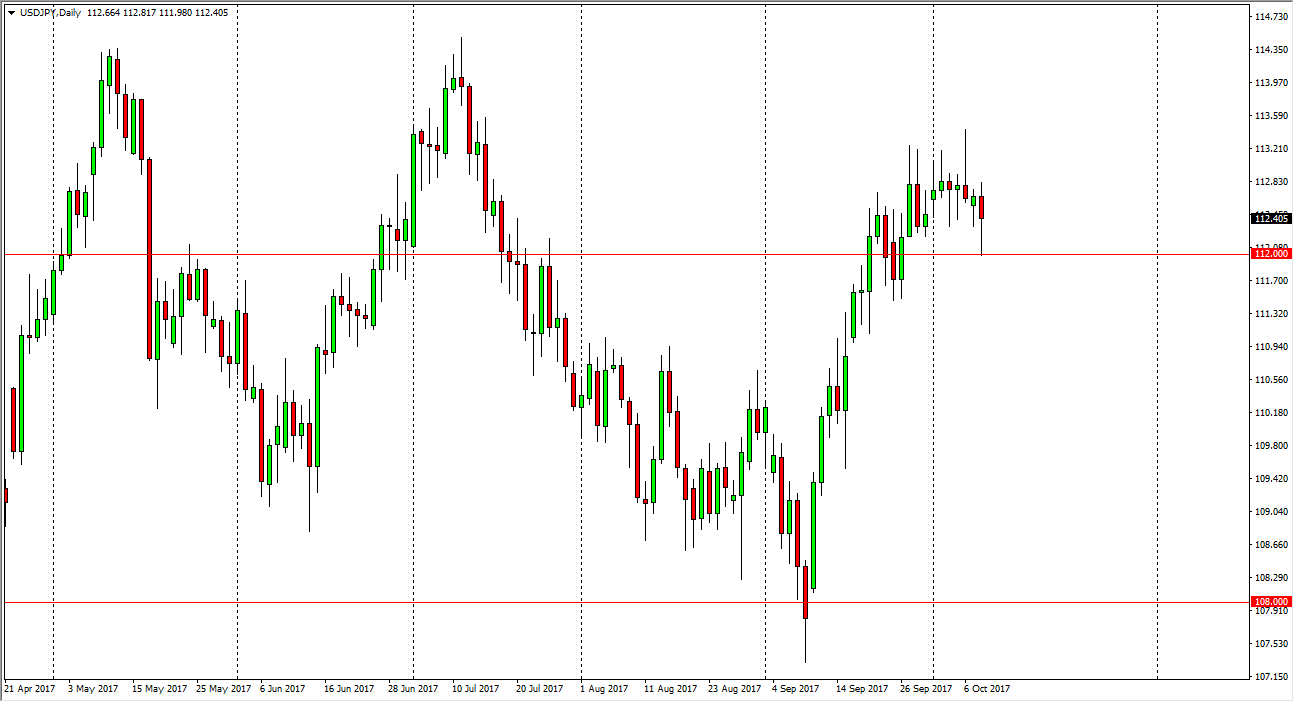

USD/JPY

The US dollar fell significantly during the session on Tuesday, reaching down towards the 112 level. We found enough support there to turn things around and form a hammer though, and I believe that it’s only a matter of time before the US dollar continues to rally against the Japanese yen. I think that the interest rate differential between the 2 currencies will continue to favor the US dollar, and after the FOMC Meeting Minutes today, we could get more hawkish rhetoric out of the Federal Reserve, driving this pair even higher. I believe that a lot of the sideways action around the 112 level is simply an opportunity to build up a little bit of confidence after we had exploded to the upside during the previous month. I think that eventually we will go to the 114.50 level, which is the top of the consolidation area that the market has been stuck in for some time.

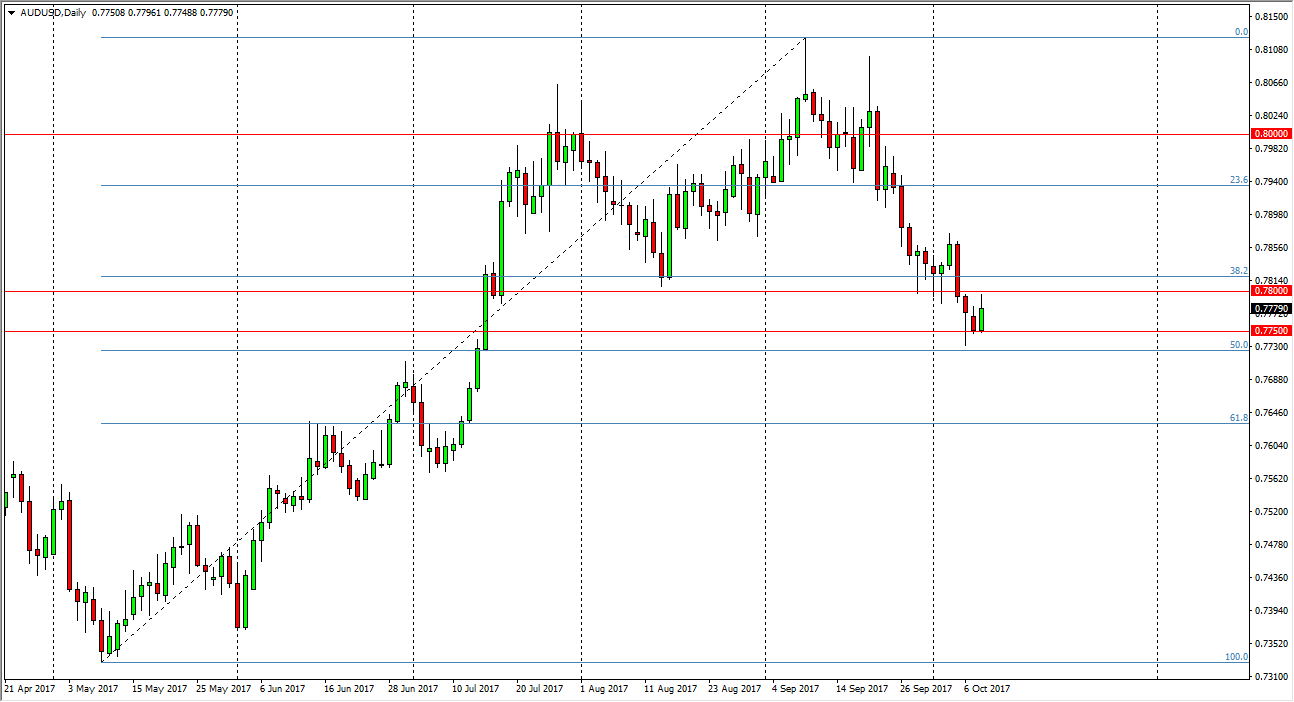

AUD/USD

The AUD/USD pair rallied during the trading session on Tuesday, after touching the 0.7750 level. This is an area that had been significant resistance in the past, and I think now we are going to go sideways between the 0.7750 level underneath, and the 0.78 level above. Once we break out of this area to the upside, I think that we can continue to see buyers jump in this market. The FOMC Meeting Minutes of course can give us an idea as to how hawkish central bank is, and what happens to gold next. If gold rallies, it’s likely that this pair will as well. However, if it rolls over, it’s possible that the market could drop below the 0.77 handle, and perhaps much lower than that.