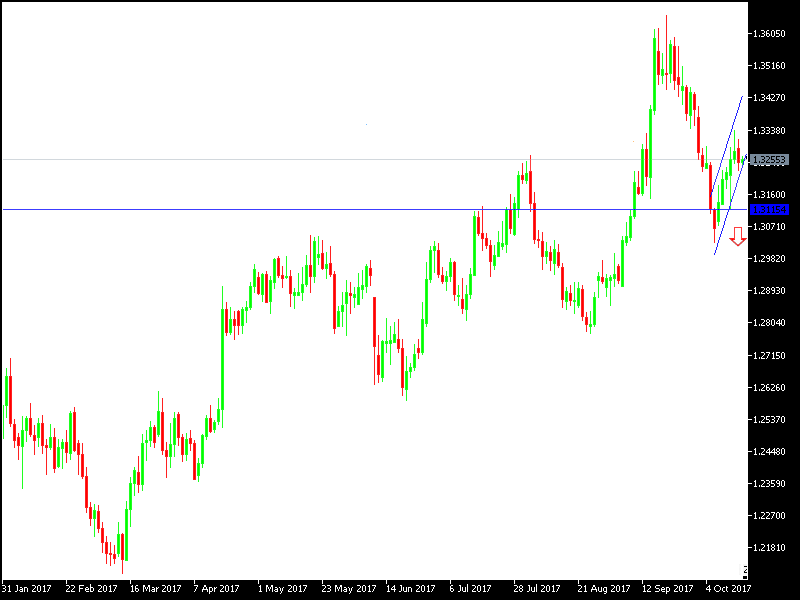

The GBP/USD retreated to the support at 1.3225 level after reaching to 1.3337 last week, as the USD regained strength. With the USD Index reaching a top of 93.41 DXY, along with a new record high for the US stock markets, investors disregard US inflation numbers, which albeit high, it was lower than expectations. Trump's talks with new officials to replace Yellen as a chairman of the Federal Reserve shows the US administration’s support to the more hawkish than Yellen in terms of raising interest rates, which also supports the USD.

GBP will be the center of attention this week, and traders will look out for important data from the UK, which might have a strong reaction on the Pound’s performance against other main currencies. Today, there will be an announcement on inflation data, tomorrow will see employment data, and retail sales data on this coming Thursday. We have noticed last week the return of anxiety regarding the hard BREXIT negotiations as expected, which will increase of the GBP/USD losses and negatively affect any gains made.

The Chief EU negotiator said that the negotiations with the UK have reached an impasse, which drove the pair back 140 points in minutes from 1.3262 to support at 1.3121 after media reports stating the the EU might grand the UK a transition period of 2 years with final exit. The UK Prime Minister, May, went to the EU for new talks to speed up the BREXIT process.

The GBP got support after May’s comments that the BREXIT negotiations are in the EU’s court and how she is waiting the response about the future of the negotiations. The comments from the UK’s Prime Minister today supported optimism towards the GBP. The pair found a new opportunity after some disappointing results in the US job numbers. The support is still strong for the USD from the path to raise the interest rate by the Federal Reserve, despite what was mentioned in the last Fed’s minutes of meeting.

Technical Analysis:

The GBP/USD pair will be in new sell zones in case it moved towards resistant areas at 1.3330 and 1.3400. On the bearish side, the nearest support levels are currently at 1.3050, 1.3120 and 1.3200, and the last of them confirms the bearish theory in this pair.

Economic Data:

The pair will look out for the first important data releases this week, which is the UK inflation and the comments of the Bank of England governor, Carney and from the US where there will be announcement regarding manufacturing production. The pair will also look at any updates regarding the BREXIT negotiations as well as Trump’s internal and external policies.