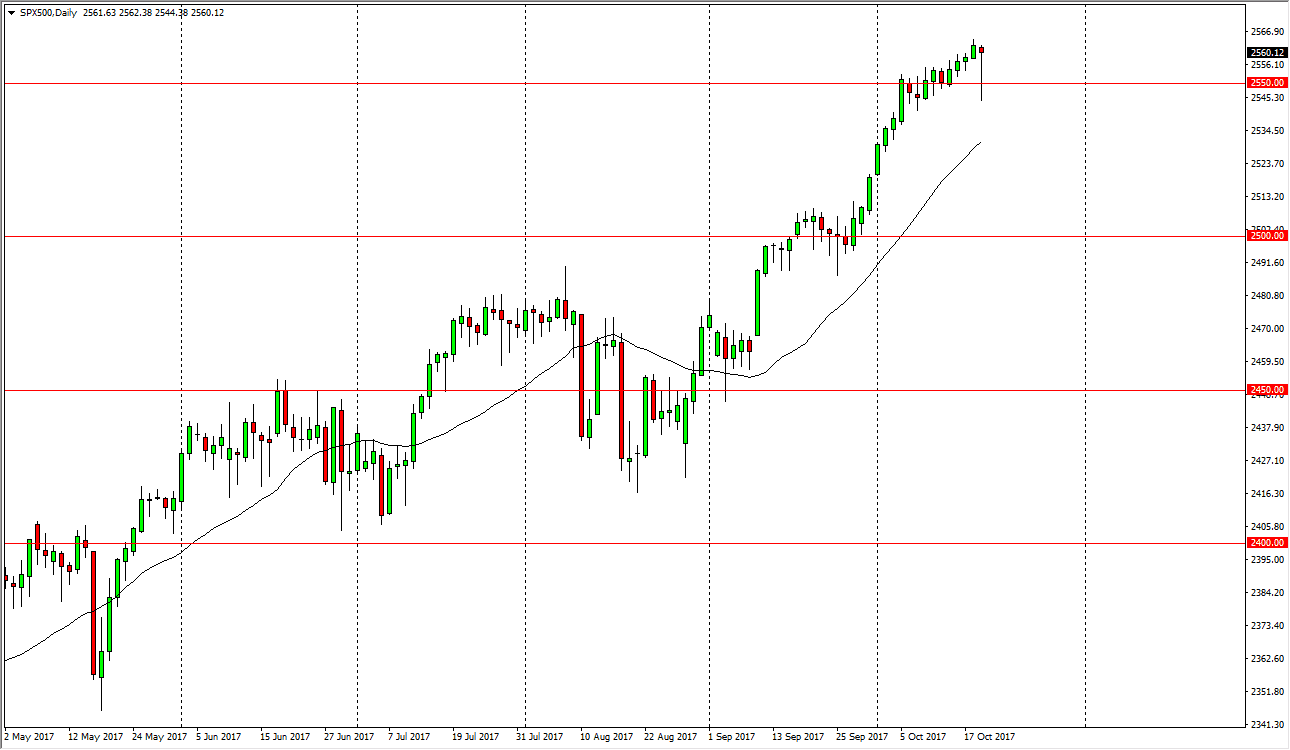

S&P 500

The S&P 500 initially fell during the Thursday session, but found enough support near the 2545 level to turn things around and rally significantly. By doing so, we ended up forming a massive hammer, which of course is a very bullish sign. I think that the market forming this hammer suggests that we are going to go much higher, and I think that eventually we will reach towards the 2600 level. With the earnings season going reasonably well, it makes sense that we should continue to see the markets go higher. I believe the pullbacks offer value, and therefore I have no interest in and trying to short this market, we are obviously a very strong move to the upside, and should continue to be so. I think the 2500 level underneath offers the “floor” in the overall uptrend.

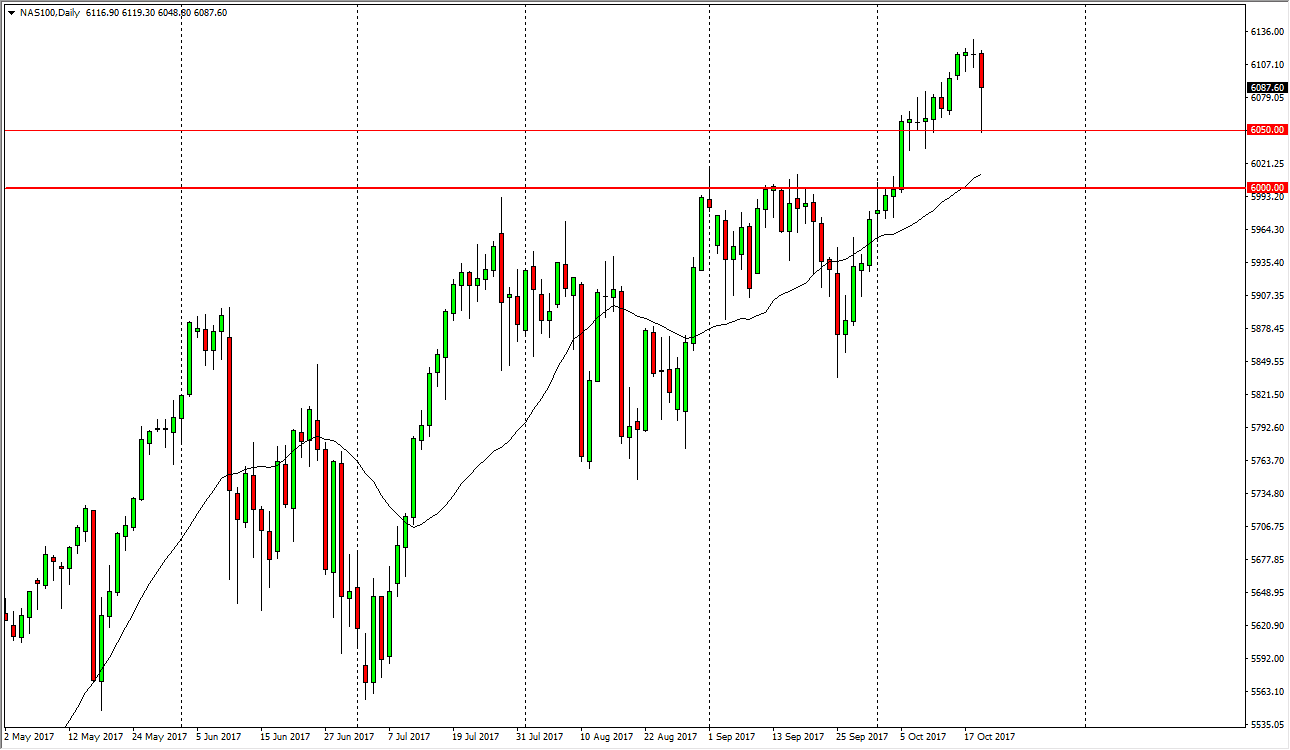

NASDAQ 100

The NASDAQ 100 fell significantly during the session, reaching down to the 6050 level. We found enough support underneath to turn around and bounce significantly though, as US traders continue to jump into the marketplace and buy dips. I think that the market still is looking to go to the 6200 level, so it’s only a matter of time before we reach that level. Once we do, I think that the market will find plenty of buyers once we clear that area, because it becomes more of a “buy-and-hold” situation. I think that the 6000 level underneath is the “floor” in the uptrend, and I do not think we will break down below there. Because of this, I remain bullish and have no interest in shorting this market. Ultimately, I think that the NASDAQ 100 will continue to show extreme strength.