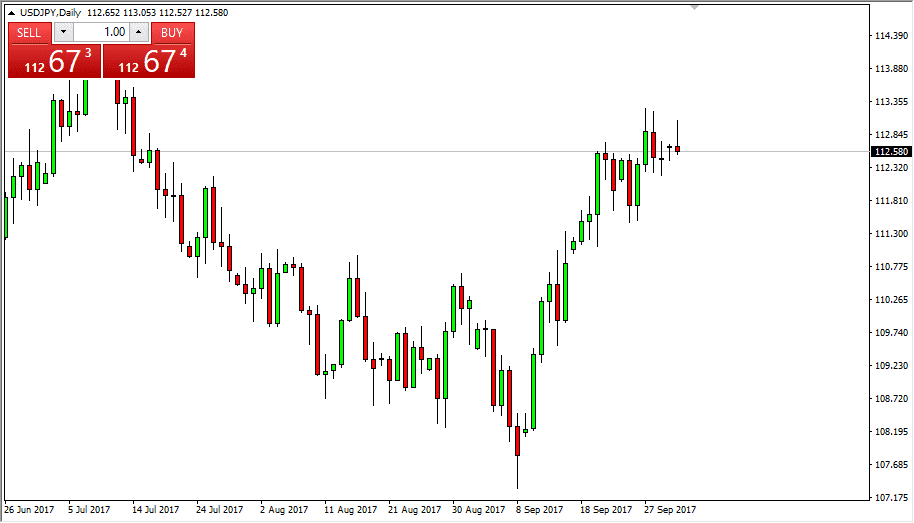

USD/JPY

The US dollar try to rally on Monday against the Japanese yen, but it appears that the market is ready to consolidate around the 112.50 level. I think that there is plenty of support just below though, so any pullback at this point should be thought of as a potential buying opportunity. If we can break above the top of the shooting star for the day on Monday, that is also a buying opportunity as it would show real strength. Longer-term, the market has been consolidating between the 108 level on the bottom, and the 114.50 level above. Once we break above the 115 handle, this becomes more of a “buy-and-hold” pair. Remember, this pair reacts in positive correlation to risk appetite, so of stock markets rally, it will as well. I like buying dips.

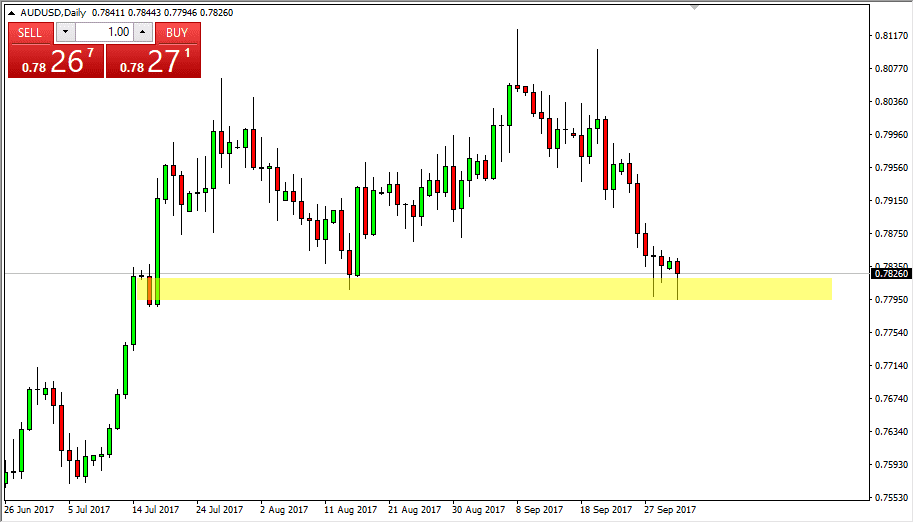

AUD/USD

The Australian dollars falling again on Monday, but just as we have seen over the last several sessions, there seems to be a significant amount of support at the 0.78 handle. The market looks likely to bounce from here, and if we can break above the high is from the last couple of trading days, I think that we go looking towards the 0.80 level above. That is a significant level going back decades, that of course will attract a lot of attention. It also needs a lot of momentum to break out and above, so I think that’s part with this pullback is, momentum building. Also, goal markets have recently been churning, and that of course causes volatility over here as well. Ultimately, I am a buyer, and I believe that the Australian dollar will continue to rally over the longer-term, but in the meantime it choppy.