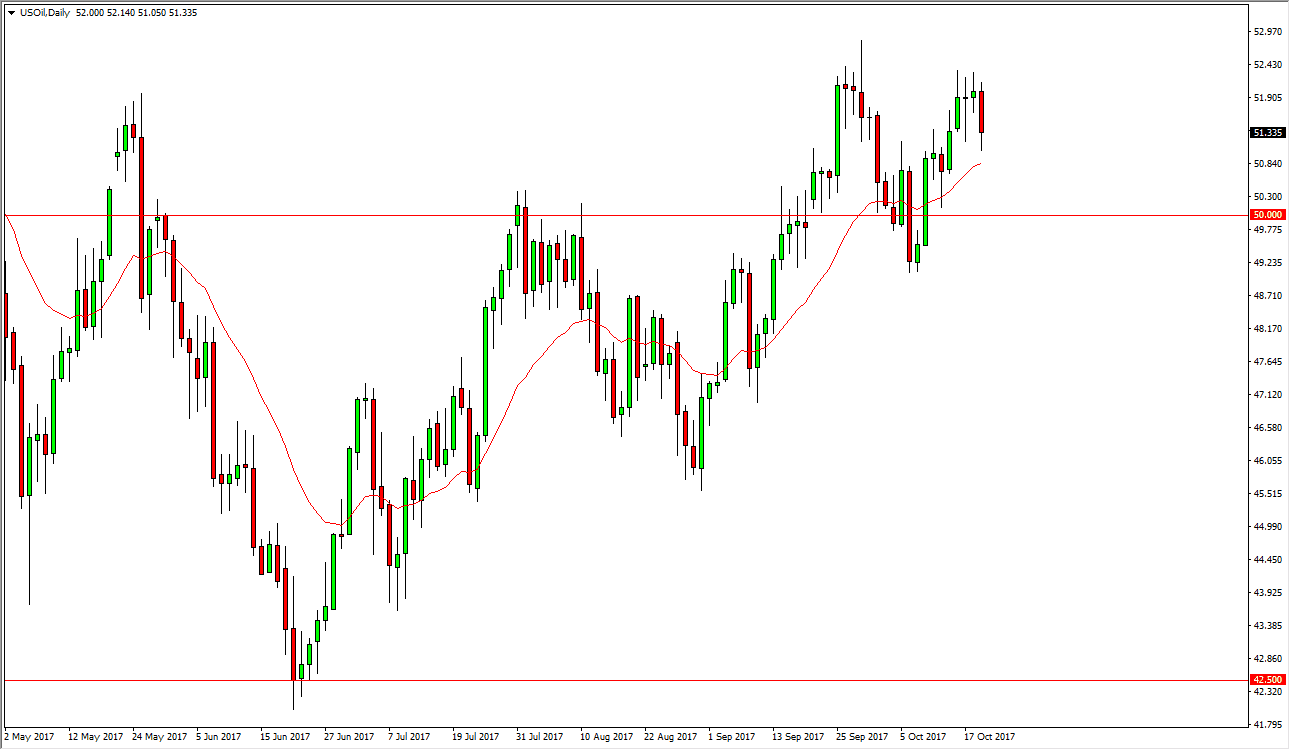

WTI Crude Oil

The WTI Crude Oil market fell during the day on Thursday, reaching towards the $51 level. There is a significant amount of support below though, so even if we pull back from here, I suspect that the buyers will come back rather soon. With this being said, I think it’s only a matter of time before the market rallies and goes towards the $52.50 level again, but a breakdown below the $49 level would be very bearish. I think we continue to see a lot of noise in the crude oil market, because we are so many different moving headlines at the same time. With Russia and Saudi Arabia looking to cut production, it’s possible that we could get a bit of a bum from that, but at the same time the markets can get too overly expensive, because that brings in more supply from North America.

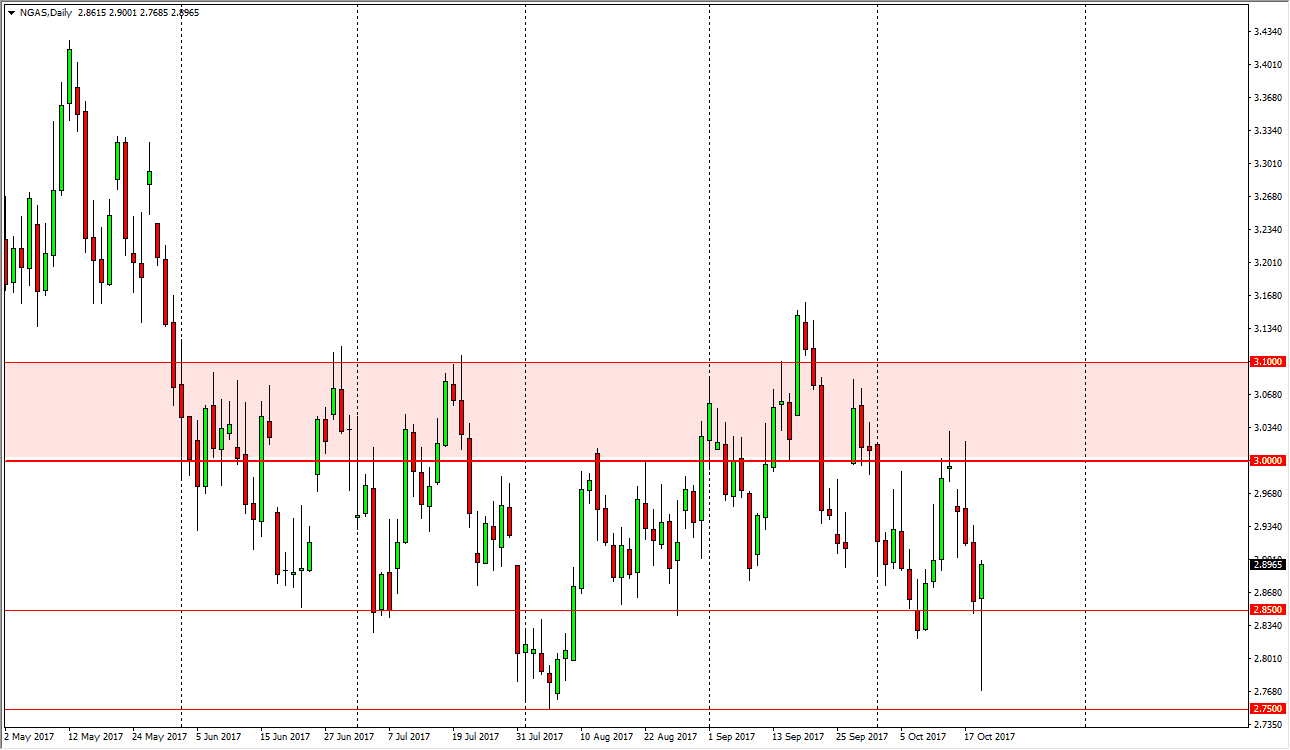

Natural Gas

Natural gas markets fell precipitously during the trading session on Thursday, reaching down to the $2.77 level. However, we had a bullish inventory announcement coming out of the United States, and turned around completely to form a huge hammer. However, I still believe that if we get closer to the $3 level, the sellers will come back out. After all, although the number was more bullish than anticipated, it should be thought of as “less bad” than what had originally been forecasted. Because of this, I think that the reaction is a bit overdone, and I will be looking for exhaustion on short-term charts to take advantage of what has been an extraordinarily negative market.