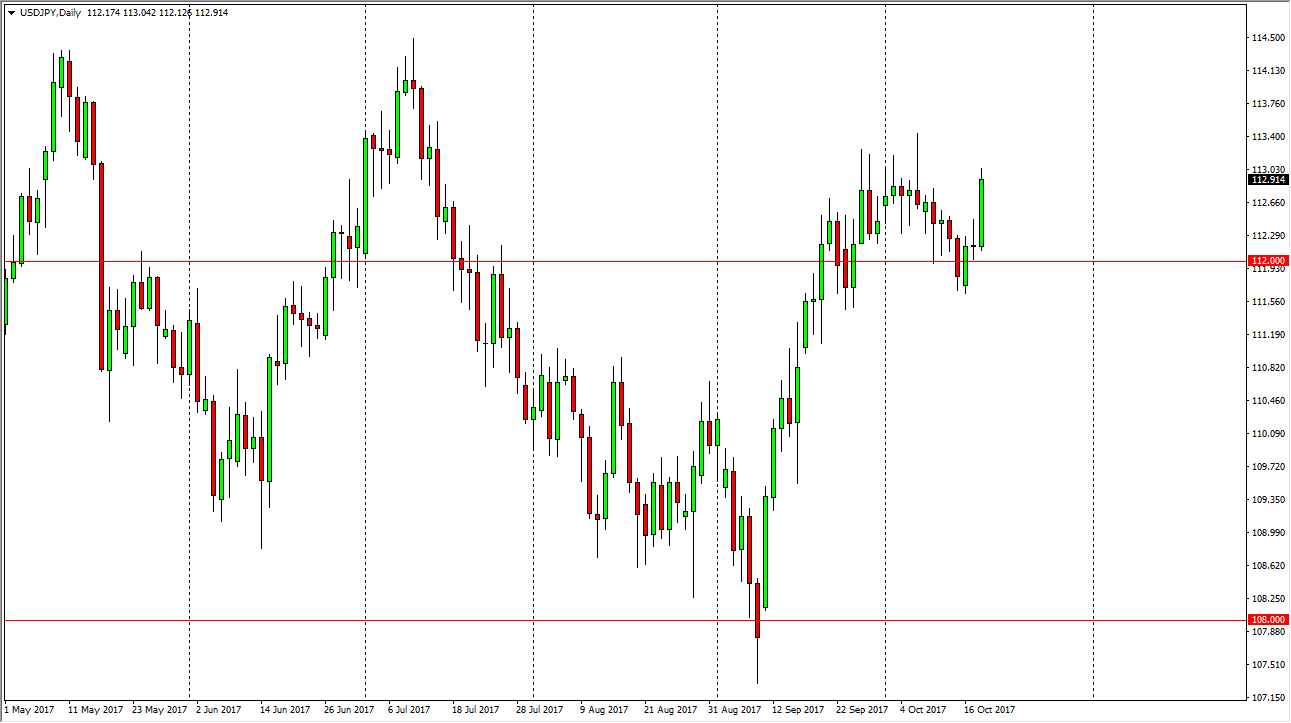

USD/JPY

The US dollar rallied significantly during the day on Wednesday, breaking the top of the shooting star from Tuesday, which is always a very bullish sign. We tested the 113 level, and seemed to be ready to break above there. The fact that we close towards the top of the range is a good sign, and at this point I believe the pullbacks will offer value the traders are willing to take advantage of. I look at the 112 level as support, and therefore I believe that any dip towards that level will probably attract attention. Longer-term, I anticipate that this market is going to go looking for the 114.50 level above, and then perhaps even break above there. Nonetheless, I also recognize that the volatility could ratchet up, as this pair tends to be very sensitive to the stock markets which of course are dealing with earnings season right now.

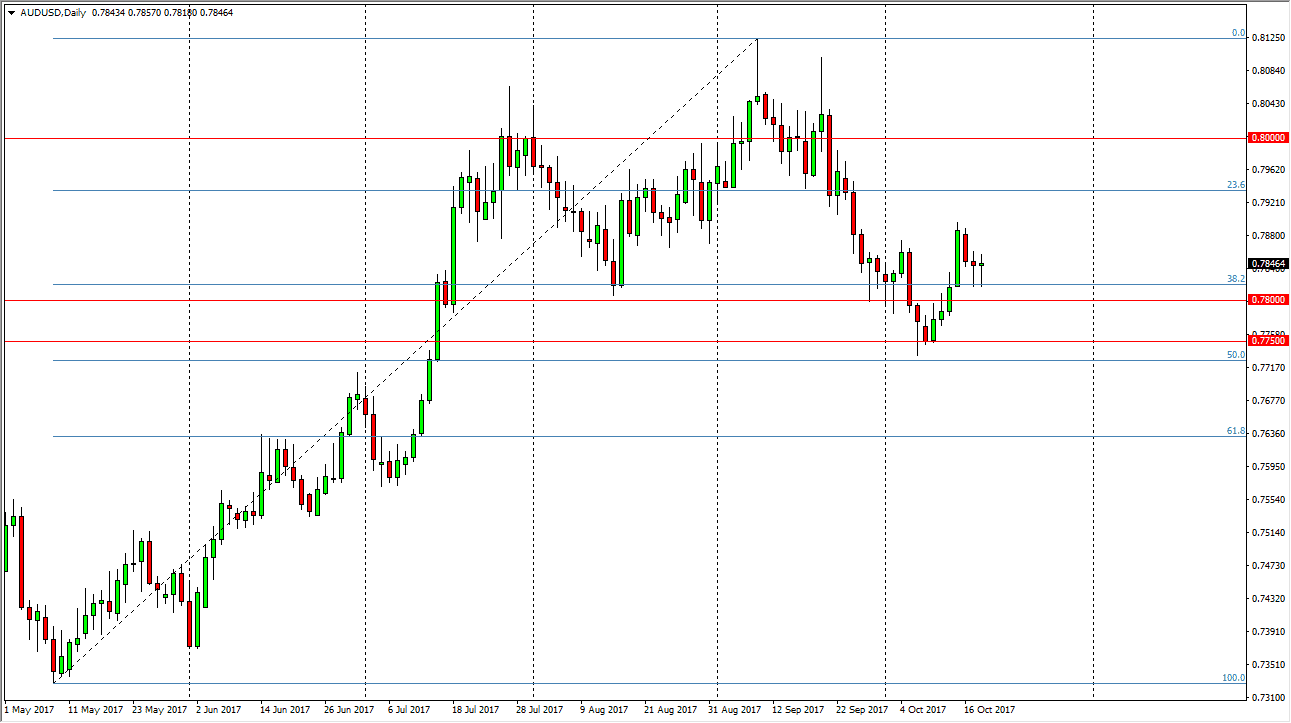

AUD/USD

It appears to be a “risk on” situation just waiting to happen. We are seeing hammers in the EUR/USD pair, the AUD/USD pair, and the GBP/USD pair. It looks as if a weaker US dollar is going to lead to more of a risk-taking scenario, with the USD/JPY pair being the outlier, as it rallies in favor the dollar when times are good. Because of this, it makes perfect sense that the AUD/USD should rally, and on a break above the hammer from the Tuesday session, we will have cleared not only a Tuesday hammer, but also the Wednesday hammer in this pair. The 0.78 level was previous resistance, and it has now been shown to offer support. Given enough time, I think we go back to the 0.0 level above, and therefore I am bullish short term.