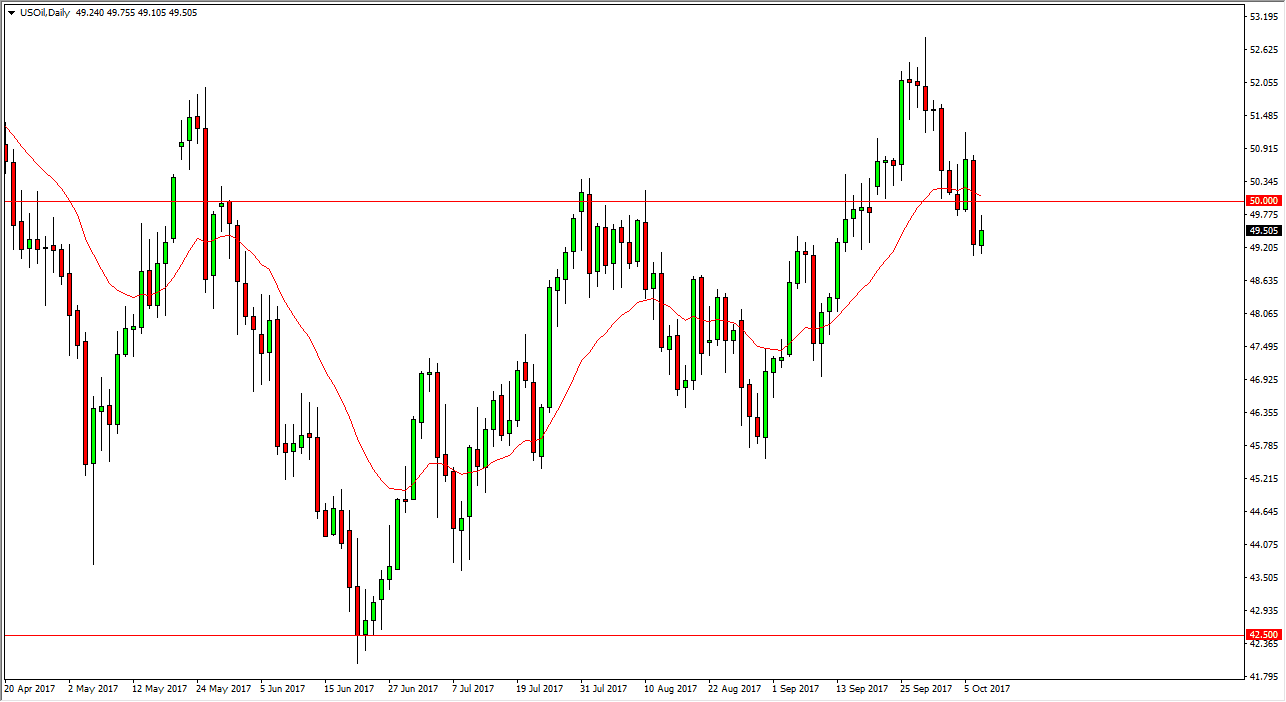

WTI Crude Oil

The WTI Crude Oil market rallied initially on Monday, but found the $50 level to be a bit too resistive. After the very bearish candle that formed on Friday, looks very likely that we are going to continue to go lower. If we break down below the $49 level, then I think the market is ready to go to the $47.50 level underneath, and then eventually the $46 level. Alternately, if we break above the $50 level, I think that the market could go to the $51 handle, and then the $52.50 level. This is a market that will continue to be very choppy overall, as there are a lot of concerns when it comes to OPEC pricing and then of course the oversupply of crude oil. Ultimately, I think that the market will start to sell off again, but clearly there is a lot of chopping to do in the short term.

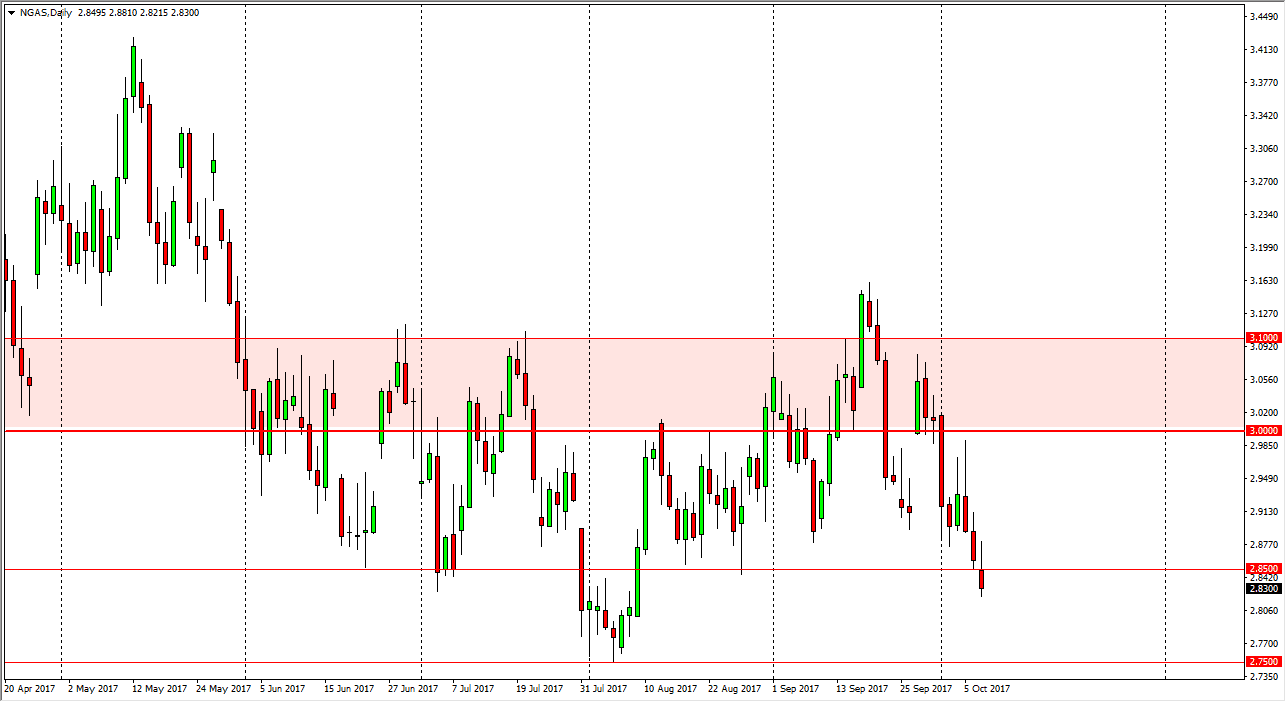

Natural Gas

Natural gas markets initially tried to rally during the day on Monday, but found the area above the $2.85 level to be far too resistive to continue to go higher. We ended up forming a bit of a shooting star at the bottom of a downtrend, and that normally means that we are going to continue to see selling pressure. I think that we will go down to the $2.75 level underneath, which has been massively supportive in the past. The market is obviously broken, and therefore I think that even if we do rally from here, it’s only a matter of time before we see exhaustive price action that we can start shorting. If we can break down below the $2.75 level, then I think we go down to the $2.50 level next.