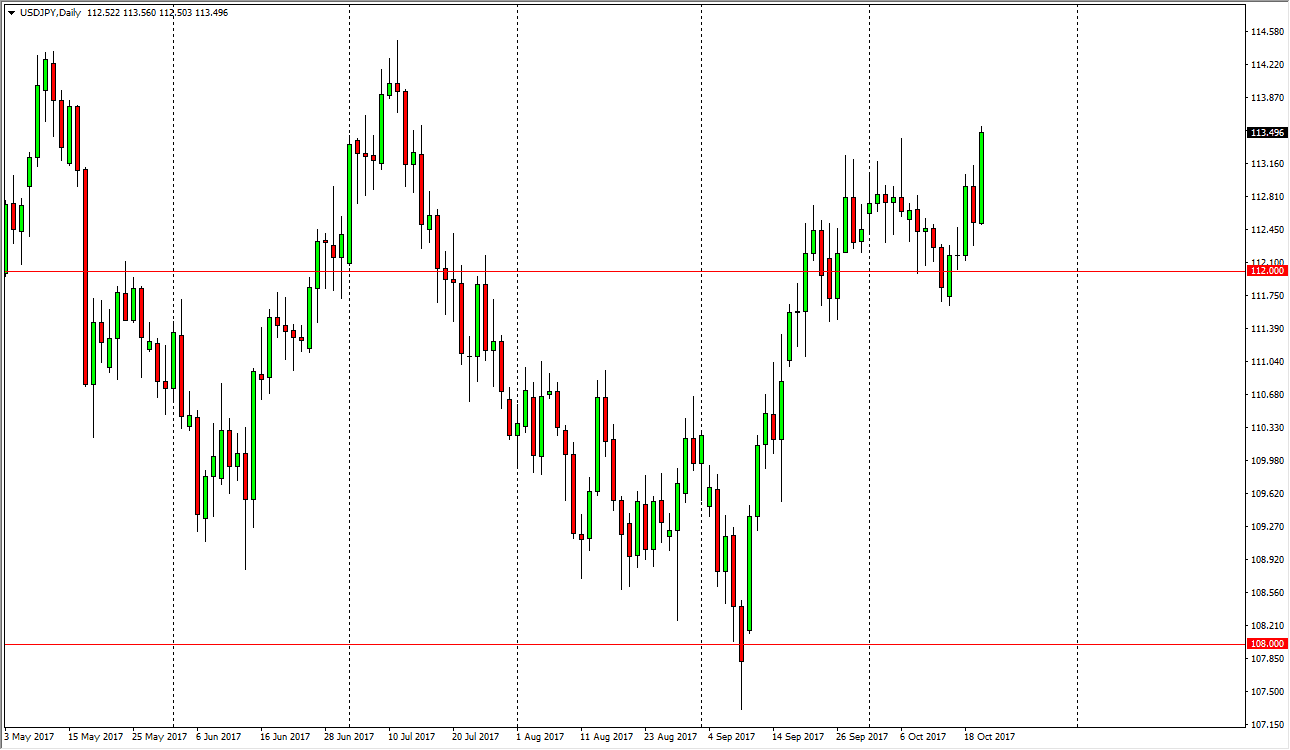

USD/JPY

The US dollar exploded to the upside during the day on Friday as it appears that Donald Trump is going to nominate a hawkish Federal Reserve Chairman, which of course is bullish for the US dollar. Because of this, it looks as if the 112 level will offer support underneath, and breaking above the range for the day should send this market towards the 114.50 level, an area that has seen a significant amount of resistance in the past. That resistance extends to the 115 handle, and if we can break above there, the market is free to go much higher. If we do pull back from here, I think there is also support to be found near the 111 level, so at this point I am bullish, even if we do drop a bit.

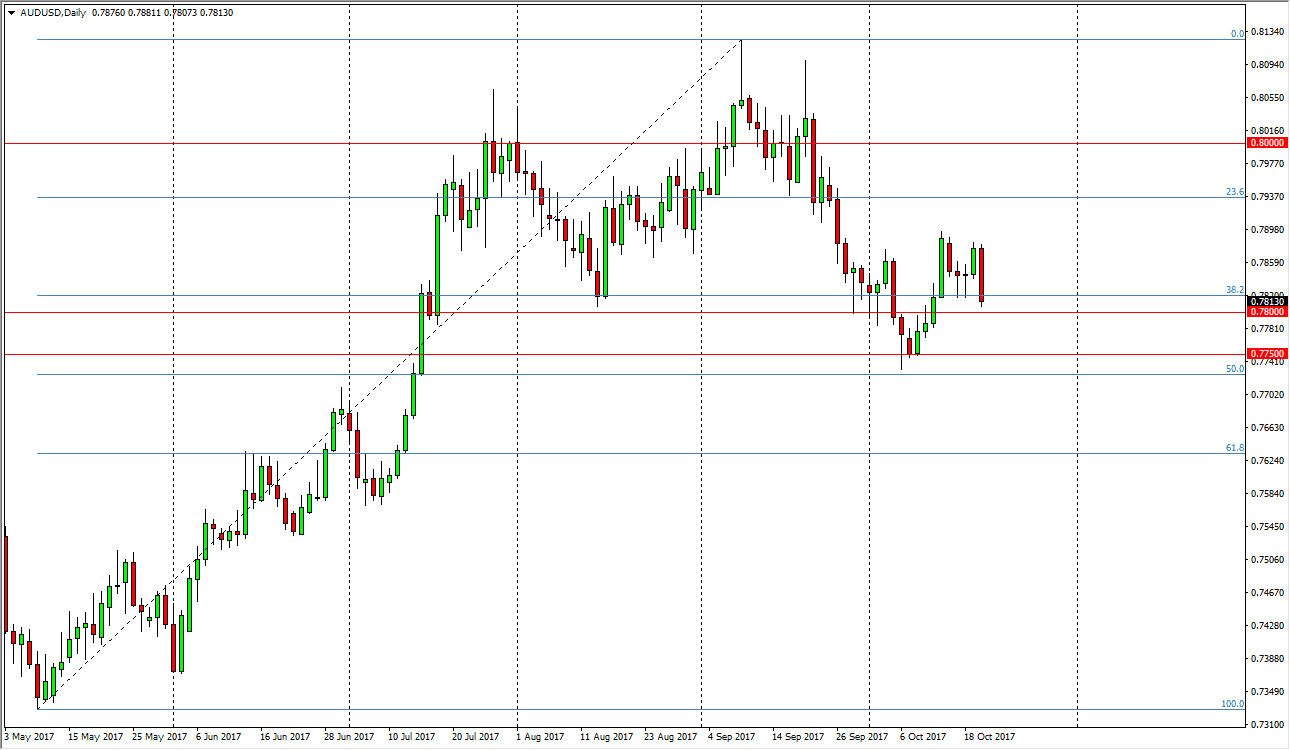

AUD/USD

The Australian dollar got hammered during the day, breaking down below 2 hammers from earlier in the week, and testing the 0.78 level. The Australian dollar is particularly vulnerable, because the gold markets rolled over, and of course the US dollar rallied. This is a bit of a “double whammy” for this market, and I think that the situation looks very precarious. However, I’m not willing to sell this market until we break down below the vinyl 0.7750 level, on a daily close. Until then, I am simply observing, as I recognize this could be an area where the markets get very interesting. I think you should let the market prove itself to you in one direction or the other, and then tried to follow. Until then, it’s going to be difficult to gauge where the markets going next, as I suspect we are about to see a lot of noisy trading over the next several sessions.