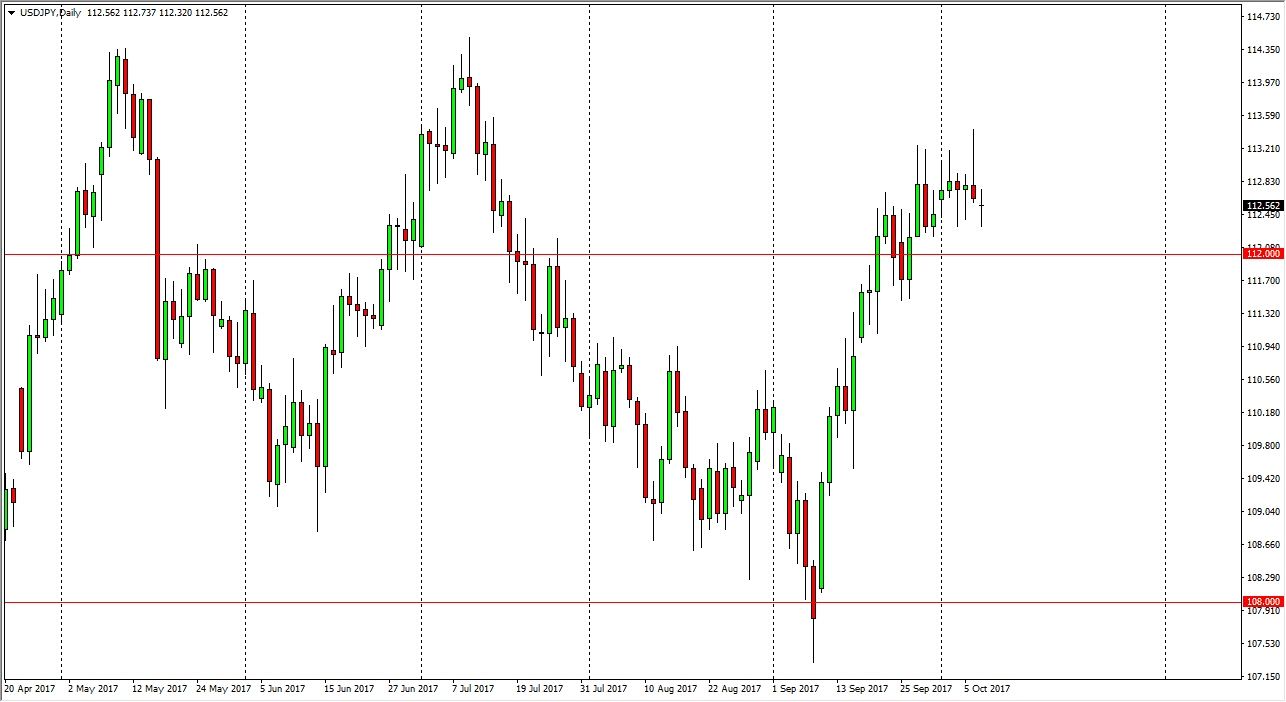

USD/JPY

The US dollar initially fell against the Japanese yen during the session on Monday, but has found enough support to turn around and form a hammer. There is a significant amount of support at the 112.50 level, as we have seen previously. However, I think that the support extends down to the 112 level, which is massively supportive as well. I think that we are going to continue to see choppiness in this area, but with the recent impulsive move that we have had, I think we will get a bit of consolidation, and then continuation, perhaps reaching towards the 114.50 level above which has been the top of the recent consolidation in this market over the last several months. Even if we did breakdown from here, I believe that the 111 level will be massively supportive also. Because of this, I’m looking for value to start buying yet again.

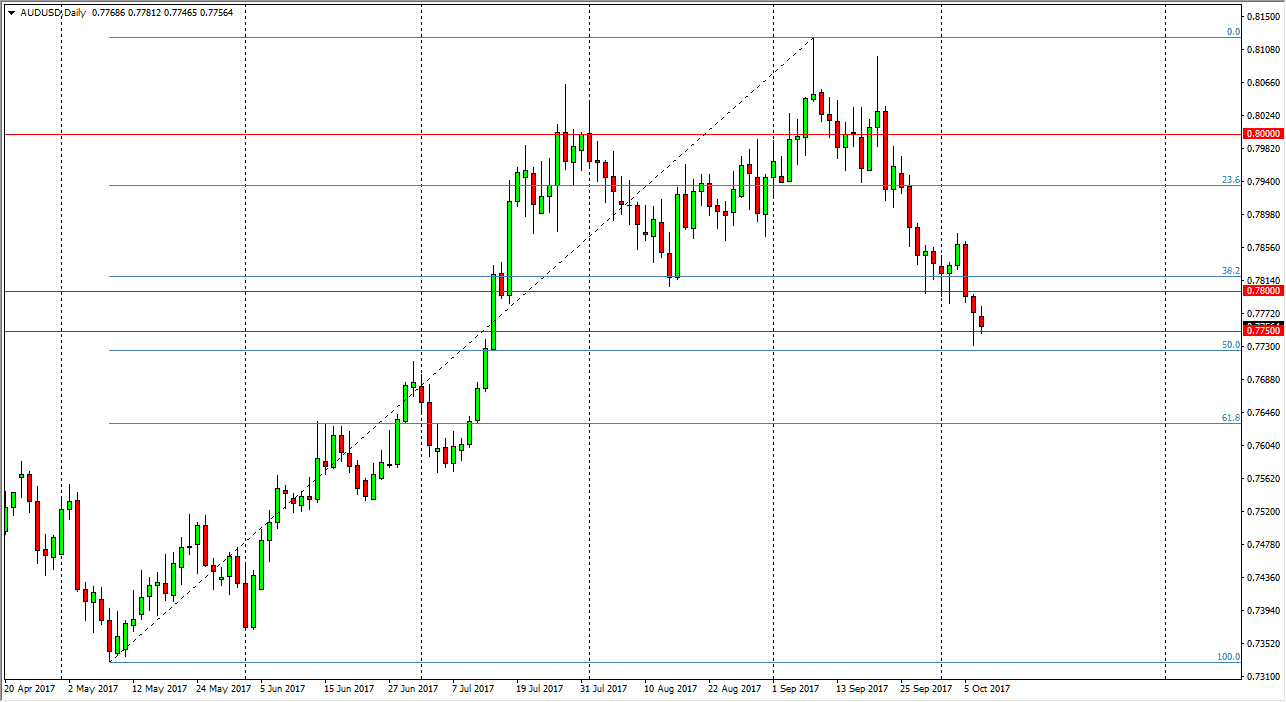

AUD/USD

The Australian dollar had a slightly negative session on Monday, reaching towards the 0.7750 level. I think that the market should continue to find support in this general vicinity, but I also recognize that a breakdown below the hammer of the Friday session from last week would be very negative. We have recently seen the market break above this general area as a sign that we were going to continue to go higher, and I think given enough time we will reach towards the 0.80 level above which is massively resistive. That’s an area that extends to the 0.81 level, which is the gateway to much higher prices, perhaps breaking out towards the 0.90 level, and then eventually the parity level over the longer term. I have no interest in trying to sell this market if we do breakout above there, but in the meantime, I think that the motive of this market is going to be an attempt to build up enough momentum to make a breakout possible.