The USD/JPY is trying to avoid settlement below 112 level not to increase the bearish pressures on the pair towards lower levels. The pair was in a bearish move at the beginning of this week’s trades supported by the renewed pressure on the USD due to the inflation data which were lower than expectations. This is in addition to the renewed anxiety and geopolitical fears with the near North Korean missile tests and constant US threats to increase the sanctions or even a limited military act. The pair retreated to support at 111.65 level before going back to settle around 112.30 at the time of writing. The interest rate expectations and the effects on the USD in December lost confidence after the release of inflation data, which although were below expectations, it did support the path of higher rates.

The USD/JPY is trying to settle above the 112.00 level to avoid more bearish momentum, and despite what was mentioned in the last Fed’s minutes of meeting, the pair maintained the move above that level. The meeting showed a split among the Fed’s members regarding the path of higher rates in light of current inflation levels, therefore increasing the pressure on the USD, with the USD index retreating to 92.82 before bouncing upwards to 93.40 today. Along what was mentioned in the minutes, the pair faced strong bearish pressure with the resale of disappointing US jobs data, based on which the pair went downwards again. The devastating hurricanes which hit the country affected the results and the jobs fallback for the first time in seven years, but there were some positive results regarding the average wages, which grew stronger than expected.

The USD strength is supported by Trump's tax plans aiming to reduce the US taxes, which were long awaited since Trump won the US elections. This is along expectations of higher US interest rates.

Markets are on the lookout for any on ground developments regarding the North Korean tests that might be stronger than previous ones, or any US military move. Which might support the strong and constant move towards save heaven led by the JPY, CHF and gold, and therefore increased bearish pressure on this pair.

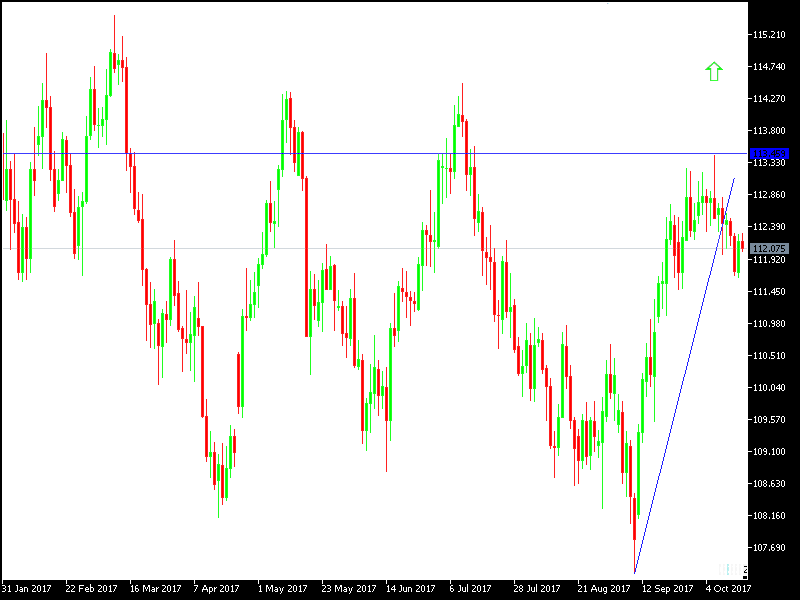

Technically: If the pair succeeds in breaking through 112.00 peak, this will create a strong momentum for the pair to test higher peaks which might reach to 113.00, 113.75 or 114.20. on the bearish side, the nearest support levels are located at 111.60, 111.00 and 110.00, the last of which will threaten the bullish move in this pair.

On the economic data front: The economic agenda today has no important Japanese data. From the US, there will be a resale of the manufacturing production data. The USD/JPY pair will carefully watch the renewed geopolitical fears with the reemerging of the North Korean issue, as well as everything related to Trump’s internal and external policies.