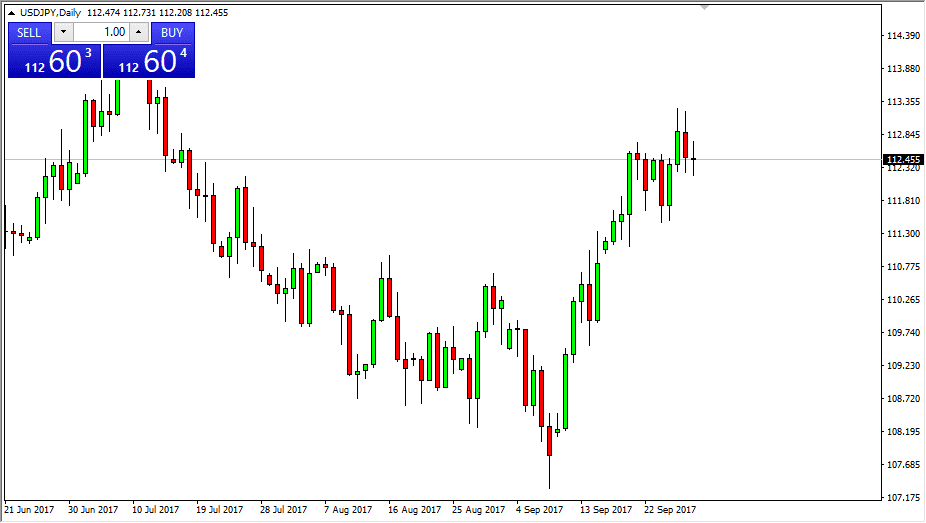

USD/JPY

The US dollar went sideways against the Japanese yen after both rallying and falling during the Friday session. It looks as if we are comfortable near the 112.50 level, and therefore I think we will eventually be attracted to this level if we do fall from here. I think that the 112 level is supportive, but I also recognize of the 113.25 level has offered resistance. Given enough time, the market should go looking towards the top of the longer-term consolidation, which is closer to the 114.50 handle. Rising interest rates in the United States will continue to support the US dollar, as the treasury markets are starting to selloff. With that in mind, I am a buyer of dips in this market but recognize that headline shock skin of course have traders buying the Japanese yen occasionally.

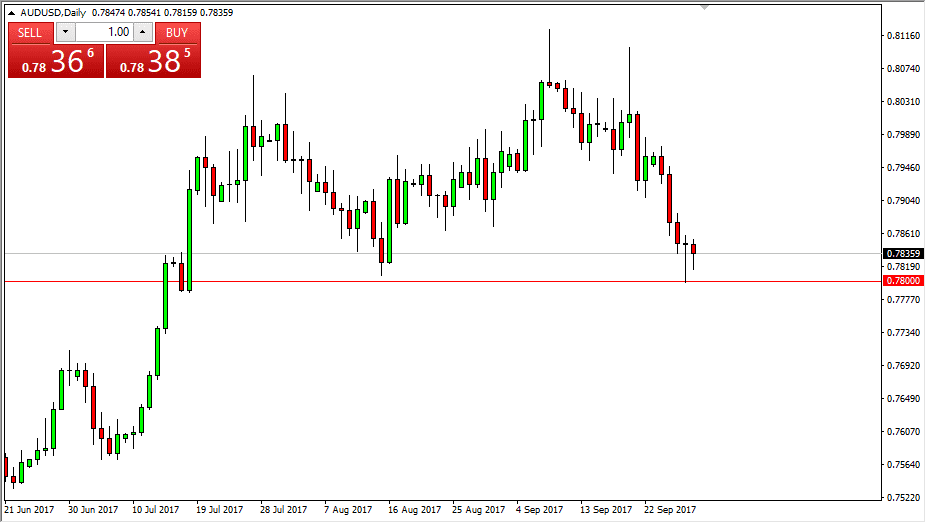

AUD/USD

The Australian dollar fell on Friday, but turned around and form a hammer just as it did on Thursday. With the 0.78 level offered so much support, I suspect that it’s only matter of time before we rally. If Gold markets can start to rally as well, that will only give us another reason to go along. The 0.78 level begins a significant amount of support based upon previous resistance that should extend down to the 0.7750 level. A bounce from here probably has this market reaching towards the 0.0 level above, which has significance going back decades. I believe a break above there probably has this market testing the 0.81 handle, and a move above that level is the “buy-and-hold” phase. Ultimately, I do think that the Australian dollar breaks out but we may need to build support for some time.