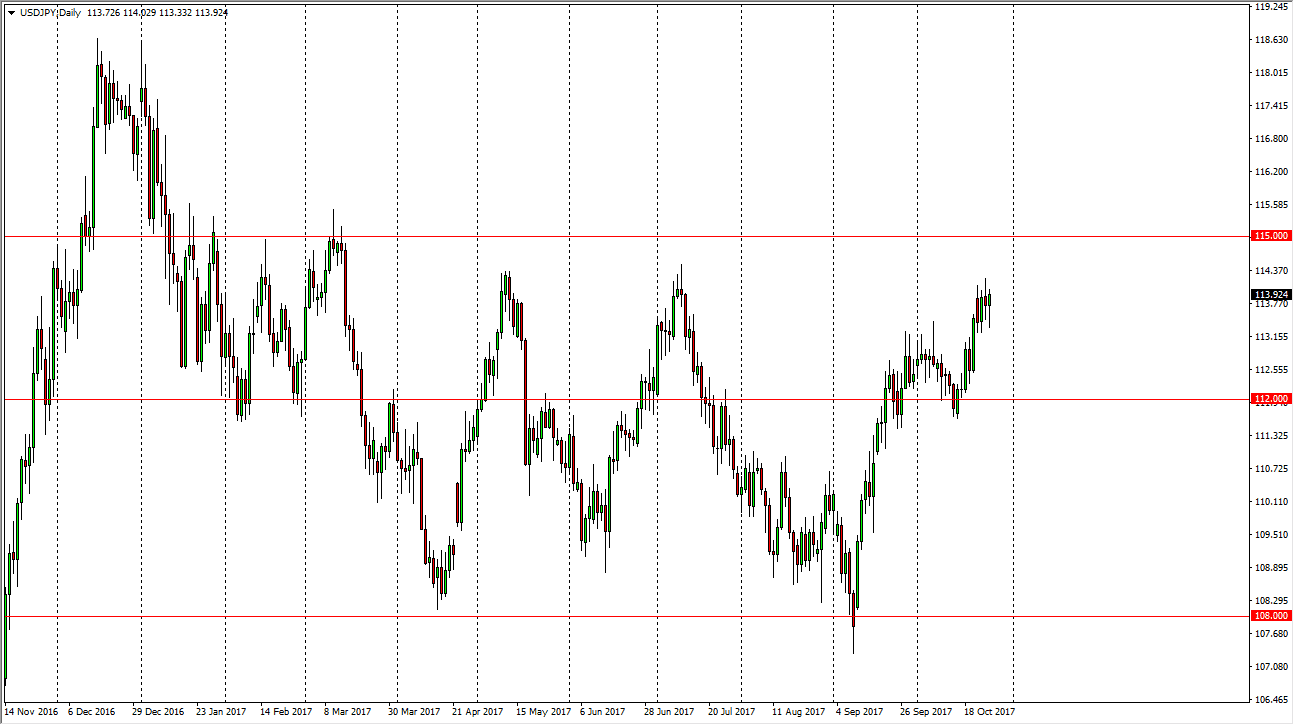

USD/JPY

The US dollar initially fell against the Japanese yen on Thursday but turned around to show signs of strength and form a hammer. There is a massive amount of resistance above though, so I am hesitant to put money to work here. I look at pullbacks as necessary to build up the momentum that it would take to break above the overall consolidation ceiling at the 115 region. I also recognize that the 112-level underneath should be supportive though, and with the Federal Reserve looking very likely to raise interest rates over the next several months, I think that it makes sense that we continue to go higher but it is of course going to take a lot of work to grind through the order flow that sits above us currently.

AUD/USD

The Australian dollar got pummeled again during the day on Thursday, as we are now testing the 0.7650 handle. Gold markets are getting beat down, and we are about to break through the 61.8% Fibonacci retracement level. Quite frankly, I do not see this market turning around and I think that rallies are going to continue to be selling opportunities as we have completely fallen off a cliff. Given enough time, we could see a retracement of the entire move, perhaps down to the 0.73 level. The US dollar is continuing to strengthen against most currencies, and of course the Australian dollar is not going to be any different. Because of this, I am looking for some type of bounce that show signs of weakness that I can sell. It’s not until we clear the 0.78 level that I would consider buying this pair, and it would have to be parallel to a move in the gold markets, which of course look very soft also.