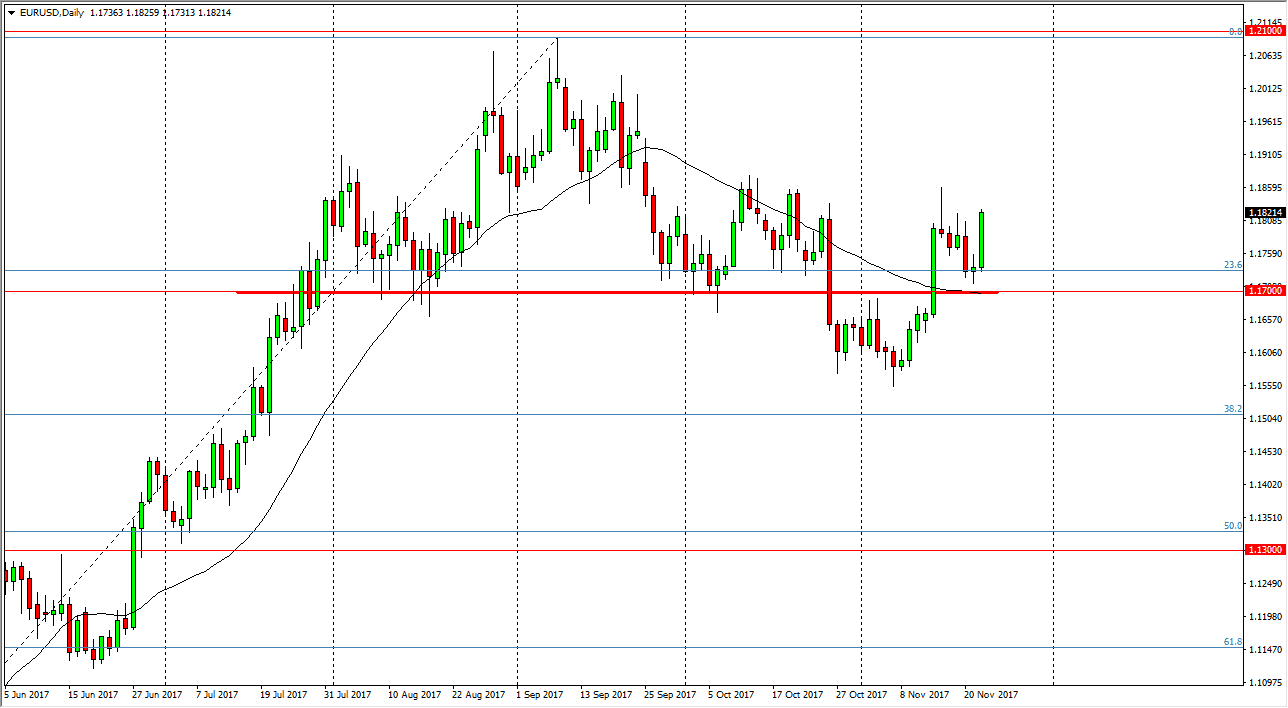

EUR/USD

The EUR/USD pair rallied significantly during the session on Wednesday, reaching towards the 1.1825 level. We broke higher, suggesting that perhaps the 1.17 level is going to offer support as it had previously been resistance. At one point, this was the neckline of a head and shoulders pattern, but that has been blown away. I believe that people are starting to worry about whether Congress can pass some type of tax reform bill, and that continues to weigh against the value of the greenback. I think if we can break above the shooting star from last week, the market should go much higher, perhaps reaching towards the 1.21 level after that. If we can stay above the 1.17 level I have no interest in shorting this market at all. The noisy trading condition should last for the next several sessions as the Americans are away at Thanksgiving.

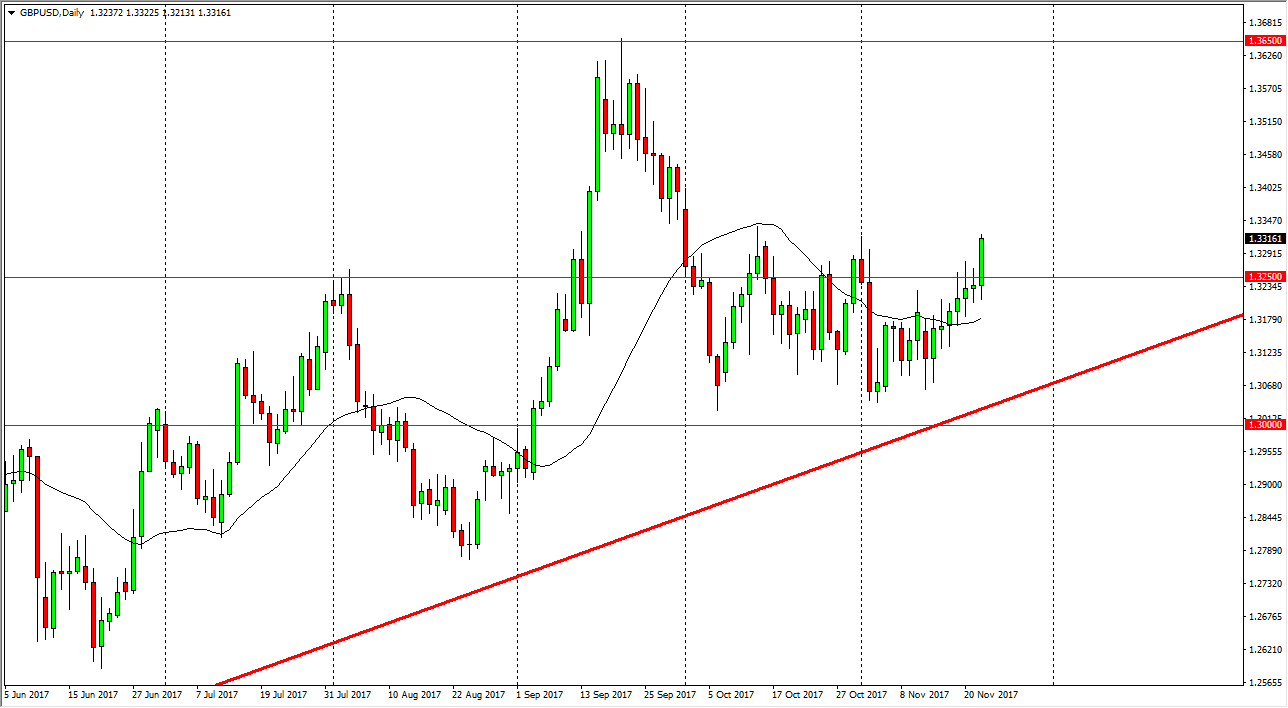

GBP/USD

The British pound initially fell during the trading session on Wednesday, but then sliced through the 1.3250 level. If we can break above the 1.3333 handle, then I think we are going to the 1.35 level, followed by the 1.3650 level after that. That is an area that is where we gapped lower previously, and I think at this point we’re trying to build up enough momentum to finally break out to the upside. Given enough time, I think that the market will eventually break out above there and go looking towards the 1.40 level, but that is going to be after building up a significant amount of momentum building, which is going to take some time. In general, I don’t have any interest in shorting this market, as I believe that the most recent action is indicative of a market that is trying to build up longer-term movement.