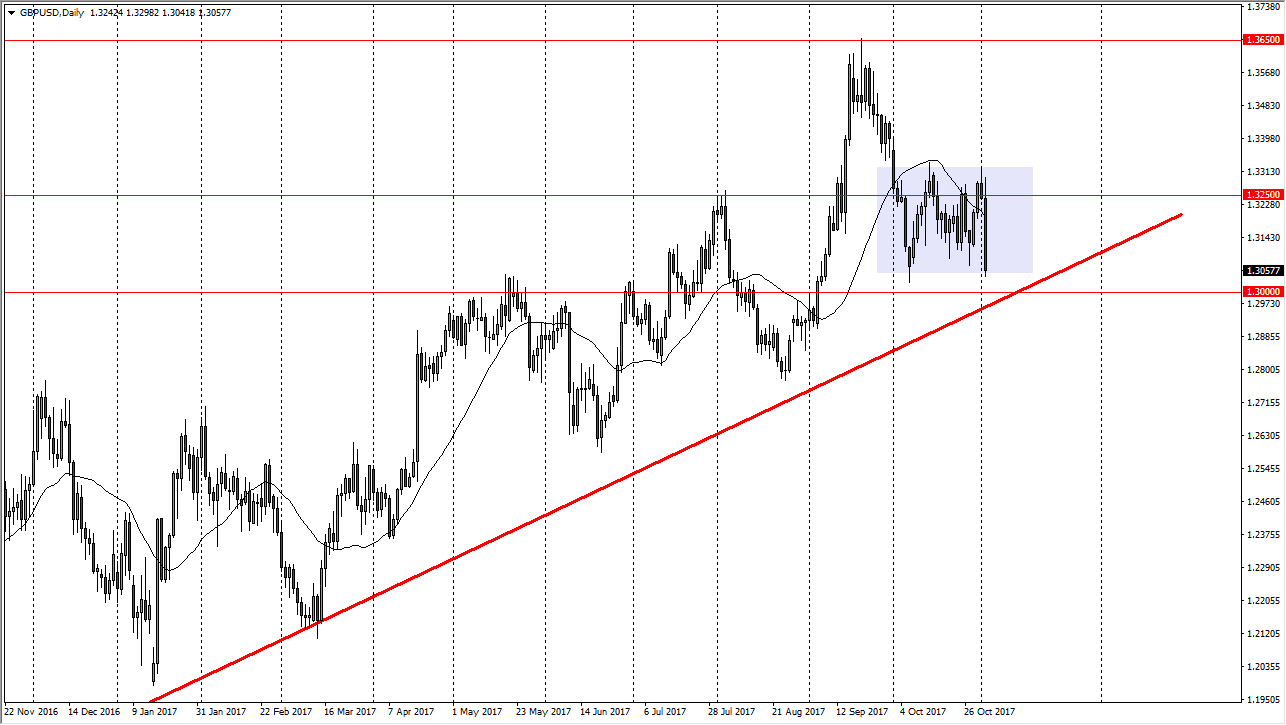

GBP/USD

The British pound got absolutely hammered during the day as Mark Carney said after the interest rate hikes that the next interest rate hike will be a very gradual process, not something that happens immediately. That had people running from the British pound, as we fell towards the 1.31 level, and will need to look at the 1.30 level underneath. A breakdown below that level changes everything, and it should send this market much lower. Any bounce from here should send this market back towards the 1.3250 level, which should be resistive. If we can break above there, then the market is free to go much higher. In general, the Federal Reserve looks likely to raise interest rates several times, so we could break down below the uptrend line, which of course would be a very negative sign indeed. I would have to look to the 1.2750 level underneath, which would be supportive. A break above the 1.3250 level would then send this market to the 1.35 handle above.