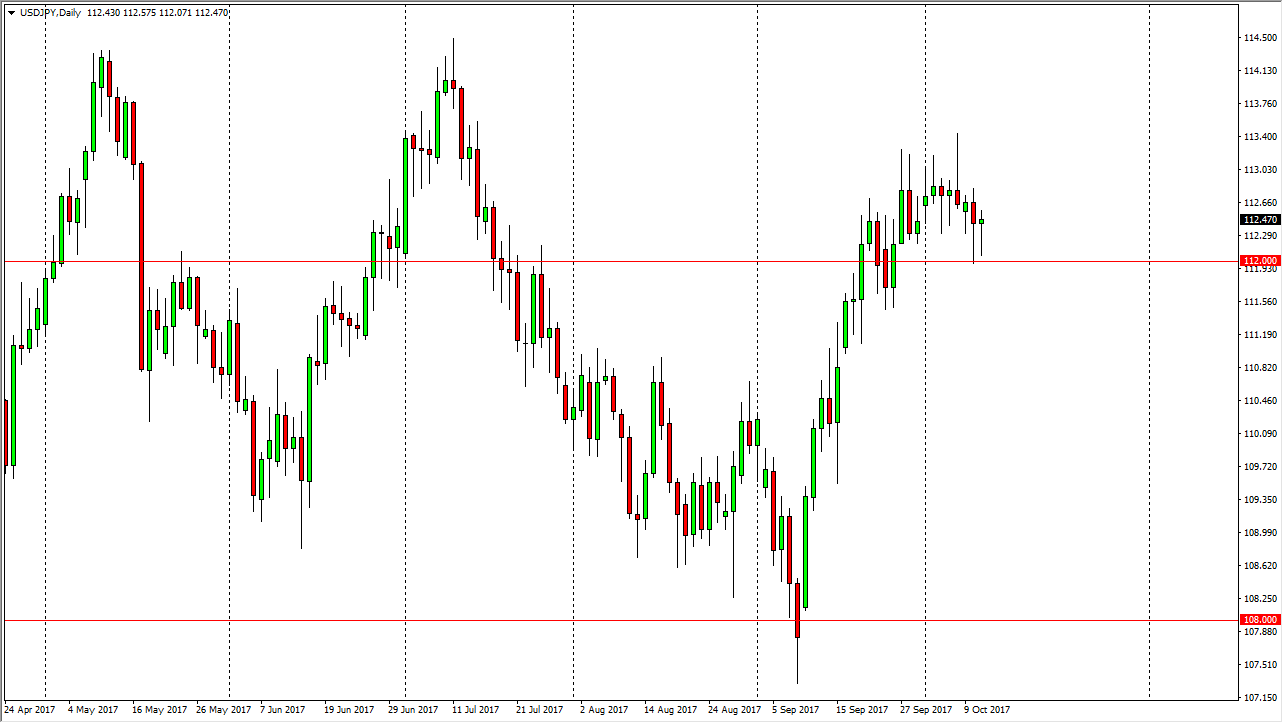

USD/JPY

The US dollar had a volatile session as one would anticipate on Wednesday, with the FOMC Meeting Minutes coming out. Because of this, we tested the 112 level, which continues to be supportive. Looking at the last several candles, I see a couple of hammers, and of course a couple of shooting stars. This tells me that the market is probably going to be stuck in consolidation and the short-term, with the 112 level obviously being support underneath. Longer-term, I still believe that the market goes to the 114.50 level, which is the top of the overall consolidation that we have been in for some time. I believe that there is a significant amount of resistance above that level and extending to the 115 handle, so it’s not until we clear that area that I think that the market becomes more of a “buy-and-hold” scenario. Even if we did breakdown below the 112 level, I think there’s plenty of support at the 111 level to start buying there as well.

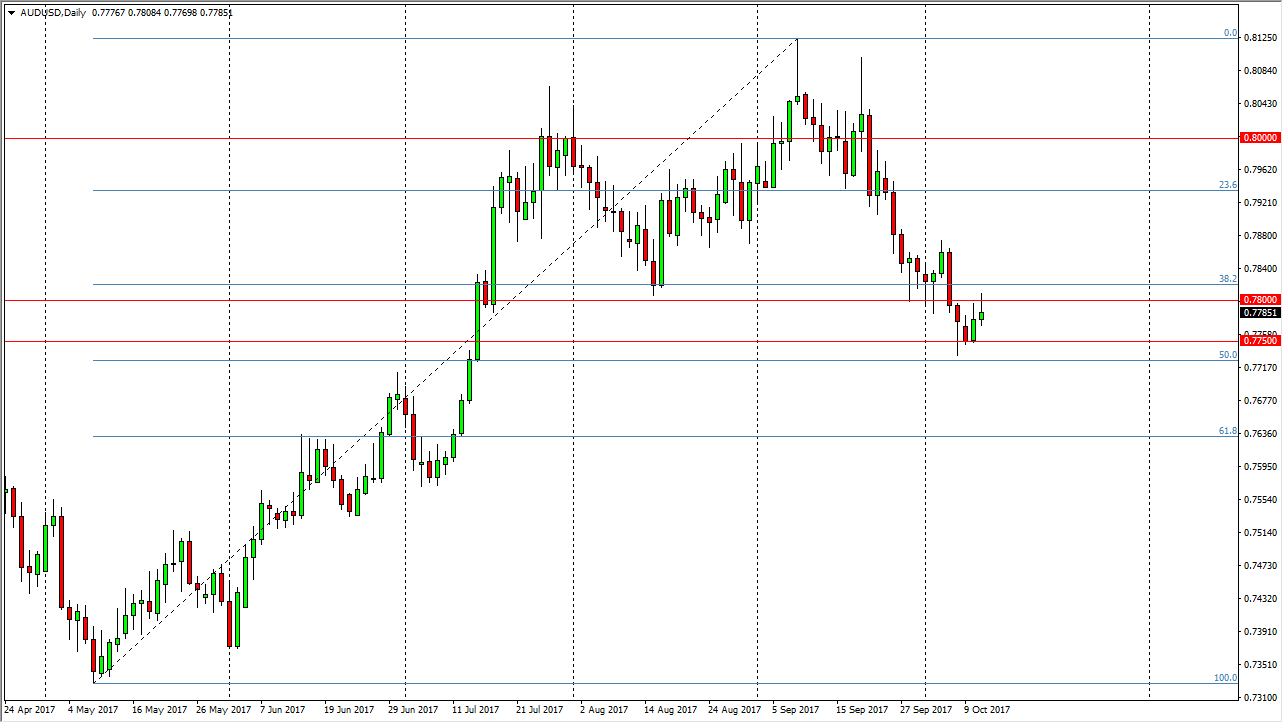

AUD/USD

The Australian dollar rallied on Wednesday, breaking above the 0.78 level one point, but did pull back slightly. If we can break above the top of the range for the day on Wednesday, I think that the market will have shown enough strength to continue the longer-term move towards the 0.80 level. The pullback has recently tested the 50% Fibonacci retracement level, and more importantly, the area that had previously been resistance and should now be support. I think that the market will eventually break out above the recent high, and then go to much higher levels such as the 0.90 level and of course parity after that. Pay attention to gold, it has a direct influence on the Australian dollars well.