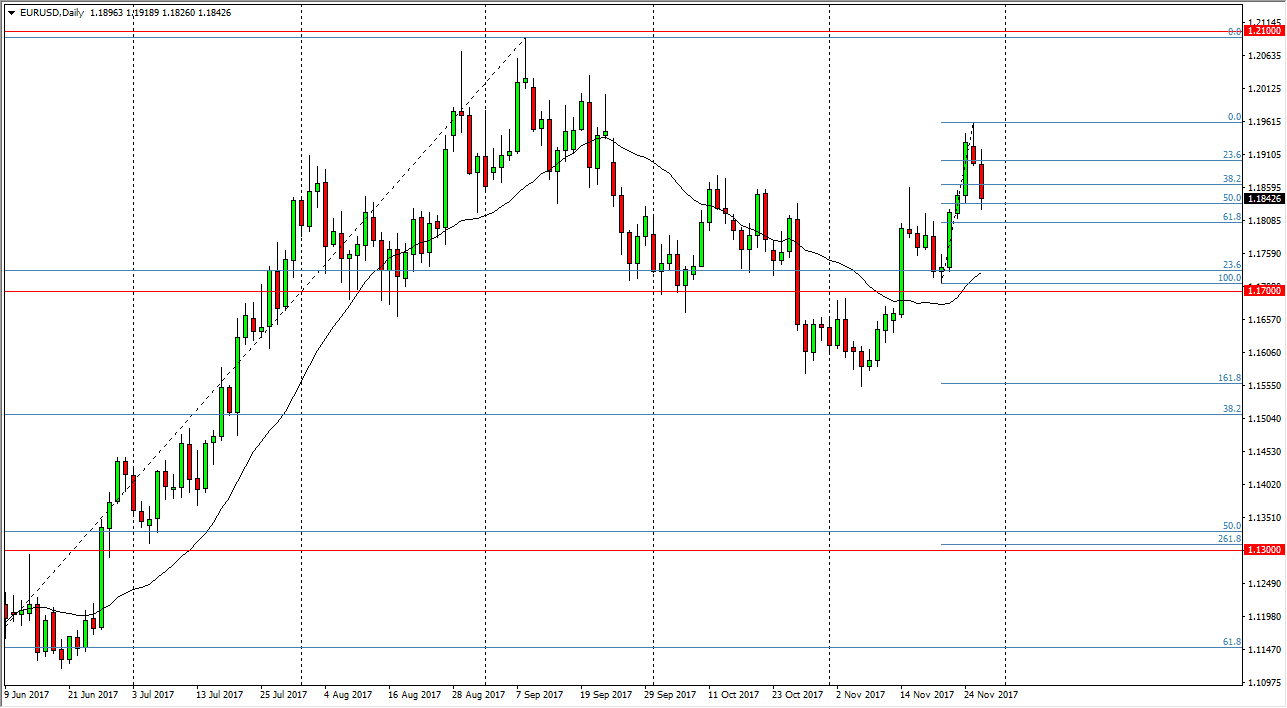

EUR/USD

Initially, the EUR/USD pair tried to rally during the Monday trading session but found the area above the 1.19 level to be a bit too resistive to continue. Because of this, we ended up breaking below the bottom of the shooting star from the Monday session, which of course is a classic signal to start selling. We touch the 50% Fibonacci retracement level near the 1.1850 level, drift a little bit lower, and started to find buyers again. I believe there’s going to be a bit of a floor at the 1.18 level anyway, as it is a 61.8% Fibonacci retracement level and could be the extension of a downtrend line on the daily chart. I think that if we get any type of negative news about the tax reform coming out of the United States, that should send this market higher.

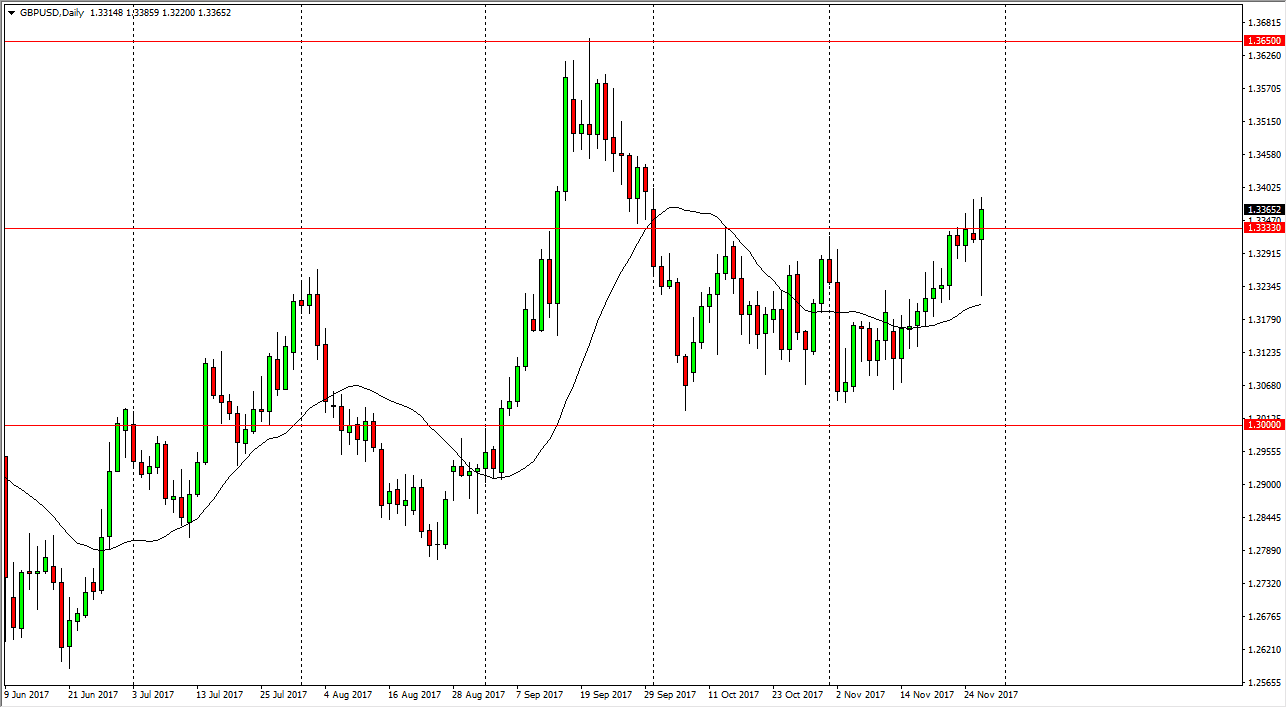

GBP/USD

The British pound had a wild ride during the day, initially drifting lower, but then bouncing significantly to form a hammer at the 1.3333 level after word got out that perhaps a deal for the payment to the European Union for leaving had been reached. There are conflicting reports as I record this, so it’s difficult to tell what the truth is, as London has claimed that the reports were overblown. If that’s the case, we will probably continue to see a bit of stagnation. From a technical standpoint of you, if we can break above the top of the range for the day on Tuesday, I would be willing to start buying as the market should go looking towards the 1.35 level, and then eventually the 1.3650 handle. I believe that there is plenty of support below, and therefore aren’t interested in selling quite yet.