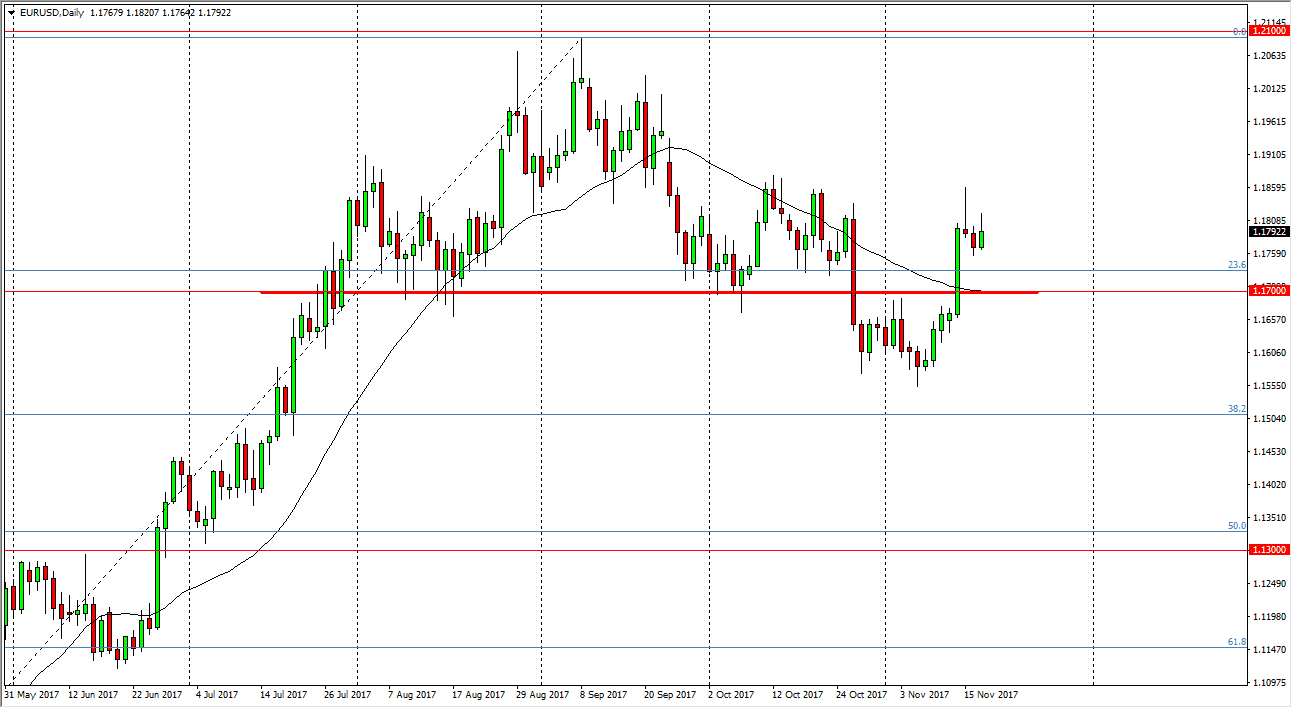

EUR/USD

The EUR/USD pair rally during the day, but gave back about half of the gains to form a shooting star like candle. Because of this, I think that the market could pull back to a significant support at the 1.17 level. That’s an area that was the previous neckline for the head and shoulders pattern that you see on the daily chart, but if we break down below there, I think that shows just how volatile the market is. I would anticipate the buyers should come back in the markets near the 1.17 handle, and at the first signs of a bounce, I am more than willing to go long. Alternately, if we break above the 1.19 level, I’d be a buyer there as well as we should then eventually go to the 1.21 handle. A breakdown below the neckline would be very chaotic.

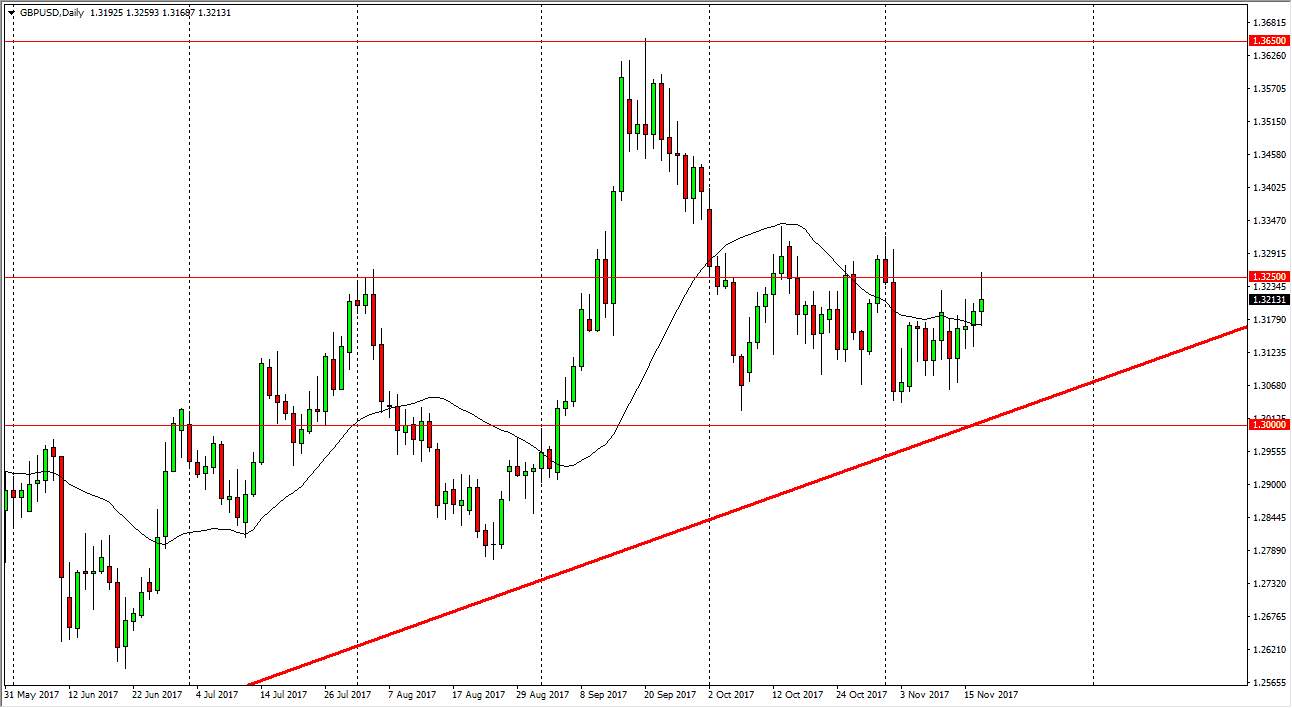

GBP/USD

The British pound initially tried to rally during the day but gave back most of the gains as we got to the 1.3250 level. We formed a shooting star, so I suggest that we are going to continue to consolidate, and perhaps reach down towards the 1.3050 level after that. There is a significant amount of support based upon the 1.30 round number, and of course the uptrend line that you see on the chart. I think that a pullback makes sense, as there is no reason to expect a huge change in the market as there has been no catalyst. However, if we break above the 1.33 area, we could then break out to the upside and continue to reach towards the 1.3650 level. This is a market that continues to be very noisy.