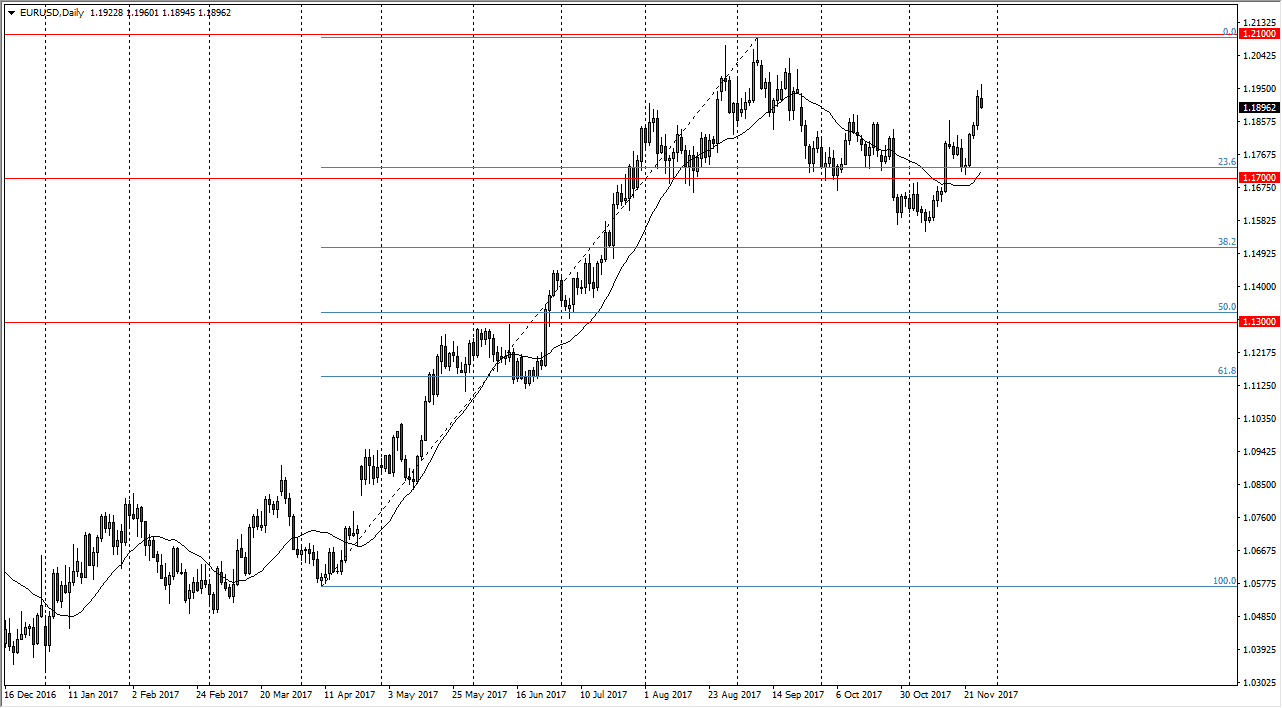

EUR/USD

The EUR/USD pair initially rallied on Monday, but found enough exhaustion above the 1.19 level to roll over and form a shooting star. I believe shooting star signifies that we need to pull back a little bit to build up bullish momentum. I anticipate that the market is going to find buying at both the 1.1850 level and the 1.18 level, respectively. Because of this, I am waiting for some type of bounce or supportive candle to go long. In fact, I considered the 1.17 level to be the “floor” in the market going forward, and I do think that we are getting ready to reach towards the 1.21 handle. US Congressional failures to pass meaningful tax legislation will continue to put upward pressure on the market, and I believe that buying on the dips will remain to be the best way to play the EUR/USD pair forward.

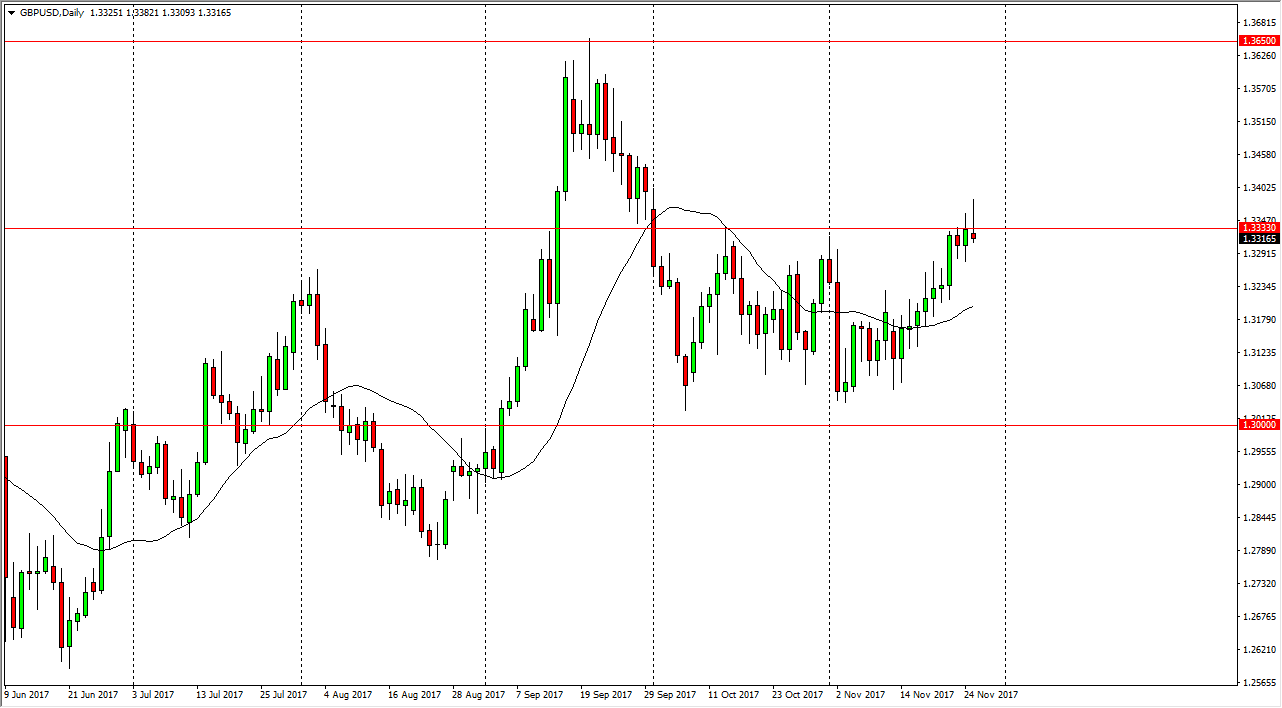

GBP/USD

The British pound broke above the vital 1.3333 handle during the Monday session, but turned around to form a shooting star. However, the last couple of candles have been rather aggressive, and I believe that any pullback we get from here should be short-lived at best. We essentially just filled the gap from 2 months ago, now the question is can we break above it? If we can break above the top of the range for the session on Monday, that is an extraordinarily bullish sign. However, if we pull back I believe that it simply offers value at lower levels, and standing on the sidelines to wait for some type of supportive candle or a bounce might be the best way to play the market. It’s not until we break down below the 1.30 level that I am worried about the uptrend that we have recently formed.