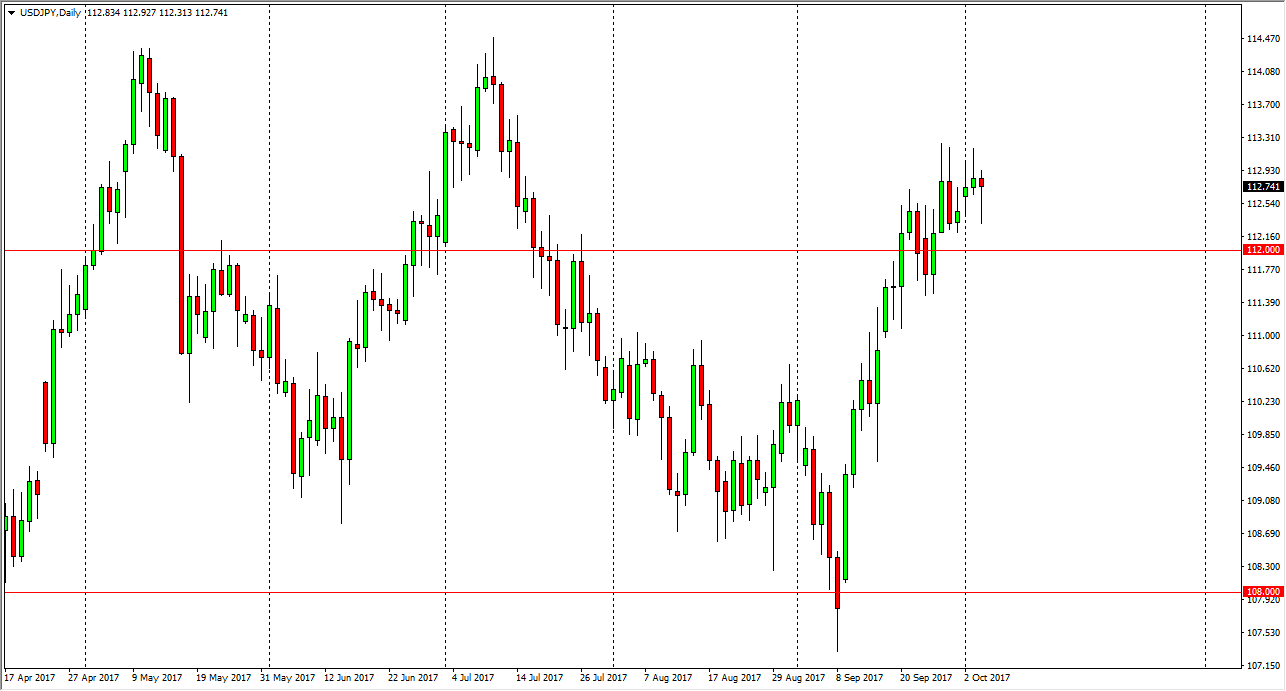

USD/JPY

The US dollar initially fell on Wednesday, but turned around to form a nice-looking hammer. By showing so much strength near the 112 level, looks likely that the market will continue to go higher. I believe in buying dips, as the interest rate differential between the United States and Japan continues to widen. Ultimately, I believe that we will go looking towards the 114.50 level above, which was massive resistance in the past. Ultimately, I believe that the 115 level is the top of that resistance barrier, and if we can clear that, it’s likely that we continue to go much higher. I have no interest in shorting this market, as we have seen so much in the way of resiliency but I also recognize that we have been a little bit overbought, so expect choppiness.

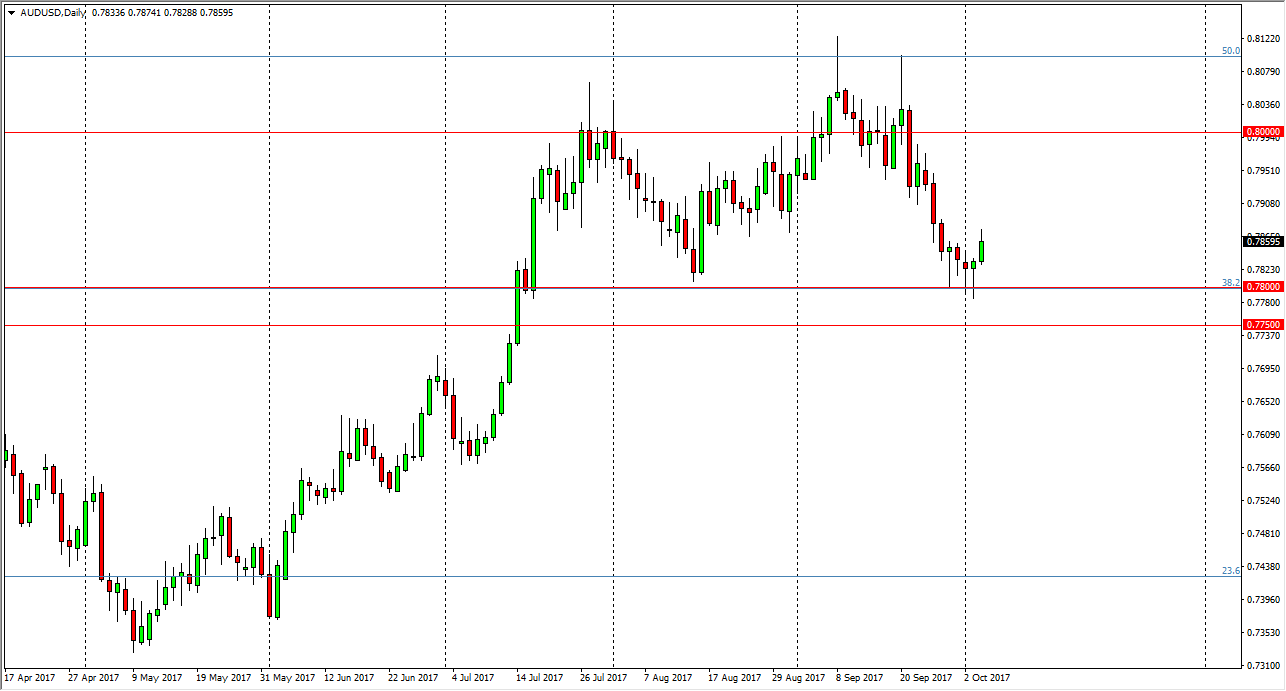

AUD/USD

The Australian dollar has broken out to the upside, clearing the hammers from the last 4 sessions. That’s an excellent opportunity, and buying signal as far as I can see. I think we will go looking towards the 0.0 level above, given enough time. I don’t have any interest in shorting this market, and I believe that there is massive amounts of support below the 0.78 handle and extending to the 0.7750 level. I don’t know if we can break out, but we would need to clear the 0.81 level to feel comfortable with a longer-term buy-and-hold situation, but I think that the short-term trade certainly allows you to go long. Pay attention to the gold markets, because quite frankly they have a huge influence on the Australian dollar. Overall though, I think that we are simply going to continue the consolidation and reach towards the top of the range that we are in.