EUR/USD

The EUR/USD pair fell on Monday, reaching towards 1.17 level. I think there is a significant band of support in this area though, so I think that the buyers will return sooner rather than later. If we did break down below the 1.17 level, the market probably goes looking towards the 1.15 level, which was the scene of a major breakout. By breaking out of the consolidation, the market looks likely to go looking towards the 1.25 level over the longer-term, but we may need to pull back in order to build up the necessary momentum. That being said, I think that looking to buy on the dips will probably continue to be the best way to play this market, and therefore I will be ignoring sell signals in the short term.

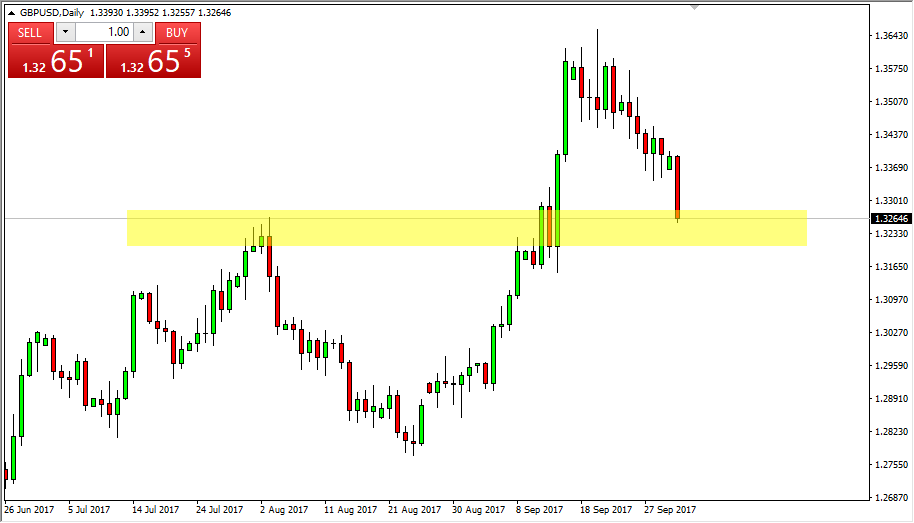

GBP/USD

The British pound broke down significantly on Monday, cracking the 1.33 level. I think we’re going to go looking for support just below, probably somewhere near the 1.32 handle, and if that level doesn’t hold, I suspect we will go looking towards the 1.30 level after that. A bounce from here makes sense, and quite frankly I think that’s what we will see. However, we have gotten a bit ahead of ourselves lately, so this pullback is not only healthy, but I’m sure it’s necessary. I’m going to stand back, wait for the market to find support or a somewhat impulsive bounce, and then take advantage of value. I still believe that we may be able to break above the 1.3650 level, but that’s can take a lot of momentum to do so, so these pullbacks will more than likely be opportunities to build up the necessary power to start going higher. If we broke down below the 1.30 level though, that would of course be very negative.