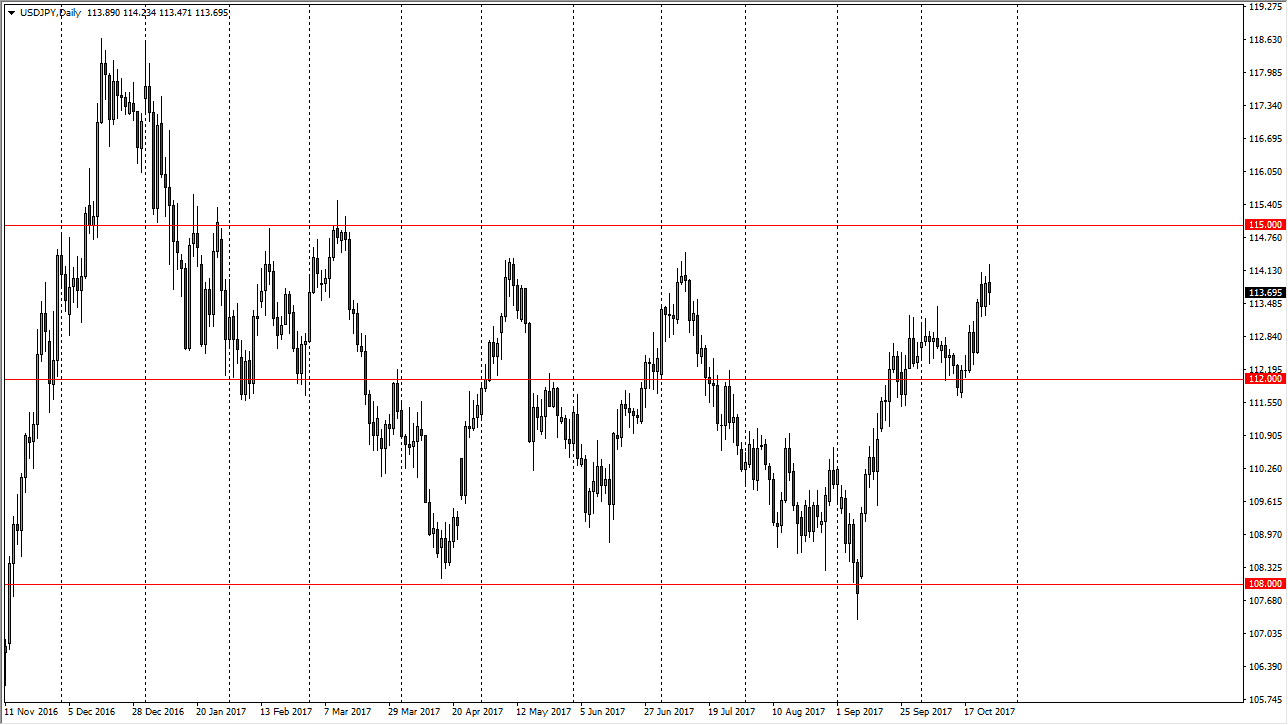

USD/JPY

The US dollar initially tried to rally during the session on Wednesday, as the US dollar continues to show strength in general. However, it’s likely that we turned around based upon the previous exhaustion area between 114.50 level and the 115 handle. If we were to break above there, that would be a very bullish sign, and send this market towards the 118-level next, followed by the 120 level. Ultimately, this is a market that I think is supported at the 112-level underneath, so even if we do roll over here, and it’s likely that we will, I believe there are plenty of buyers underneath that can keep the market afloat, and given enough time, I expect the market to break out. However, it’s going to be very volatile and choppy, but we are overextended, and it makes sense that the pullback occurs so that we can get an opportunity to build up momentum.

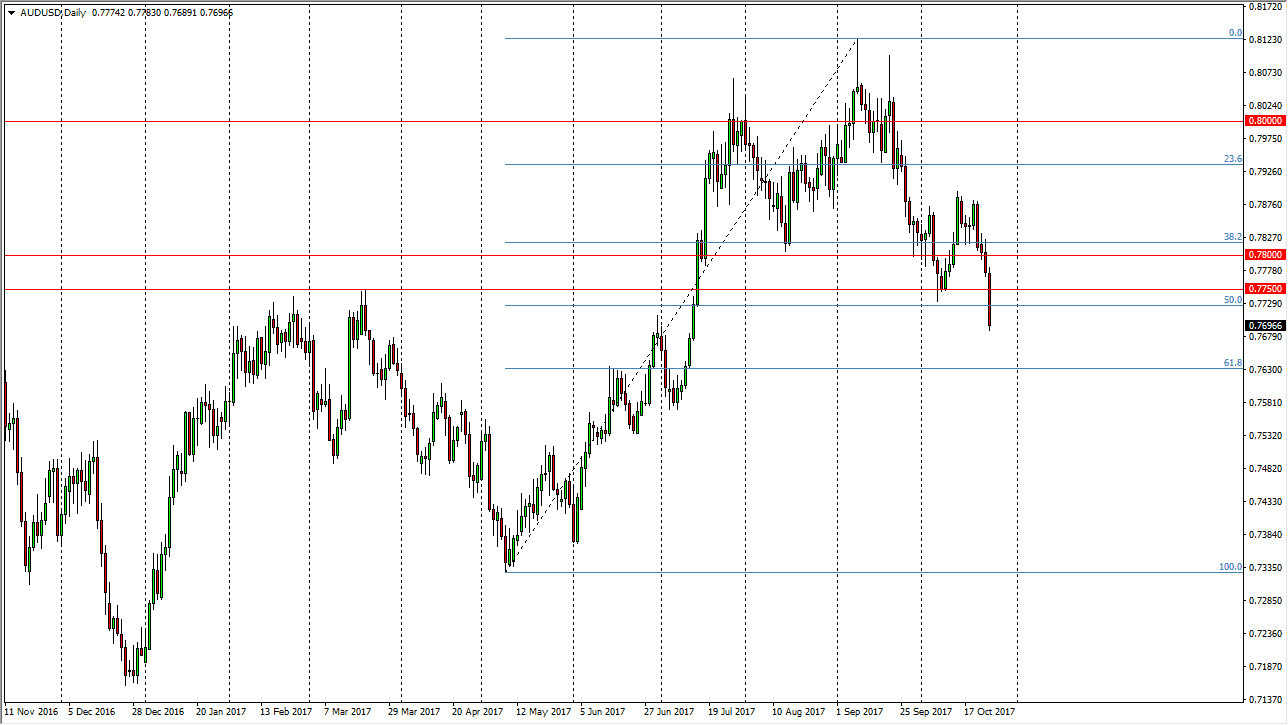

AUD/USD

The Australian dollar broke down significantly, breaking below the 50% Fibonacci retracement level and smashing through the hammer from a couple of weeks ago. Because of this, and the fact that we are well below the 0.77 handle, I think that the Australian dollar continues to fall from here, perhaps reaching towards the 0.76 level, followed by the 0.75 handle. Pay attention to gold, if it starts to roll over as well, that will work against the value of the Aussie dollar also. The US dollar has been strengthening in general, so it makes quite a bit of sense that the AUD/USD pair continues to drift to the downside, as the Federal Reserve looks likely to raise interest rates several times over the next year.