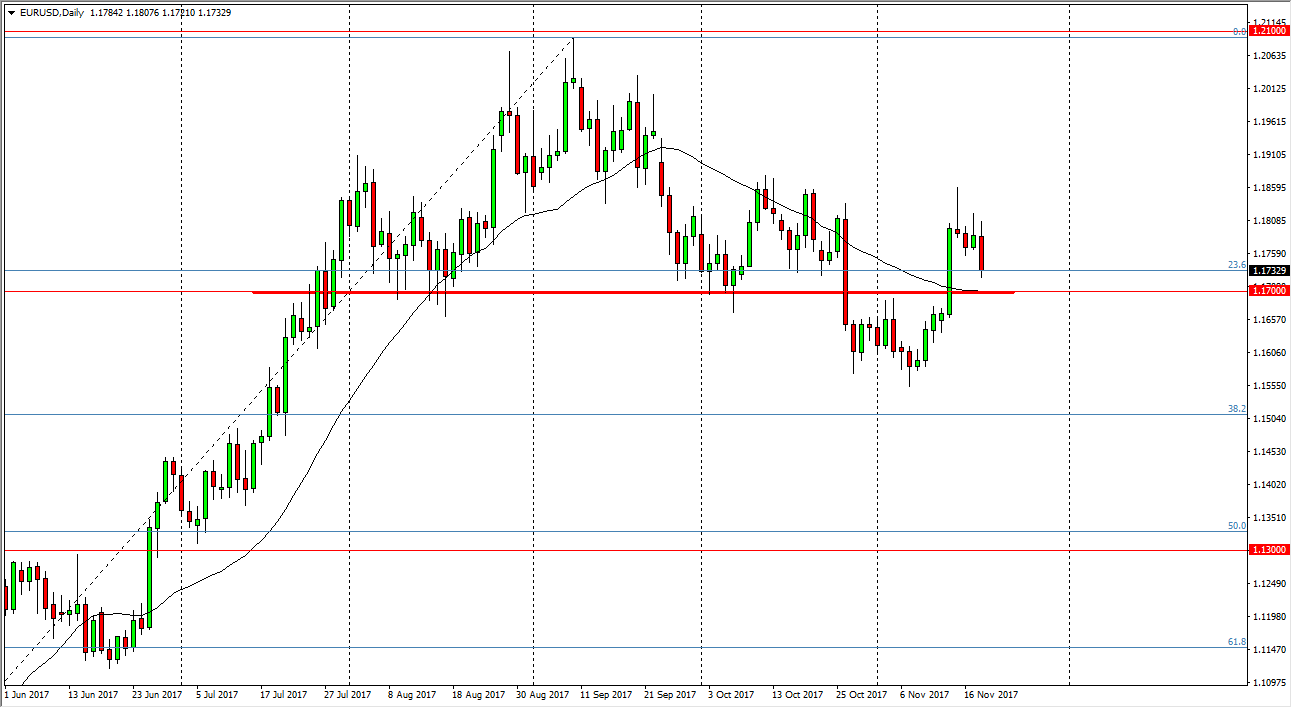

EUR/USD

The EUR/USD pair initially tried to rally during the day on Monday, but broke down significantly, reaching towards the 1.1730 region as German politicians failed to put together a coalition government. The 1.17 level underneath was the neckline on the head and shoulders pattern that I had pointed out previously, and I think it could offer support again. However, if we break down below the 1.1650 level, then I think the market could continue to drop, completely negating all previous technical analysis, and perhaps looking towards the 1.15 level next. Alternately, if we do get a bounce from the 1.17 level, I feel it’s only a matter of time before we reach towards the 1.20 level again, and then eventually the top of that resistance barrier at the 1.21 handle.

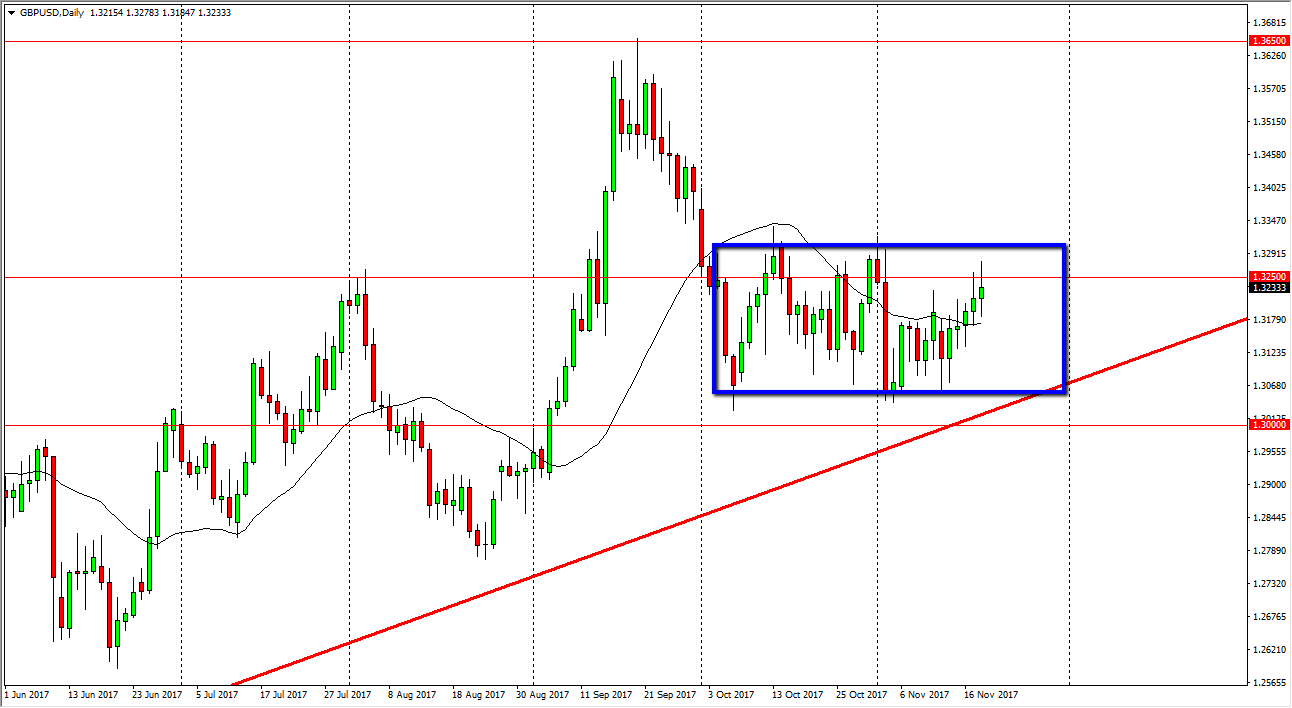

GBP/USD

The British pound continues to be very noisy, trying to break above the 1.3250 level, but failing. We are pulling back and forth, forming a bit of a shooting star, but I think eventually we will break out. If we can get above the 1.3333 handle, then we will probably go looking towards the 1.35 level after that. We are certainly starting to see a lot of noise in this market, and today will of course be very interesting as various members from the Bank of England will be testifying in front of Parliament about inflation. This will obviously have a significant effect on the British pound, so I expect a lot of noise today. Again, break above the 1.3333 handle has been buying, otherwise I think we will probably pull back into the previous consolidation area just below.