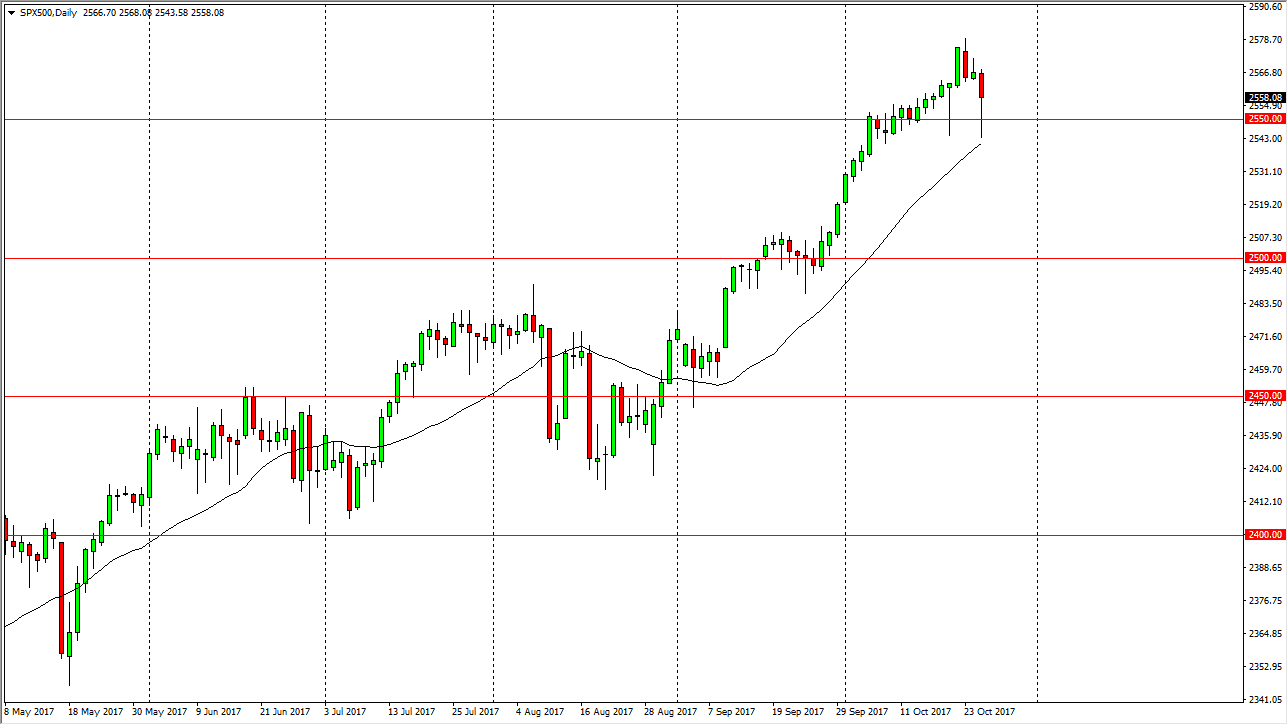

S&P 500

The S&P 500 fell significantly during the trading session on Wednesday, but found enough support underneath the 2550 level to turn around and form a nice-looking hammer. The hammer suggests that we have plenty of buyers underneath, and that it’s only a matter of time before we reach towards the 2600 level in my estimation. The fact that we bounced so significantly tells me that the algorithmic traders are still in the markets overall, buying dips every time they get shown. The market seems to be immune to mass selloffs, so I think that it’s only a matter of time before we rally after these pullbacks. I think the bottom of the overall uptrend is below at the 2500 level. Ultimately, I have no interest in selling and look at pullbacks like this as value.

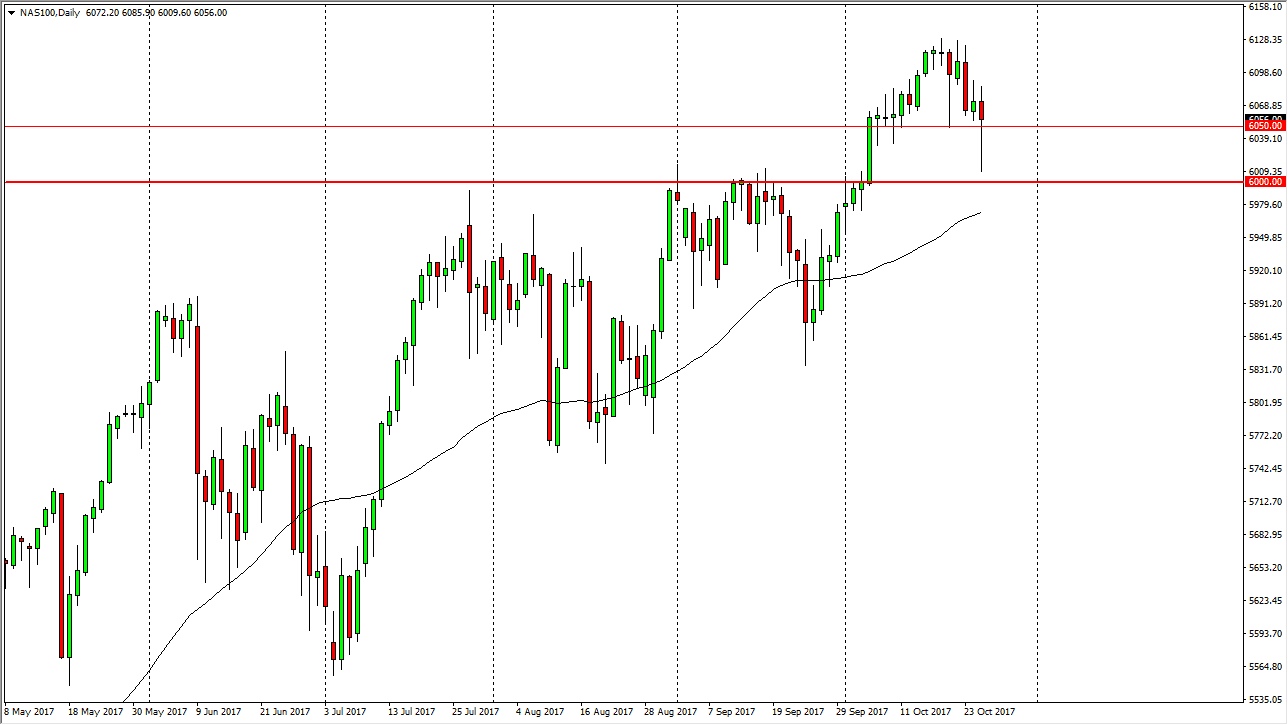

NASDAQ 100

The NASDAQ 100 fell drastically during the session on Wednesday, slicing through the 6050 level, reaching towards the 6000 handle where we have seen a significant amount of support. Quite frankly, this is where we had seen so much in the way of resistance previously, so that being the case it makes sense that we had money of buyers underneath. The fact that we had formed a massive hammer tells me that the uptrend is very much intact, and should continue to be going forward. This was a very impressive move, and with that being the case I remain bullish and have no interest in shorting. I still believe that the market is going to go to the 6200 level above, and obviously the candle for the session has only confirmed that it seems more likely than not to happen.