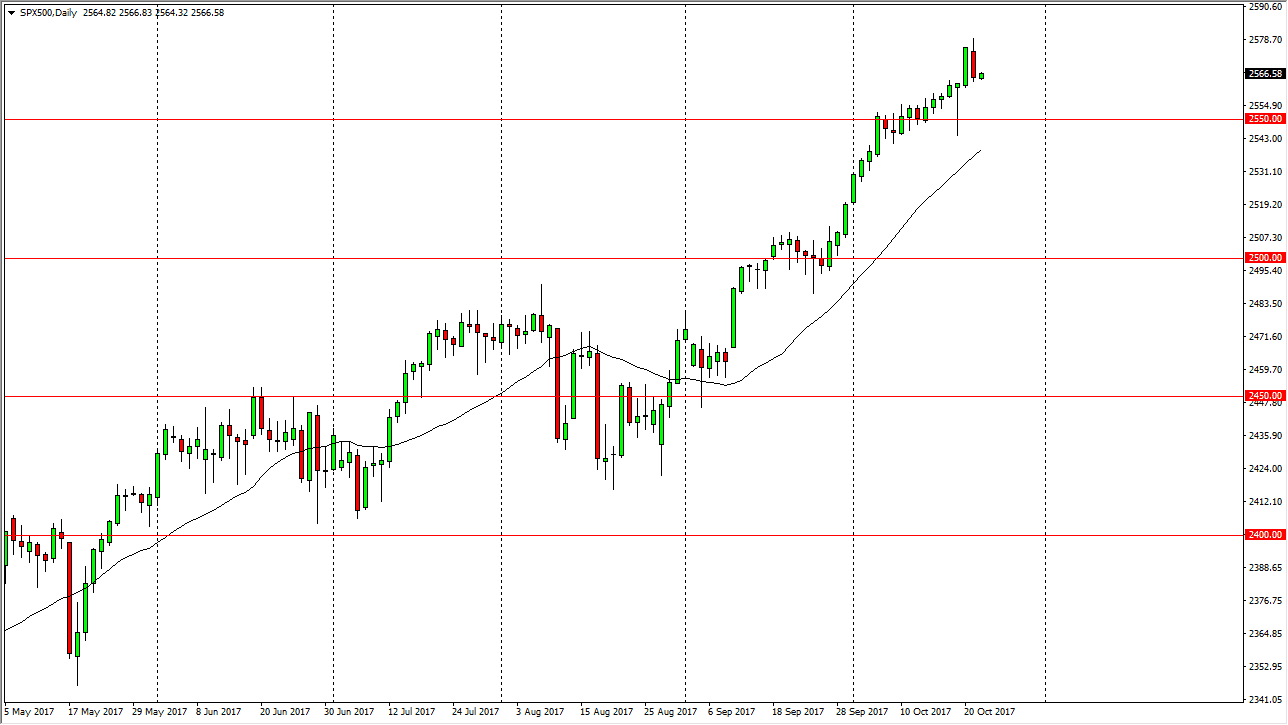

S&P 500

The S&P 500 initially tried to rally during the session on Monday, but then rolled over to form a negative candle. However, I think there is plenty of support just below, and as we roll into the Tuesday session, looks like the buyers are ready to come back. The 2550 level underneath should continue to be supportive, and I think that eventually we will go looking towards the 2600 level. This is a market that is extraordinarily bullish, and I think that the 2550 level has already shown itself to be rather interesting for traders in both directions, and that now should offer plenty of support due to the massive amount of order flow in that region. Even if we break down below there, I think that the 2500 level underneath will be even more supportive.

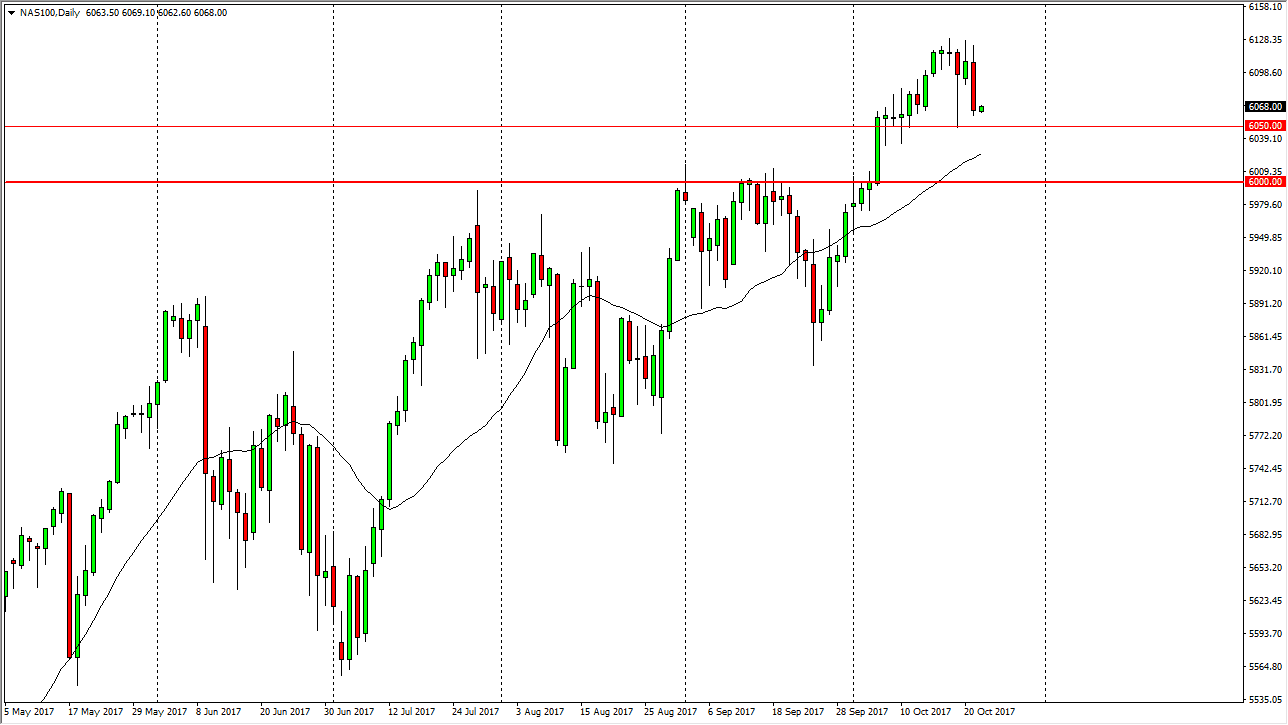

NASDAQ 100

The NASDAQ 100 initially tried to rally but then fell significantly. I think the 6050 level is going to start offering support though, and I think that support runs down to the 6000 level. The bottom of the uptrend at this point is probably closer to the 6000 handle, so I’m looking for some type of supportive candle or an impulsive candle to the upside that I can take advantage of. Eventually, the market should then go to the 6200 level next, which would be the target based upon the ascending triangle that we broke out of. In the meantime though, these pullbacks are necessary to continue the overall bullish pressure that we have seen as the market got a bit overbought. Over the longer term, I think we do go much higher and earnings season should be helpful as well.