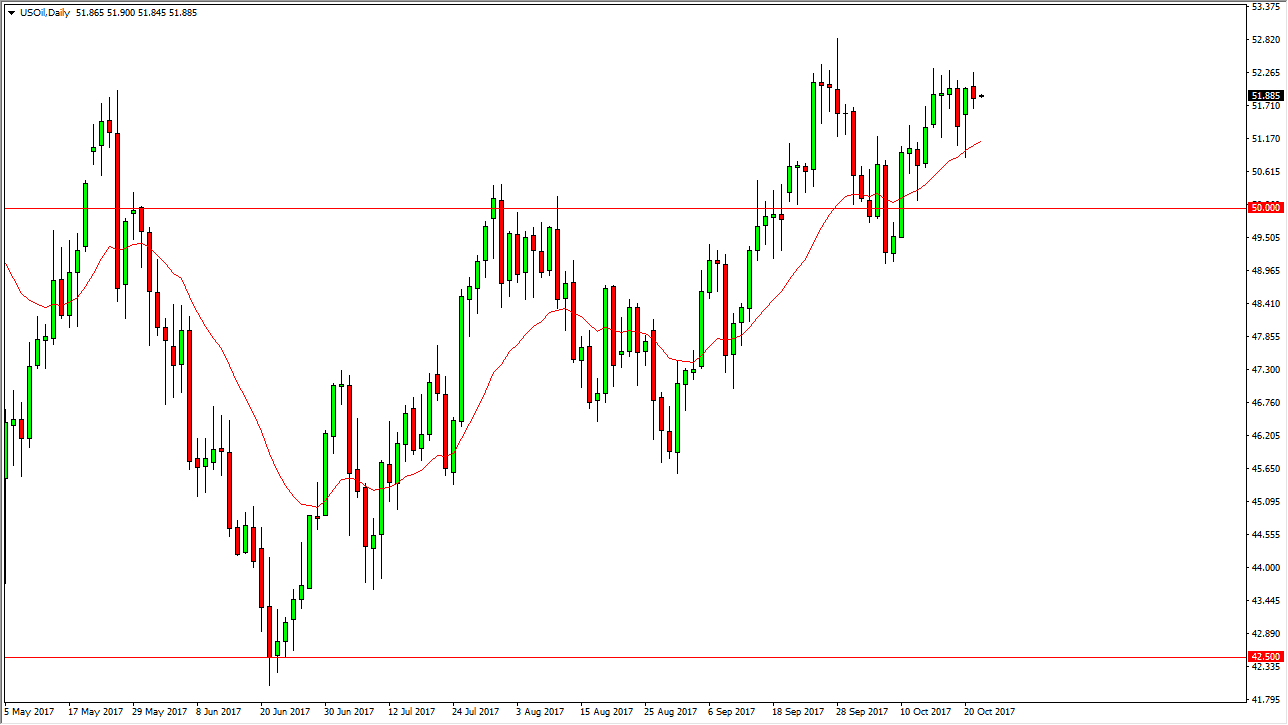

WTI Crude Oil

The WTI Crude Oil market was volatile on Monday, as we continue to find resistance just above the $52 handle. I think that there is a significant amount of resistance at the $53 level to well. If we can break above there, the market should then go to the $55 level next, but I think it’s going to take quite a bit of noise and momentum to break out. A pullback from here will more than likely find support near the $50 level. If we break down below there, the market will probably test the $49 level, and then break down significantly from there. I think that the crude oil markets continue to be very volatile, and of course the strengthening US dollar smacks this market around as well. Until we break out of one of these levels, expect a lot of short-term volatility.

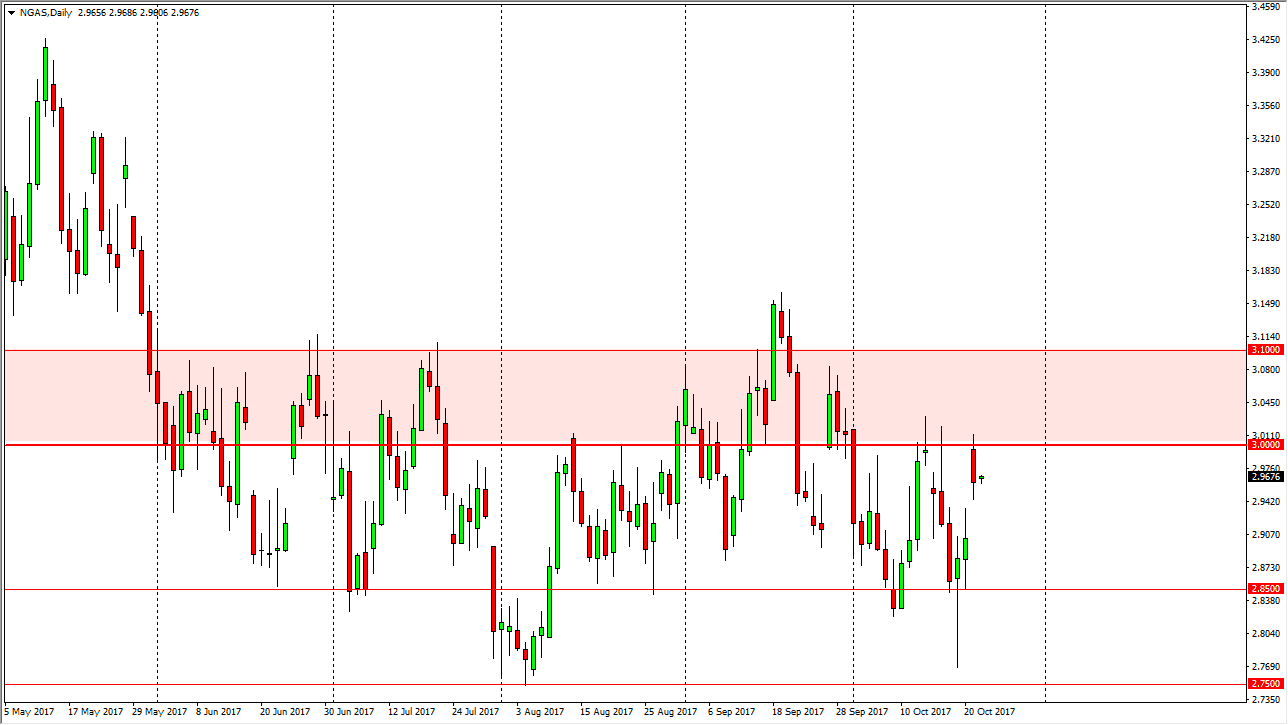

Natural Gas

Natural gas markets exploded to the upside, gapping all the way to the $3 handle at the open on Monday. However, this begins an area where we continue to see sellers, based upon oversupply. After all, there are plenty of fracking companies in the United States willing to dump supply the market at $3, because it offers them an opportunity to make a profit. Natural gas is oversupplied by all metrics, and I think that we will continue to see choppiness in this general vicinity, with the $3.10 level above being massively resistive, and the $2.85 underneath being massively supportive. I’m looking for some type of opportunity to short this market, but we don’t have an exhaustive candle yet or an impulsive red one that I can take advantage of. Being patient should present plenty of selling opportunities over the next several sessions.