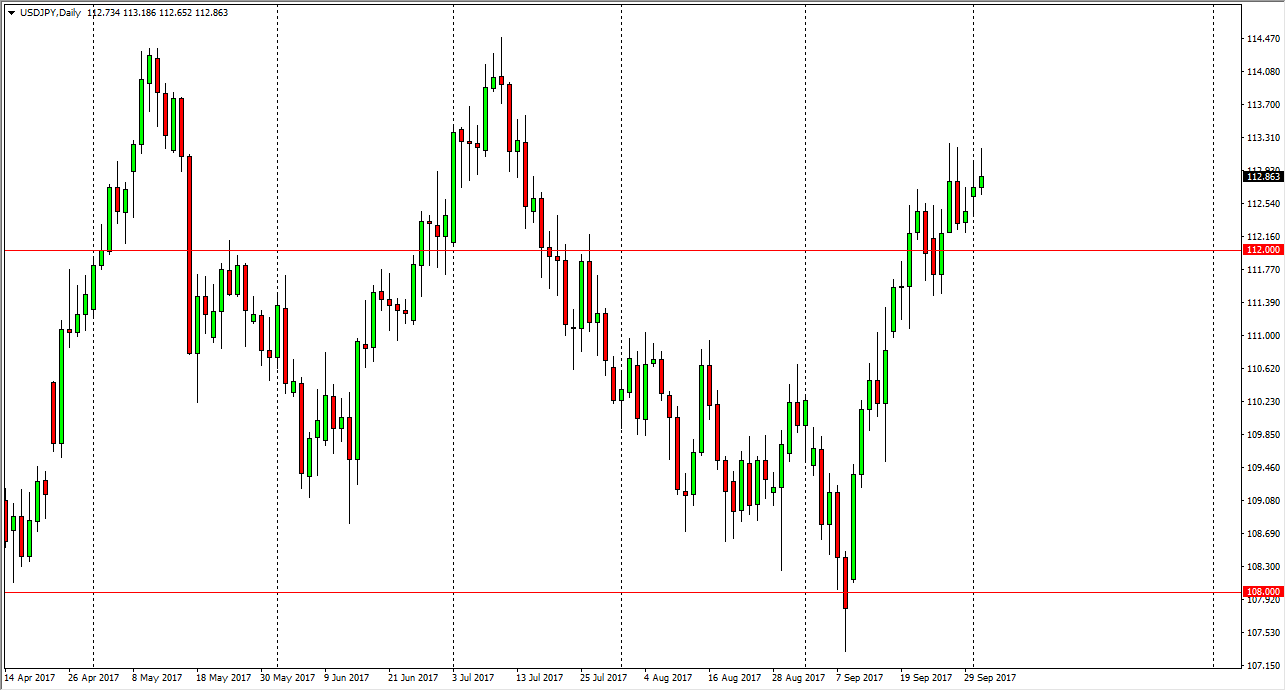

USD/JPY

The US dollar rallied initially on Tuesday, but found enough resistance near the 113.25 level to turn around and form a shooting star. We are starting to run into a significant amount of resistance just above, so I think a pullback is imminent. The pullback should find plenty of support near the 112 level though, so I think this is short-term at best. I like buying supportive candles at lower levels, and think that even if we were to break down below the 112 level, the 111 level should be even more supportive. Longer-term, I anticipate that we are going to go looking towards the 114.50 level above, which is the top of the most recent consolidation area. After that, a break above 115 should send this market much higher.

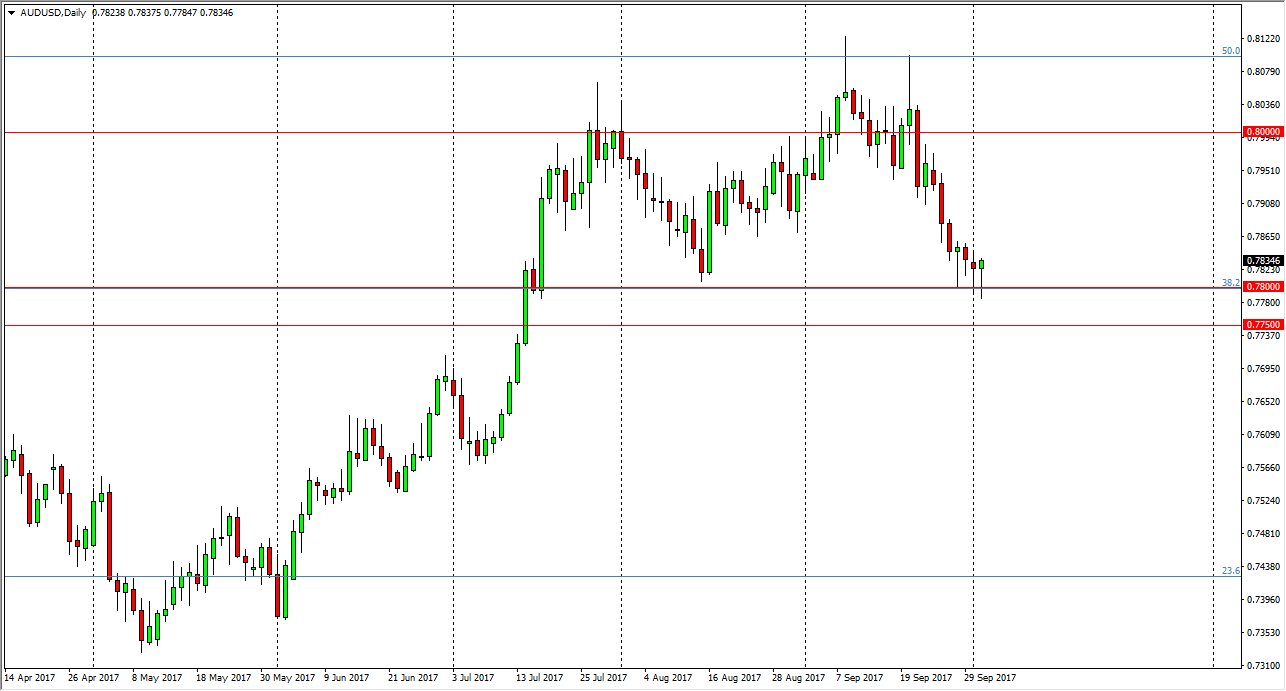

AUD/USD

The Australian dollar fell initially on Tuesday, but found enough support below the 0.70 level to turn things around and form a hammer. The hammer of course is a bullish sign, and it is preceded by 3 other ones. Because of this, I think it’s only a matter of time before the Australian dollar goes higher, perhaps reaching towards the 0.80 level. That’s an area that should be important, as it has been an area of both support and resistance over the last several decades. I think the level has resistance all the way to the 0.81 level above, and therefore if we can break above there, the market becomes more of a “buy-and-hold” scenario. Ultimately, the market looks likely to try to make that move, but it’s going to take a significant amount of time to break above there, and I think that each pullback that we get is a buying opportunity that offers another attempt to build up the necessary momentum to break out.