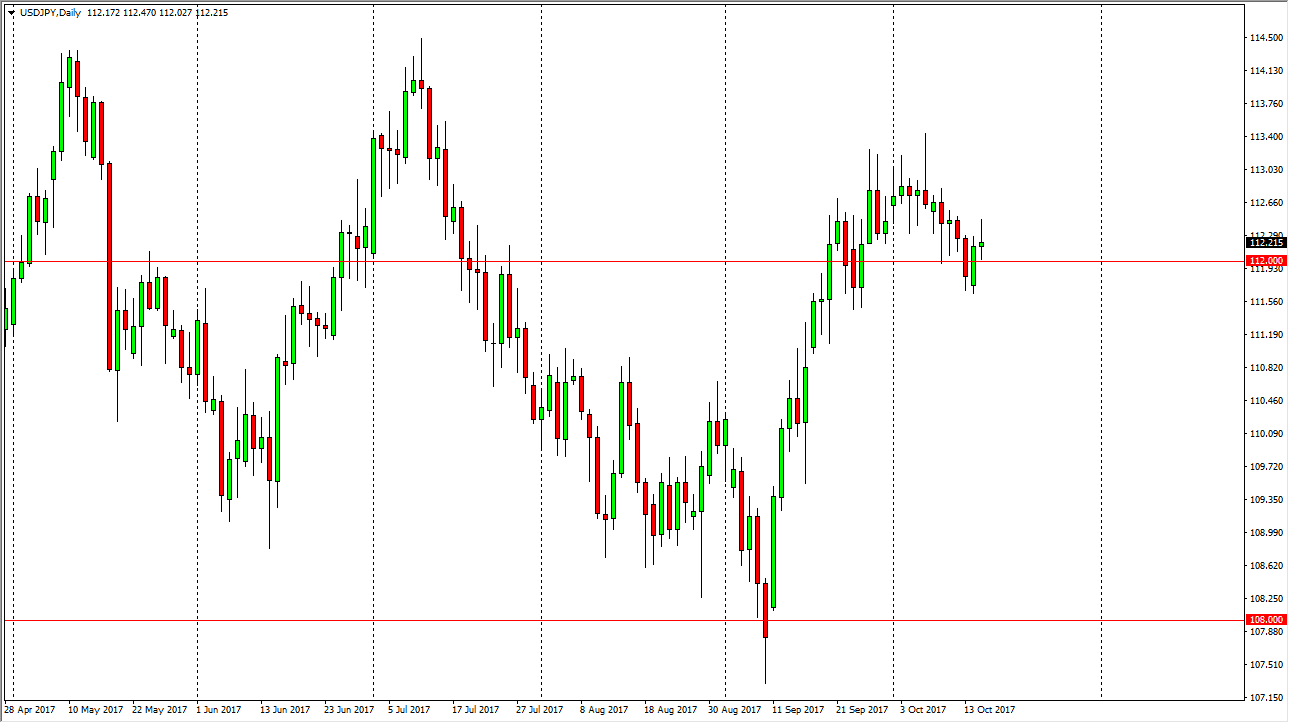

USD/JPY

The US dollar initially fell during the day on Tuesday, reaching towards the 112 level. We found enough support at that level to turn things around though, but then fell after words. Because of this, we ended up forming a bit of a shooting star that sits just above the 112 handle. I think that this market should continue to find a lot of noise in this general vicinity, so therefore I’m not looking for some type of major selloff. However, if we were to fall from here, I think there is plenty of support at the 111-level underneath to keep the market afloat. If we break above the top of the shooting star for the day, that is reason enough to start buying as it would show the market breaking through resistance. Longer-term, I think the buyers will return, but we may need to pull back to build up the necessary momentum.

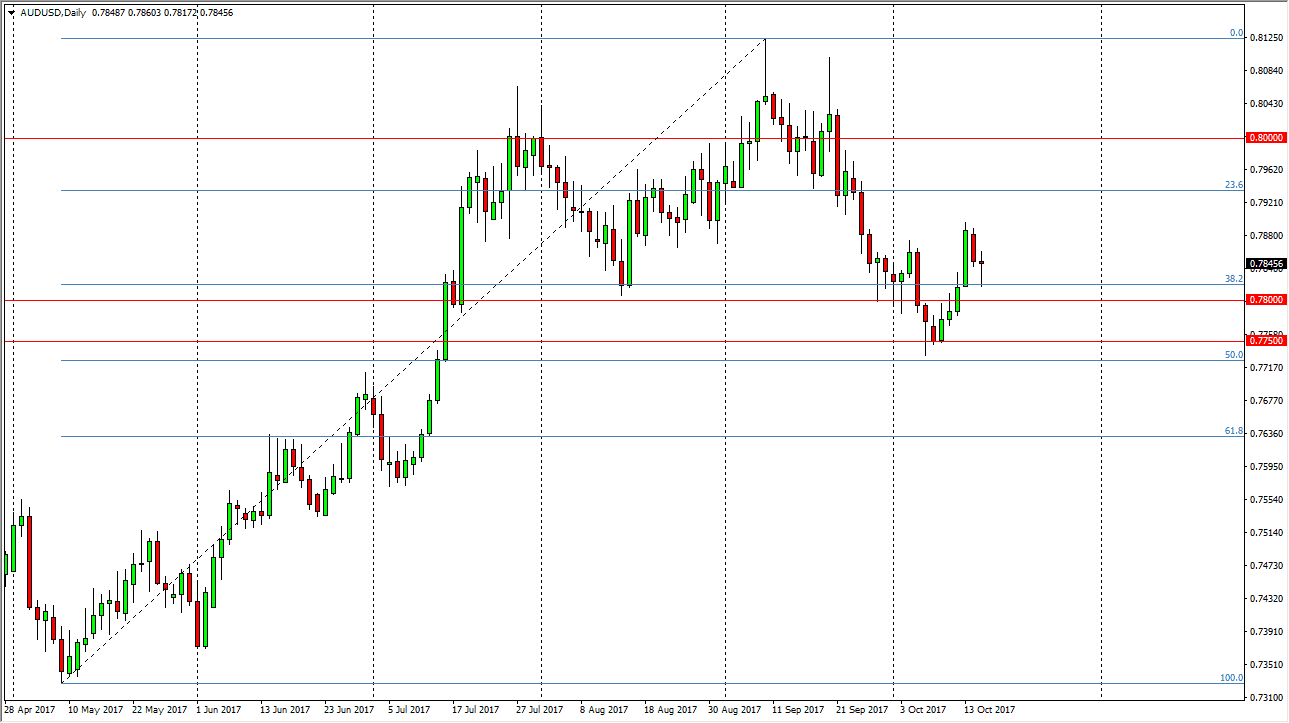

AUD/USD

The Australian dollar initially fell during the day but turned around to form a hammer. The hammer of course is one of the most bullish candlesticks that you can form, and as a result I think if we break above the top of the range for the session on Tuesday, the buyers will probably jump into this market and trying to push you towards the 0.80 level above. It would help if gold rallied as well, as the Australian dollar is greatly influenced by the gold market. I believe that there is a significant amount of resistance at the 0.80 level above, that extends to the 0.81 level above. A clearance of that sends this market towards the 0.90 level longer term. I am bullish, but I recognize it will be very noisy on the way back up.