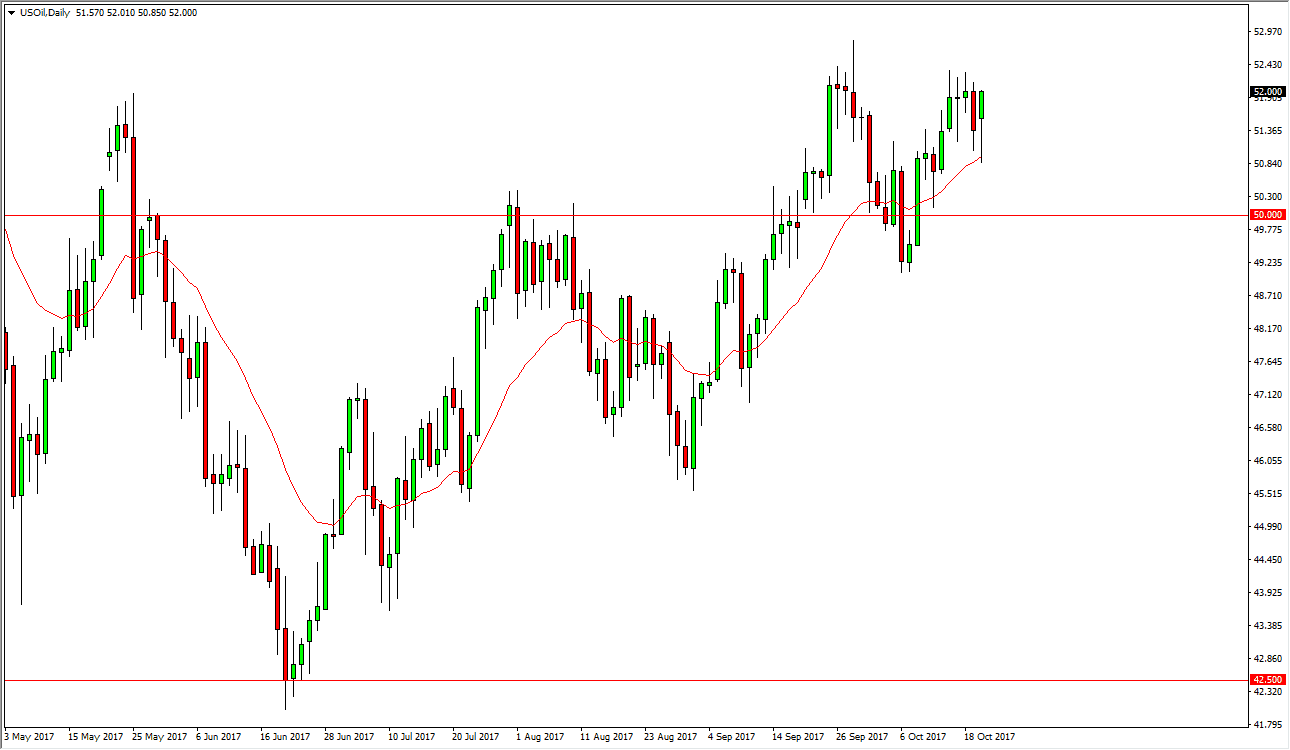

WTI Crude Oil

The WTI Crude Oil market initially fell during the Friday trading session, but found enough support underneath that the $50.80 region to turn around and form a nice-looking hammer. It now looks as if we are going to try and reach towards the $52.50 level again, an area that has been resistive. Because of this, it’s likely that we will continue to see volatility but if we can break above that level on a daily close I feel that the market is ready to go towards the $55 level above. The $50 level underneath should continue to be supportive, so I think that short-term pullbacks could be buying opportunities in a market that although not ready to break out quite yet, certainly doesn’t look ready to break down.

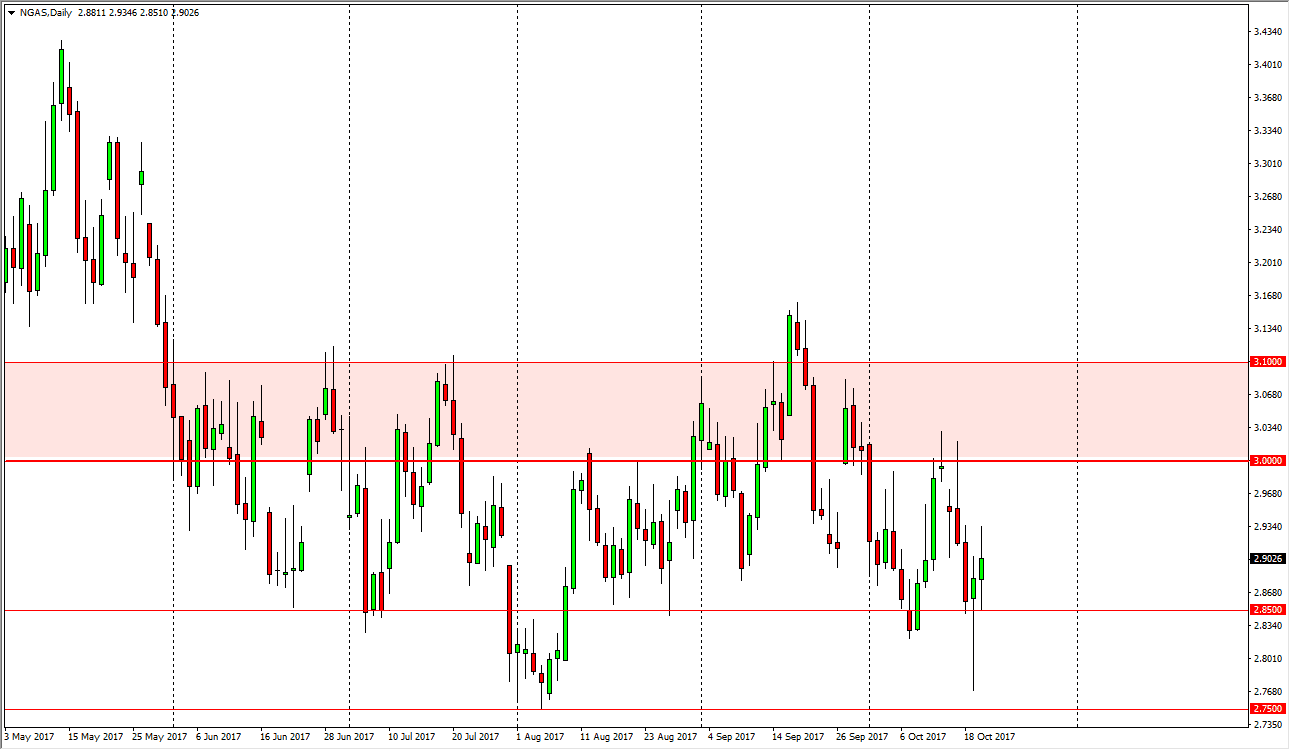

Natural Gas

Natural gas markets went back and forth during the day on Friday, testing the $2.85 level, but then bounced enough to form a positive candle. We continue to see a lot of volatility, and the natural gas markets of course are notorious for being noisy. I think that at this point in time, selling rallies continues to be the best way to take advantage of what has been extraordinarily bearish pressure on the market above. I recognize that US fracking companies continue to dump supply on the market at the $3 level, so I’m looking for this short-term rally to offer yet another selling opportunity. I think that the $2.85 level will continue to be supportive, so I think short-term selling opportunities will present themselves time and time again. I have no interest in buying natural gas, because quite frankly there is so much in the way of negativity.